Tesla and Panasonics Strategic Partnership

- In which ways may the Gigafactory 1 joint venture create value? To what extent would those benefits be achieved if Panasonic and Tesla were to build their plants independently but physically next to each other (i.e., similar to the configuration of the Gigafactory 1 factory)?

- What risk(s) of strategic alliances did Panasonic experience in the Gigafactory 1 partnership? Why was Panasonic vulnerable to the risk(s)? (Hint: the case indicates that Tesla always pushed for lower prices.)

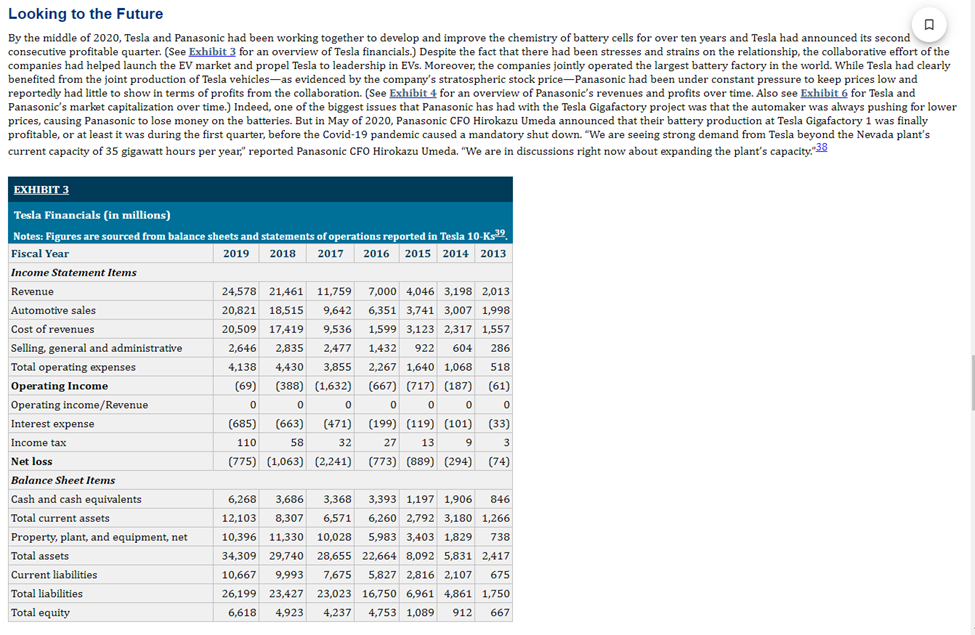

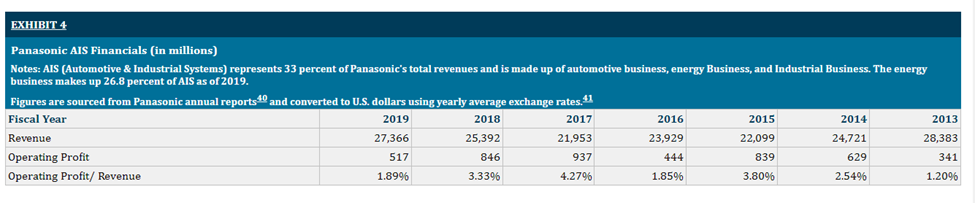

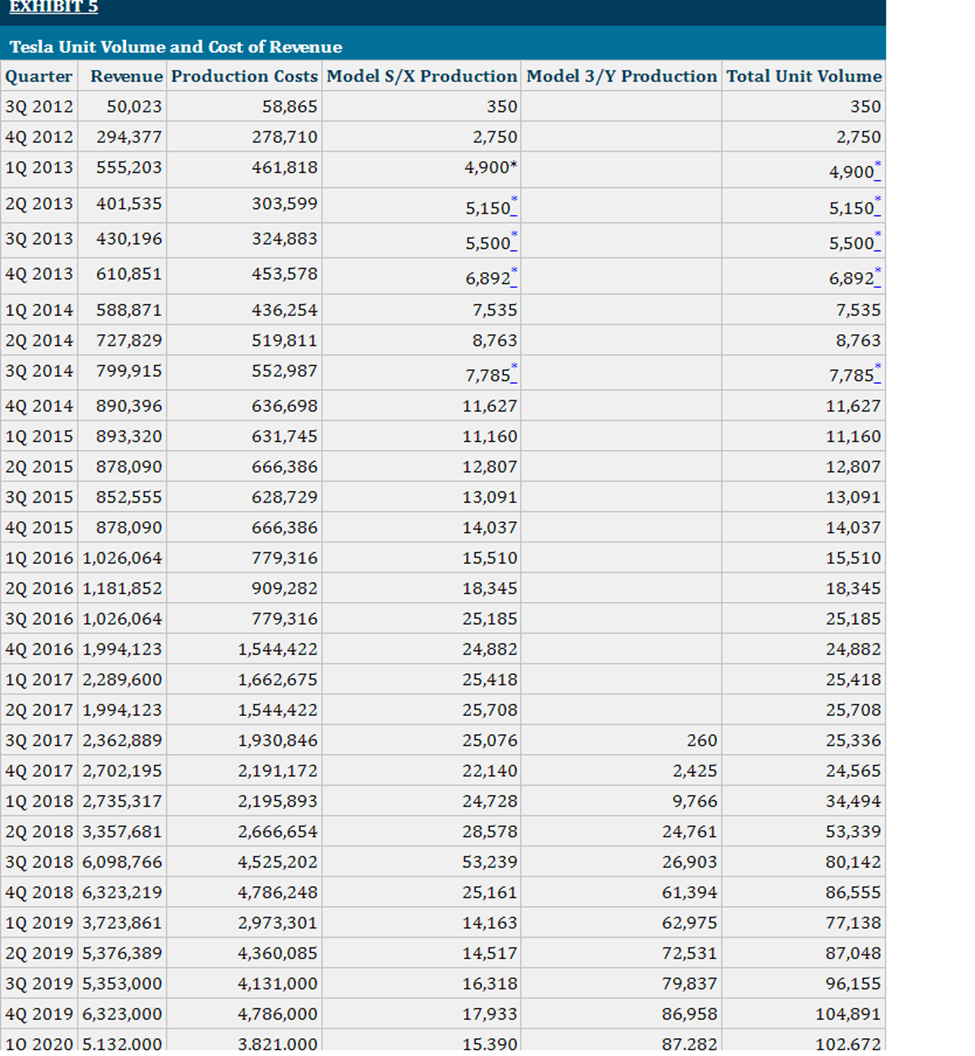

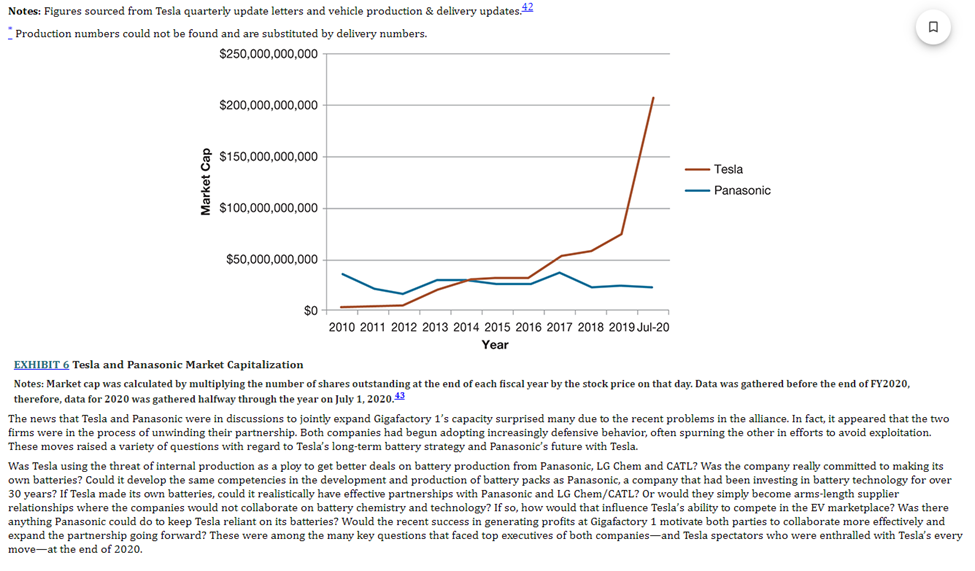

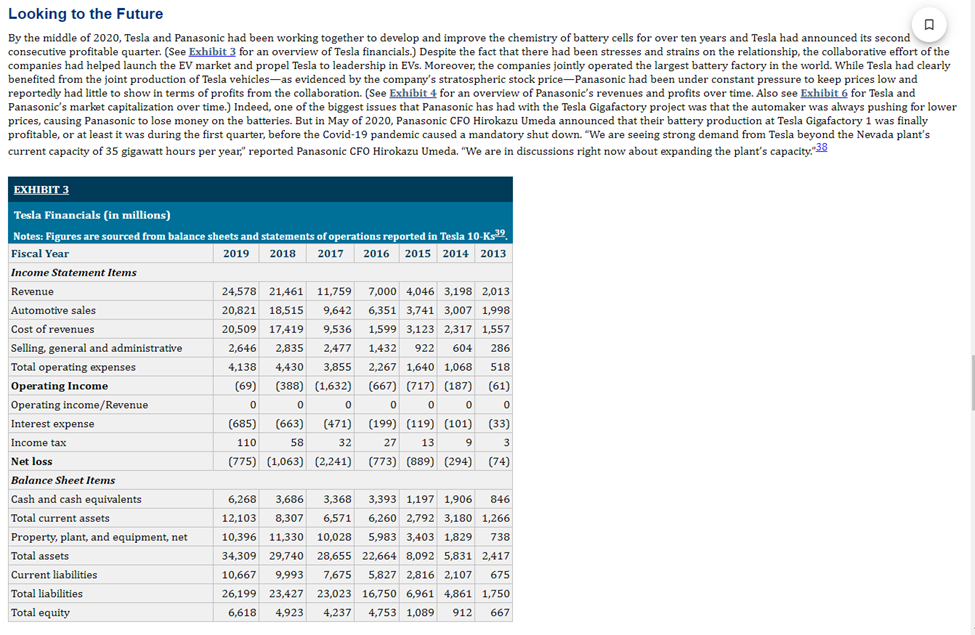

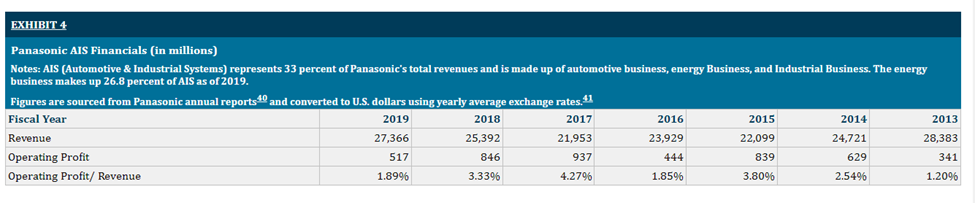

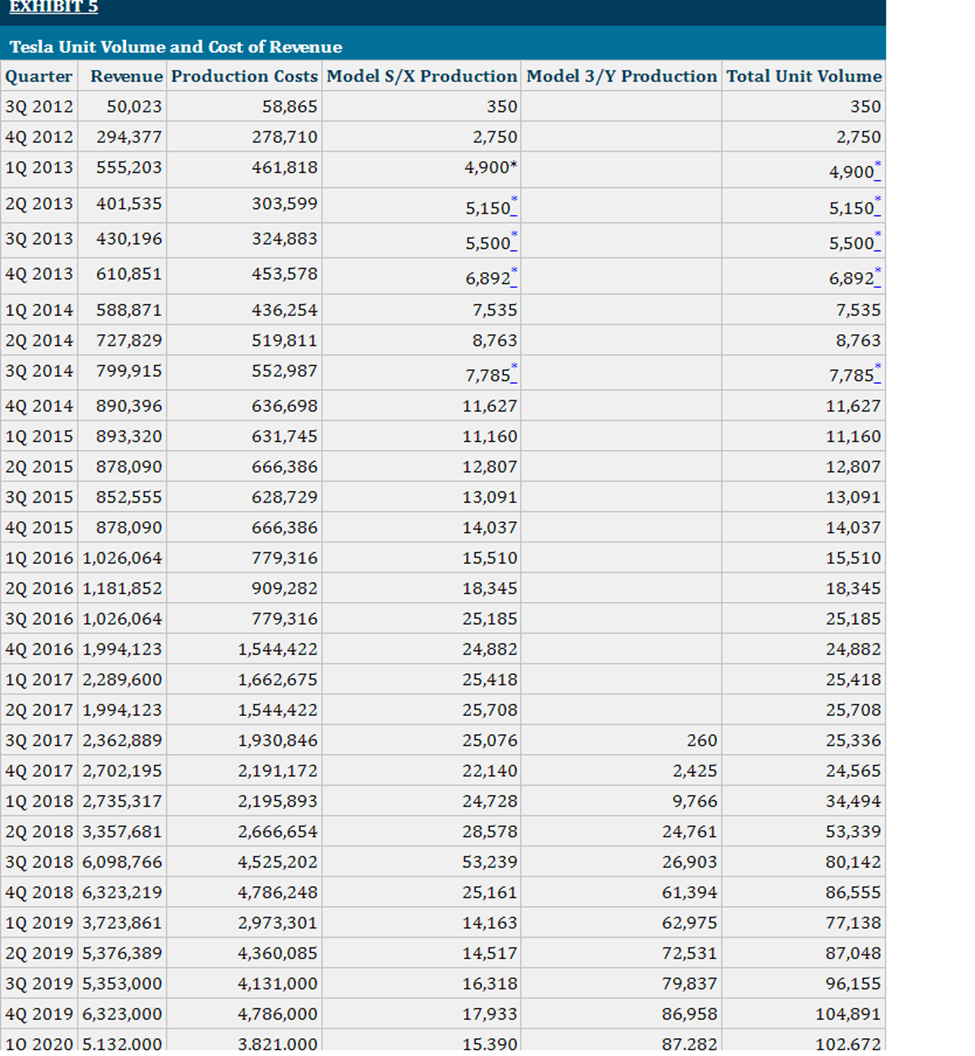

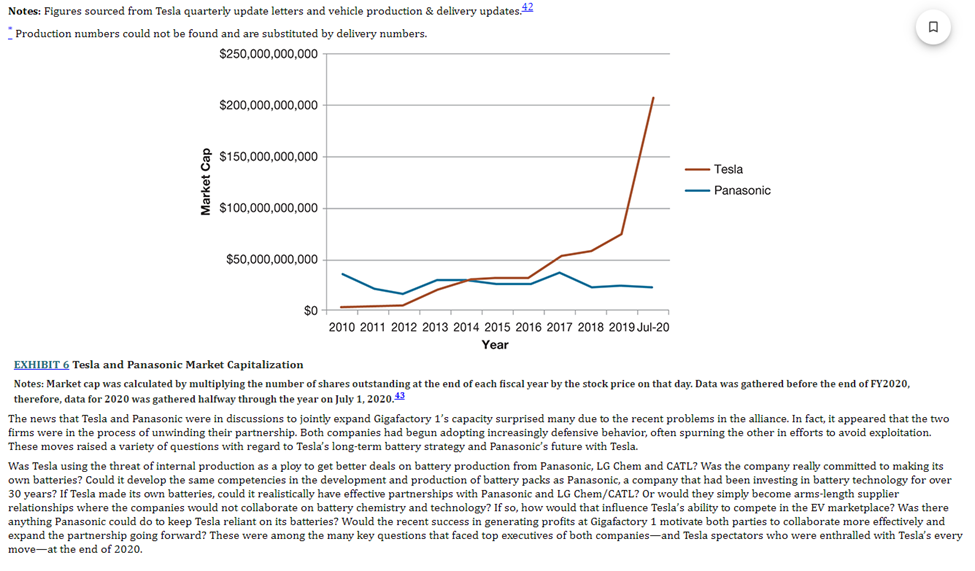

CASE 10B Tesla and Panasonic's Strategic Partnership: By Jeff Dyer and Gordon Scott Introduction prior year, making it the most valuable company in the industry, despite the fact that it held a relatively small share (1.3 percent of unit volume) of the U.S. market.2 pursuit of improvements in chemical efficiency were crucial for the rapid scaling of Tesla. cell manufacturing in New York, 6 it seemed that Tesla and Panasonic were mutually committed to a long-term partnership across a variety of ventures. Tesla leading the fight, the future of the partnership was filled with uncertainty. Early Years bring vehicles to market and allow a greater focus on the design of the vehicle system, Tesla chose to outsource the production of its battery cells. strength in lithium-ion technology to establish a presence in the emerging EV market. lithium-ion cells to Tesla over the course of 4 years to further enable the rapid scaling of Tesla. 15 Gigafactory 1 Panasonic together in a joint venture termed the Gigafactory. produce the Model 3, a four-door sedan targeted at the middle class with a starting price of $35,000. The Gigafactory project propelled Tesla and Panasonic into the next phase of their relationship, requiring significant investment, communication, and vulnerability from both Tesla and Panasonic. It was agreed that Tesla would purchase the land and construct the building while Panasonic would invest in all the equipment, machinery, and other manufacturing tools required to produce the necessary lithium-lon batteries. By its scheduled completion date in 2020, the Gigafactory would demand a combined investment of $5 billion with Panasonic shouldering $1.6 billion of the total. 17 Tesla's Energy Business and the Buffalo Gigafactory The introduction of the Powerwall and Powerpack in 2015 expanded Tesla's scope to include the energy storage industry Rather than require solar power producers to waste or sell their power in daylight hours and rely on the power grid after sundown, Tesla's Powerwall and Powerpack stored clean energy produced by solar panels for use at the owners' discretion. In 2016 Tesla expanded its energy business by paying \$2.6 billion to acquire SolarCity, 18 the country's dominant installer of rooftop solar panels. The acquisition was shortly followed by the announcement of a new joint venture between Tesla and Panasonic to construct a second Gigafactory in Buffalo, New York focused on the design and production of solar panels. The Buffalo Gigafactory was to be heavily subsidized by the state of New York,,219 but would also require investments from both Tesla and Panasonic in order to purchase the needed machinery to produce the solar panels. Panasonic planned to invest over $256 million in the Buffalo Gigafactory, 20 and Tesla would pay for undisclosed costs not covered by New York or Panasonic. Strategic Fit Tesla's Value as a Partner Tesla Motors. 3 innovate. of rapid expansion in a nascent industry, it was critical that they find a partner to solve their battery problem. Panasonic's Value as a Partner Regarding the decision to partner with Panasonic, Tesla CEO and co-founder Elon Musk said: further improve our battery pack while reducing cost. 22 realizable. Company Cultures Tesla Culture Tesla created the following six principles as the backbone of its entrepreneurial and innovative culture: 1. Move fast. 2. Do the impossible. 3. Constantly innovate. 4. Reason from "first principles". 5. Think like owners. 6. We are ALL IN. 323 challenge people to work hard, they achieve more than they think they can. Most leaders don't want to do that,"24 reached by others, effective and innovative solutions could more easily be discovered. withholding nothing in pursuit of its purpose. Tesla CEO founding and growth of several companies, most of which focused on solving challenging technical problems. admiration, though skeptics of his long-term goals still remained plentiful. Panasonic Culture production and manufacturing rather than innovating. customers, Panasonic had built a worldwide reputation of reliable performance. the understanding that a bankrupt company is incapable of providing value to the world. Panasonic CEO elected to serve as CEO and tasked with returning the company to profitability following the heavy losses from overinvestment in plasma TVs. company's strongest proponents of building the relationship. Gigafactory 1 was dedicated to manufacturing Tesla's Model 3, Powerwall, and Powerpack. As a result, Panasonic needed to design a special production line, customized to manufact new 2170 battery cells used in these products. In return for Panasonic's investment in Gigafactory 1 Tesla would be obligated to purchase the needed battery cells produced on site, extending Panasonic's status as the exclusive battery supplier of Tesla. Co-locating in Nevada and collaborating to advance both the technology and the production of lithium-ion batteries would require the sharing of intellectual property. As Tesla and Panasonic worked together to achieve chemical advancements and improved battery performance, additional joint intellectual property would be created. The Gigafactory contract specified that both parties agreed they would permit the use of jointly created intellectual property both independently and with others, providing that there be no infringement of the other party's intellectual property rights. 29 In the event of a dispute, Tesla and Panasonic agreed to first attempt informal resolution through negotiation. If, after thoroughly exploring all possibilities for an amicable settlement, working directly with one another proved insufficient, the companies agreed to rely on arbitration. Tesla and Panasonic were to agree on the chosen third-party arbitrator who would be exclusively responsible for settling the dispute. Both parties agreed to abide by the results of any necessary arbitration and to keep all outcomes confidential. 28 Executing the Partnership Key Personnel In preparation for their collaboration at Gigafactory 1 Tesla and Panasonic each appointed prominent employees to serve as liaisons in the developing relationship. Yoshihiko Yamada, previously CEO of Panasonic's North American operations and one of Panasonic's strongest proponents for the partnership, spent a year working with Tesla to iron out the details of the venture. 30Mr Yamada readily acknowledged deep cultural differences between the companies and pushed hard to keep teams in constant contact, helping to foster trust and synchronizing the speed of operations at the Gigafactory. Helping Tesla to bridge the cultural gap was a Kurt Kelty, who had spent nearly 15 years employed by Panasonic prior to working at Tesla. While in Japan, Kelty had become intimately familiar with Panasonic's bureaucratic culture as well as the language. He would often attend meetings between executive teams, helping to translate and soften the blows when negotiations became tense. 