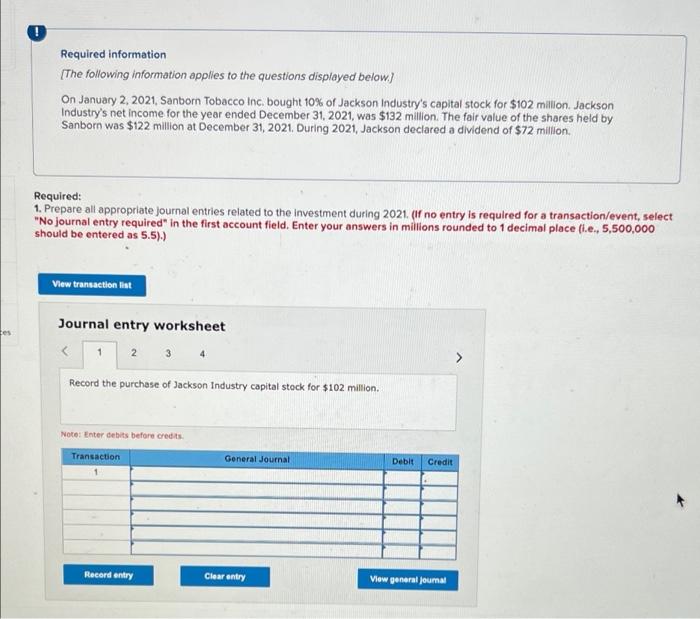

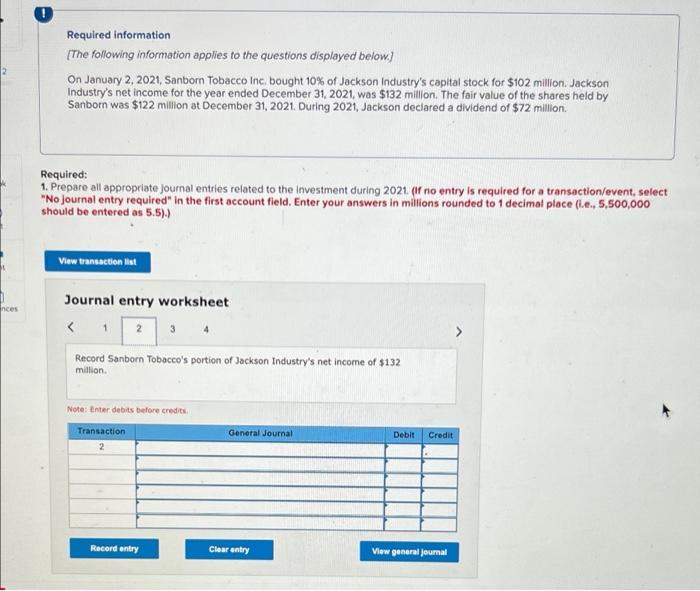

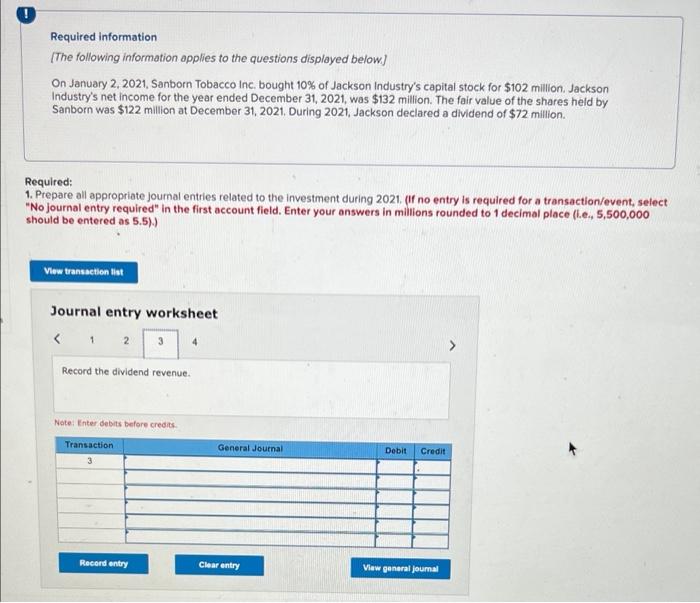

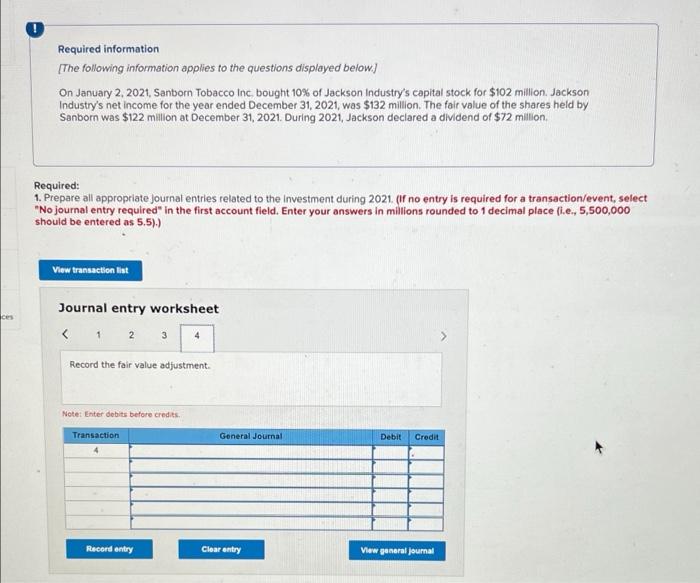

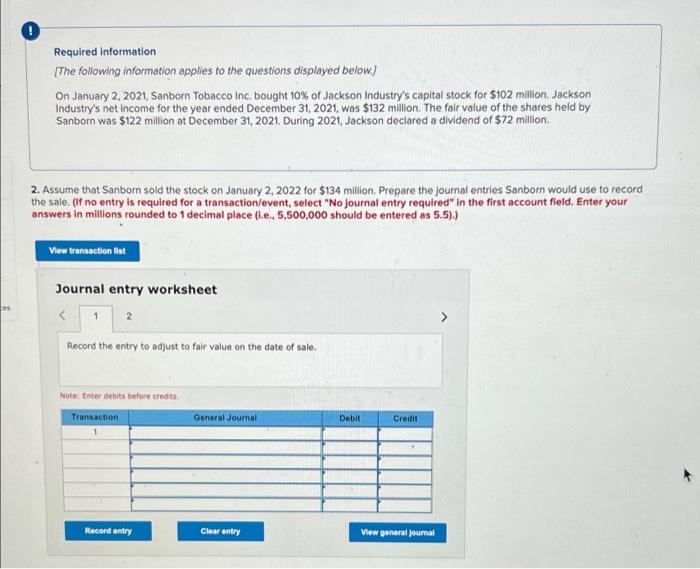

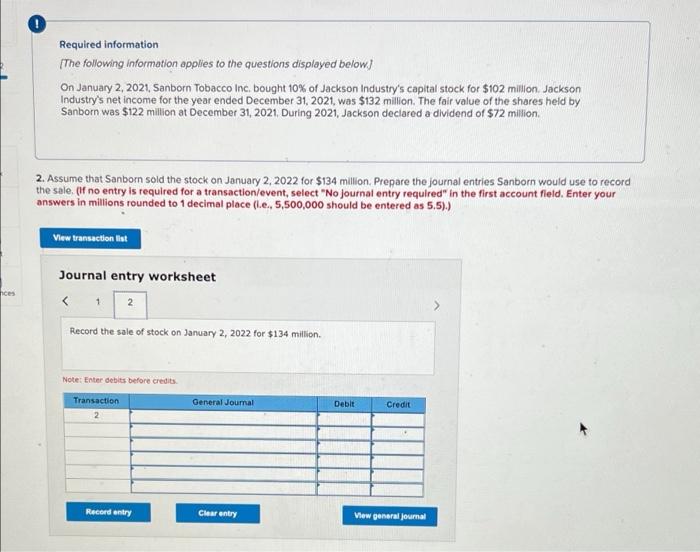

tes Required information [The following information applies to the questions displayed below.] On January 2, 2021, Sanborn Tobacco Inc. bought 10% of Jackson Industry's capital stock for $102 million. Jackson Industry's net income for the year ended December 31, 2021, was $132 million. The fair value of the shares held by Sanborn was $122 million at December 31, 2021. During 2021, Jackson declared a dividend of $72 million. Required: 1. Prepare all appropriate journal entries related to the investment during 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet 1 2 3 4 Record the purchase of Jackson Industry capital stock for $102 million. Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general journal 2 nces U Required information [The following information applies to the questions displayed below.] On January 2, 2021, Sanborn Tobacco Inc. bought 10 % of Jackson Industry's capital stock for $102 million. Jackson Industry's net income for the year ended December 31, 2021, was $132 million. The fair value of the shares held by Sanborn was $122 million at December 31, 2021. During 2021, Jackson declared a dividend of $72 million. Required: 1. Prepare all appropriate Journal entries related to the investment during 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet 1 2 3 Record Sanborn Tobacco's portion of Jackson Industry's net income of $132 million. Note: Enter debits before credits. Transaction 2 4 Record entry General Journal Clear entry Debit Credit View general journal Required information [The following information applies to the questions displayed below.] On January 2, 2021, Sanborn Tobacco Inc. bought 10% of Jackson Industry's capital stock for $102 million. Jackson Industry's net income for the year ended December 31, 2021, was $132 million. The fair value of the shares held by Sanborn was $122 million at December 31, 2021. During 2021, Jackson declared a dividend of $72 million. Required: 1. Prepare all appropriate journal entries related to the investment during 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet 2 3 Record the dividend revenue. Note: Enter debits before credits. Transaction 3 Record entry 4 General Journal Clear entry Debit Credit View general journal ces ! Required information [The following information applies to the questions displayed below.] On January 2, 2021, Sanborn Tobacco Inc, bought 10% of Jackson Industry's capital stock for $102 million. Jackson Industry's net income for the year ended December 31, 2021, was $132 million. The fair value of the shares held by Sanborn was $122 million at December 31, 2021. During 2021, Jackson declared a dividend of $72 million. Required: 1. Prepare all appropriate journal entries related to the investment during 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet