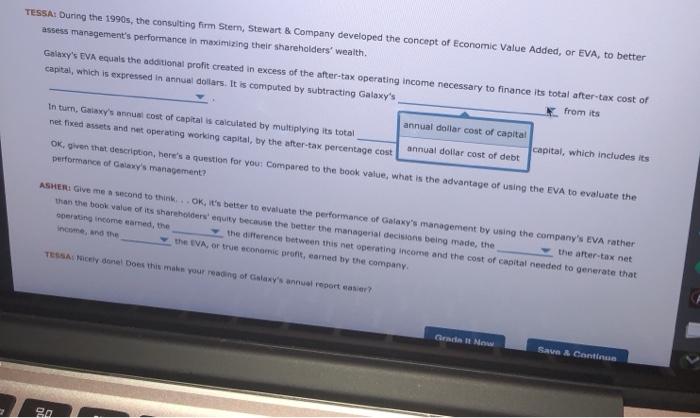

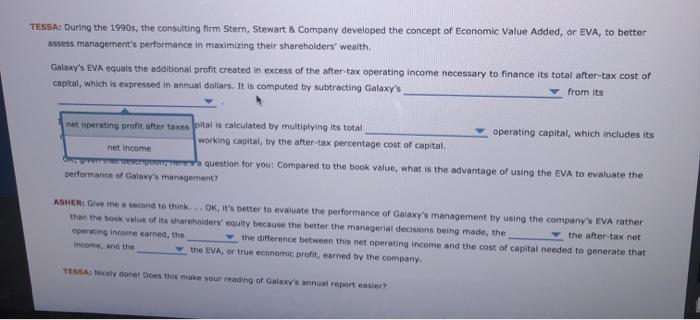

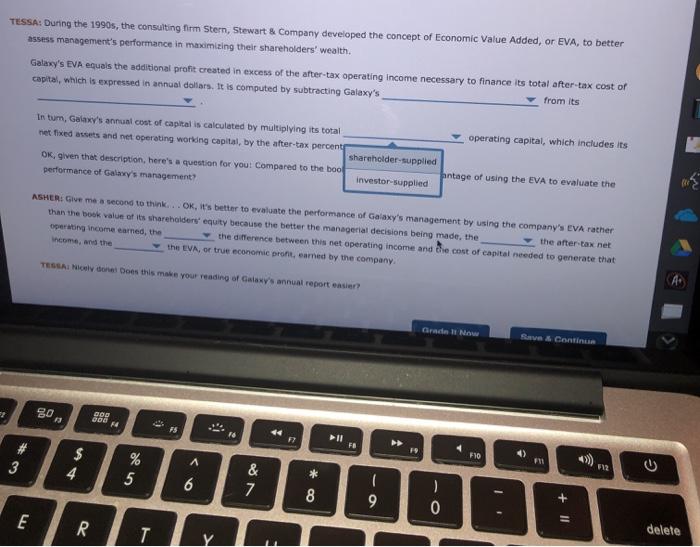

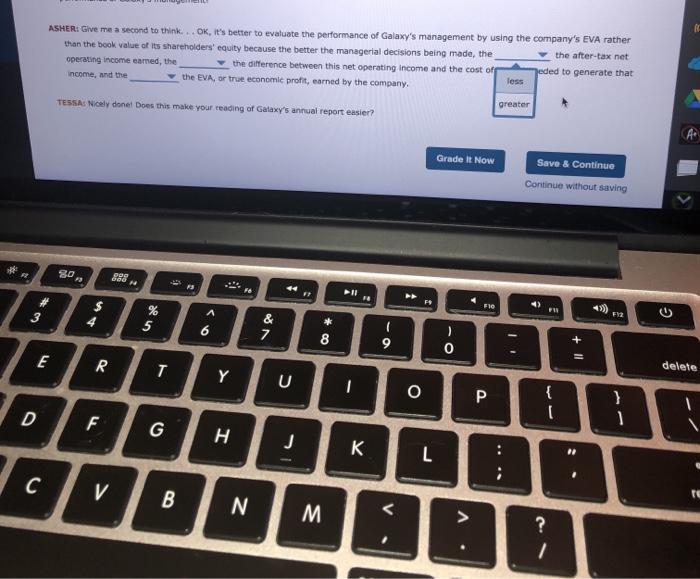

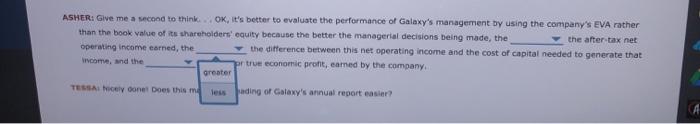

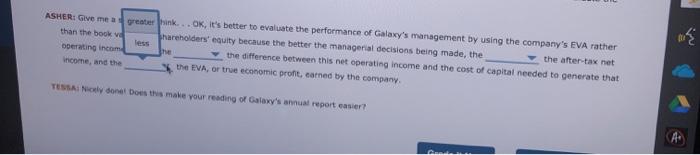

TESSA: During the 1990s, the consulting firm Stern, Stewart & Company developed the concept of Economic Value Added, or EVA, to better assess management's performance in maximizing their shareholders' wealth Galaxy's EVA equals the additional profit created in excess of the after-tax operating income necessary to finance its total after-tax cost of capital, which is expressed in annual dollars. It is computed by subtracting Galaxy's from its annual dollar cost of capital In turn, Galaxy's annual cost of capital is calculated by multiplying its total capital, which includes its net Tied ants and net operating working capital, by the after-tax percentage cost annual dollar cost of debt OK, given that description, here's a question for your compared to the book value, what is the advantage of using the EVA to evaluate the performancnot Galaxy's management? ASHER: Give me a second to think.. OK, it's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managersal decisions being made, the the after-tax net pertinencome earned, the the difference between this net operating income and the cost of capital needed to generate that the IVA, or true economic profit, earned by the company TESSATI donel Does this make your reading of Galaxy's annual report an er? Grad It Now Sam Continue 20 TESSA: During the 1990s, the consulting firm Stern, Stewart & Company developed the concept of Economic Value Added, or EVA, to better assess management's performance in maximizing their shareholders' wealth Galaxy's EVA equals the additional profit created in excess of the after tax operating income necessary to finance its total after-tax cost of capital, which is expressed in annual dollars. It is computed by subtracting Galaxy's from its met operating profit after takes pitalis calculated by multiplying its total operating capital, which includes its working capital, by the after-tax percentage cost of capital net income barem verenpoon mierere question for your compared to the book value, what is the advantage of using the EVA to evaluate the performance of Galaxy's management? ASHER: Give me a second to think... OK, it's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the the after-tax net operating income earned, the the difference between this net operating income and the cost of capital needed to generate that Vcore, and the the EVA, or true economic profit, earned by the company. TESSA Nicely dont Does this make your reading of Galaxy's annual report easier TESSA: During the 1990s, the consulting firm Stern, Stewart & Company developed the concept of Economic Value Added, or EVA, to better assess management's performance in maximizing their shareholders' wealth Galaxy's EVA equals the additional profit created in excess of the after-tax operating income necessary to finance its total after-tax cost of capital, which is expressed in annual dollars. It is computed by subtracting Galaxy's from its In turn, Galaxy's annual cost of capital is calculated by multiplying its total operating capital, which includes its net fixed assets and net operating working capital, by the after-tax percent shareholder-supplied OK, given that description, here's a question for your compared to the bool pntage of using the EVA to evaluate the performance of Galaxy's management investor-supplied ASHER: Give me a second to think... OK, 's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the the after tax net operating income earned, the the difference between this net operating income and the cost of capital needed to generate that the EVA, or true economic profit, earned by the company TESLA dones Does this make your reading of Galaxy's annual report easier Grad Now Sam Continua F2 80 COR 206 FS #2 FB 19 FO 3 3 $ 4 A % 5 * 6 & 7 8 9 ) 0 21 + E E R T delete ASHER: Give me a second to think... OK, it's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the the after-tax net operating income eamed, the the difference between this net operating Income and the cost off Jeded to generate that Income, and the the EVA, or true economic profit, earned by the company. less TESSA: Nicely donet Does this make your reading of Galaxy's annual report easier? greater Grade It Now Save & Continue Continue without saving 80 F3 BRE . FS # 4 % 5 * 6 & 7 8 9 9 : 0 + 11 E R T delete Y U I O P { D F G H J L C V B N M 0 ? ASHER: Give me a second to think OK, it's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the the after tax net operating income earned, the the difference between this net operating income and the cost of capital needed to generate that rycomeand the pr true economic profit, eamed by the company greater TESA cely cone Does this m less fading of Galaxy's annual report easier ASHER: Give me a greater... OK, it's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book ve hareholders' equity because the better the managerial decisions being made, the the after-tax net operating incom he the difference between this net operating income and the cost of capital needed to generate that income, and the the EVA, or true economic profit, earned by the company TESSA: Ny on Does this make your reading of Galaxy's annual report easier