1027 Producing Together The advancement of battery technology was integral to the common goal of popularizing the EV. (See Exhibit 2 for a depiction of how batteries are deployed in the Tesla Model S.) Prior to Gigafactory 1, Tesla had chosen to purchase Panasonic's 18650 battery cells for use in the Roadster, Model S, and Model X. The 18-650 cell, which was commonly used in portable electronics, provided the highest cell level energy density and were already available in mass quantities, however, it had not been designed specifically for EV use. In a joint effort to increase efficiencies and lower costs, Tesla and Panasonic developed the 2170 battery cell, which Musk claimed to be "the highest energy density cell in the world and also the cheapest."31 The Gigafactory was designed to manufacture only the new 2170 battery cells, which were to be adopted by Tesla's Powerwall, Powerpack, and Model 3. Looking to the Future EXHIBIT 4 Panasonic AIS Financials (in millions) business makes up 26.8 percent of AIS as of 2019. EXHIBIT 5 Tesla Unit Volume and Cost of Revenue Notes: Figures sourced from Tesla quarterly update letters and vehicle production \& delivery updates. 42 "Production numbers could not be found and are substituted bv deliverv numbers. EXHIBIT 6 Tesla and Panasonic Market Capitalization Notes: Market cap was calculated by multiplying the number of shares outstanding at the end of each fiscal year by the stock price on that day. Data was gathered before the end of FY2020, therefore, data for 2020 was gathered halfway through the year on July 1,2020.43 The news that Tesla and Panasonic were in discussions to jointly expand Gigafactory 1's capacity surprised many due to the recent problems in the alliance. In fact, it appeared that the two firms were in the process of unwinding their partnership. Both companies had begun adopting increasingly defensive behavior, often spurning the other in efforts to avoid exploitation. These moves raised a variety of questions with regard to Tesla's long-term battery strategy and Panasonic's future with Tesla. Was Tesla using the threat of internal production as a ploy to get better deals on battery production from Panasonic, LG Chem and CATL? Was the company really committed to making its own batteries? Could it develop the same competencies in the development and production of battery packs as Panasonic, a company that had been investing in battery technology for over 30 years? If Tesla made its own batteries, could it realistically have effective partnerships with Panasonic and LG Chem/CATL? Or would they simply become arms-length supplier relationships where the companies would not collaborate on battery chemistry and technology? If so, how would that influence Tesla's ability to compete in the EV marketplace? Was there anything Panasonic could do to keep Tesla reliant on its batteries? Would the recent success in generating profits at Gigafactory 1 motivate both parties to collaborate more effectively and expand the partnership going forward? These were among the many key questions that faced top executives of both companies-and Tesla spectators who were enthralled with Tesla's every move-at the end of 2020 . CASE 10B Tesla and Panasonic's Strategic Partnership: By Jeff Dyer and Gordon Scott Introduction prior year, making it the most valuable company in the industry, despite the fact that it held a relatively small share (1.3 percent of unit volume) of the U.S. market.2 pursuit of improvements in chemical efficiency were crucial for the rapid scaling of Tesla. cell manufacturing in New York, 6 it seemed that Tesla and Panasonic were mutually committed to a long-term partnership across a variety of ventures. Tesla leading the fight, the future of the partnership was filled with uncertainty. Early Years bring vehicles to market and allow a greater focus on the design of the vehicle system, Tesla chose to outsource the production of its battery cells. strength in lithium-ion technology to establish a presence in the emerging EV market. lithium-ion cells to Tesla over the course of 4 years to further enable the rapid scaling of Tesla. 15 Gigafactory 1 Panasonic together in a joint venture termed the Gigafactory. produce the Model 3, a four-door sedan targeted at the middle class with a starting price of $35,000. The Gigafactory project propelled Tesla and Panasonic into the next phase of their relationship, requiring significant investment, communication, and vulnerability from both Tesla and Panasonic. It was agreed that Tesla would purchase the land and construct the building while Panasonic would invest in all the equipment, machinery, and other manufacturing tools required to produce the necessary lithium-lon batteries. By its scheduled completion date in 2020, the Gigafactory would demand a combined investment of $5 billion with Panasonic shouldering $1.6 billion of the total. 17 Tesla's Energy Business and the Buffalo Gigafactory The introduction of the Powerwall and Powerpack in 2015 expanded Tesla's scope to include the energy storage industry Rather than require solar power producers to waste or sell their power in daylight hours and rely on the power grid after sundown, Tesla's Powerwall and Powerpack stored clean energy produced by solar panels for use at the owners' discretion. In 2016 Tesla expanded its energy business by paying \$2.6 billion to acquire SolarCity, 18 the country's dominant installer of rooftop solar panels. The acquisition was shortly followed by the announcement of a new joint venture between Tesla and Panasonic to construct a second Gigafactory in Buffalo, New York focused on the design and production of solar panels. The Buffalo Gigafactory was to be heavily subsidized by the state of New York,,219 but would also require investments from both Tesla and Panasonic in order to purchase the needed machinery to produce the solar panels. Panasonic planned to invest over $256 million in the Buffalo Gigafactory, 20 and Tesla would pay for undisclosed costs not covered by New York or Panasonic. Strategic Fit Tesla's Value as a Partner Tesla Motors. 3 innovate. of rapid expansion in a nascent industry, it was critical that they find a partner to solve their battery problem. Panasonic's Value as a Partner Regarding the decision to partner with Panasonic, Tesla CEO and co-founder Elon Musk said: further improve our battery pack while reducing cost. 22 realizable. Company Cultures Tesla Culture Tesla created the following six principles as the backbone of its entrepreneurial and innovative culture: 1. Move fast. 2. Do the impossible. 3. Constantly innovate. 4. Reason from "first principles". 5. Think like owners. 6. We are ALL IN. 323 challenge people to work hard, they achieve more than they think they can. Most leaders don't want to do that,"24 reached by others, effective and innovative solutions could more easily be discovered. withholding nothing in pursuit of its purpose. Tesla CEO founding and growth of several companies, most of which focused on solving challenging technical problems. admiration, though skeptics of his long-term goals still remained plentiful. Panasonic Culture production and manufacturing rather than innovating. customers, Panasonic had built a worldwide reputation of reliable performance. the understanding that a bankrupt company is incapable of providing value to the world. Panasonic CEO elected to serve as CEO and tasked with returning the company to profitability following the heavy losses from overinvestment in plasma TVs. company's strongest proponents of building the relationship. Gigafactory 1 was dedicated to manufacturing Tesla's Model 3, Powerwall, and Powerpack. As a result, Panasonic needed to design a special production line, customized to manufact new 2170 battery cells used in these products. In return for Panasonic's investment in Gigafactory 1 Tesla would be obligated to purchase the needed battery cells produced on site, extending Panasonic's status as the exclusive battery supplier of Tesla. Co-locating in Nevada and collaborating to advance both the technology and the production of lithium-ion batteries would require the sharing of intellectual property. As Tesla and Panasonic worked together to achieve chemical advancements and improved battery performance, additional joint intellectual property would be created. The Gigafactory contract specified that both parties agreed they would permit the use of jointly created intellectual property both independently and with others, providing that there be no infringement of the other party's intellectual property rights. 29 In the event of a dispute, Tesla and Panasonic agreed to first attempt informal resolution through negotiation. If, after thoroughly exploring all possibilities for an amicable settlement, working directly with one another proved insufficient, the companies agreed to rely on arbitration. Tesla and Panasonic were to agree on the chosen third-party arbitrator who would be exclusively responsible for settling the dispute. Both parties agreed to abide by the results of any necessary arbitration and to keep all outcomes confidential. 28 Executing the Partnership Key Personnel In preparation for their collaboration at Gigafactory 1 Tesla and Panasonic each appointed prominent employees to serve as liaisons in the developing relationship. Yoshihiko Yamada, previously CEO of Panasonic's North American operations and one of Panasonic's strongest proponents for the partnership, spent a year working with Tesla to iron out the details of the venture. 30Mr Yamada readily acknowledged deep cultural differences between the companies and pushed hard to keep teams in constant contact, helping to foster trust and synchronizing the speed of operations at the Gigafactory. Helping Tesla to bridge the cultural gap was a Kurt Kelty, who had spent nearly 15 years employed by Panasonic prior to working at Tesla. While in Japan, Kelty had become intimately familiar with Panasonic's bureaucratic culture as well as the language. He would often attend meetings between executive teams, helping to translate and soften the blows when negotiations became tense. 1027 Producing Together The advancement of battery technology was integral to the common goal of popularizing the EV. (See Exhibit 2 for a depiction of how batteries are deployed in the Tesla Model S.) Prior to Gigafactory 1, Tesla had chosen to purchase Panasonic's 18650 battery cells for use in the Roadster, Model S, and Model X. The 18-650 cell, which was commonly used in portable electronics, provided the highest cell level energy density and were already available in mass quantities, however, it had not been designed specifically for EV use. In a joint effort to increase efficiencies and lower costs, Tesla and Panasonic developed the 2170 battery cell, which Musk claimed to be "the highest energy density cell in the world and also the cheapest."31 The Gigafactory was designed to manufacture only the new 2170 battery cells, which were to be adopted by Tesla's Powerwall, Powerpack, and Model 3. Looking to the Future EXHIBIT 4 Panasonic AIS Financials (in millions) business makes up 26.8 percent of AIS as of 2019. EXHIBIT 5 Tesla Unit Volume and Cost of Revenue Notes: Figures sourced from Tesla quarterly update letters and vehicle production \& delivery updates. 42 "Production numbers could not be found and are substituted bv deliverv numbers. EXHIBIT 6 Tesla and Panasonic Market Capitalization Notes: Market cap was calculated by multiplying the number of shares outstanding at the end of each fiscal year by the stock price on that day. Data was gathered before the end of FY2020, therefore, data for 2020 was gathered halfway through the year on July 1,2020.43 The news that Tesla and Panasonic were in discussions to jointly expand Gigafactory 1's capacity surprised many due to the recent problems in the alliance. In fact, it appeared that the two firms were in the process of unwinding their partnership. Both companies had begun adopting increasingly defensive behavior, often spurning the other in efforts to avoid exploitation. These moves raised a variety of questions with regard to Tesla's long-term battery strategy and Panasonic's future with Tesla. Was Tesla using the threat of internal production as a ploy to get better deals on battery production from Panasonic, LG Chem and CATL? Was the company really committed to making its own batteries? Could it develop the same competencies in the development and production of battery packs as Panasonic, a company that had been investing in battery technology for over 30 years? If Tesla made its own batteries, could it realistically have effective partnerships with Panasonic and LG Chem/CATL? Or would they simply become arms-length supplier relationships where the companies would not collaborate on battery chemistry and technology? If so, how would that influence Tesla's ability to compete in the EV marketplace? Was there anything Panasonic could do to keep Tesla reliant on its batteries? Would the recent success in generating profits at Gigafactory 1 motivate both parties to collaborate more effectively and expand the partnership going forward? These were among the many key questions that faced top executives of both companies-and Tesla spectators who were enthralled with Tesla's every move-at the end of 2020