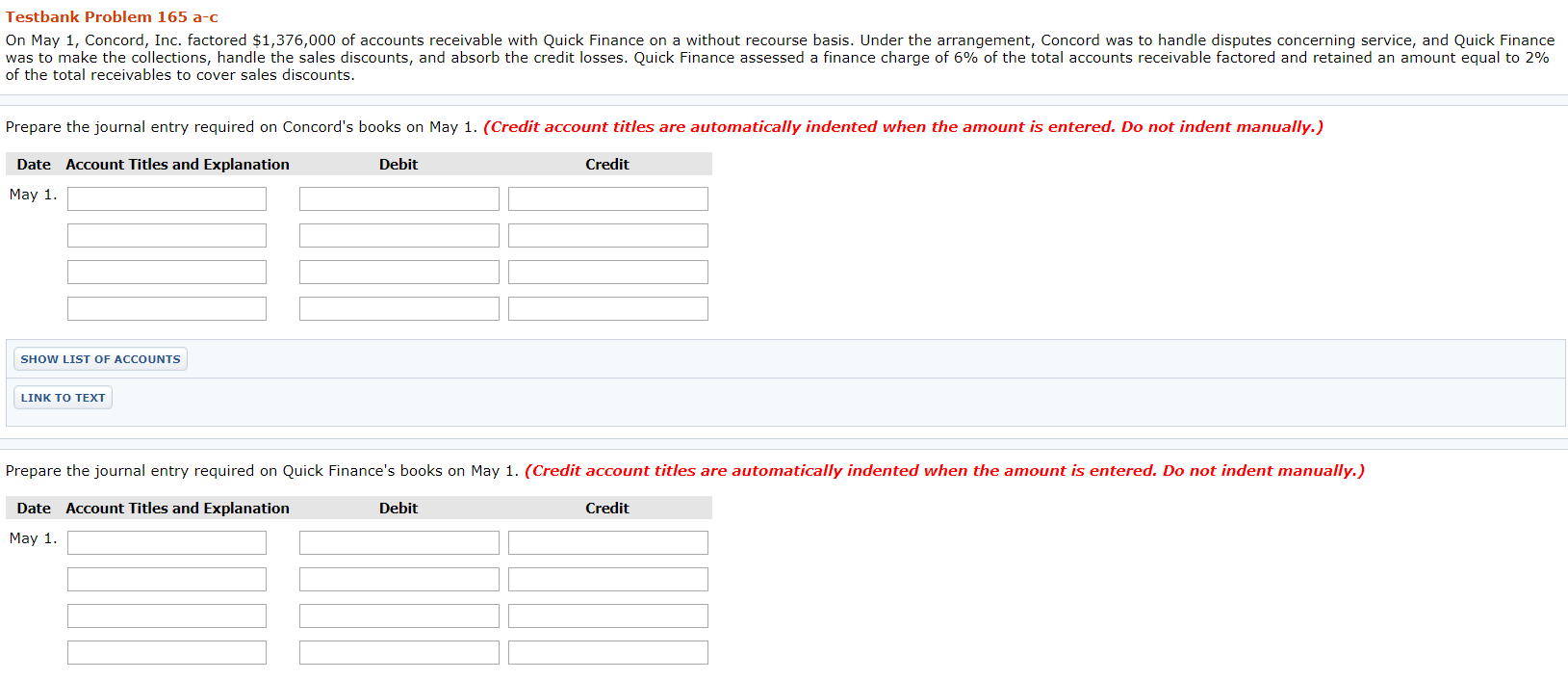

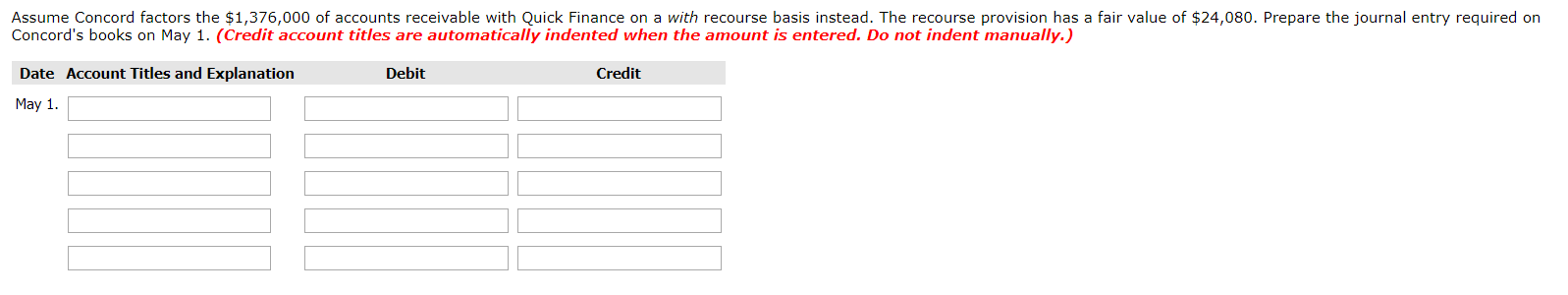

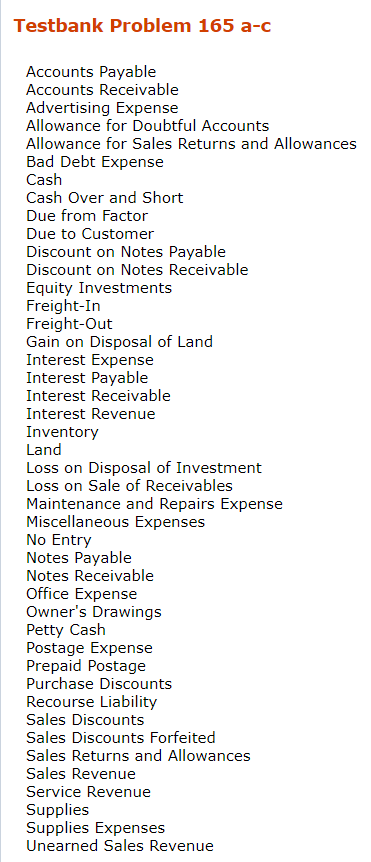

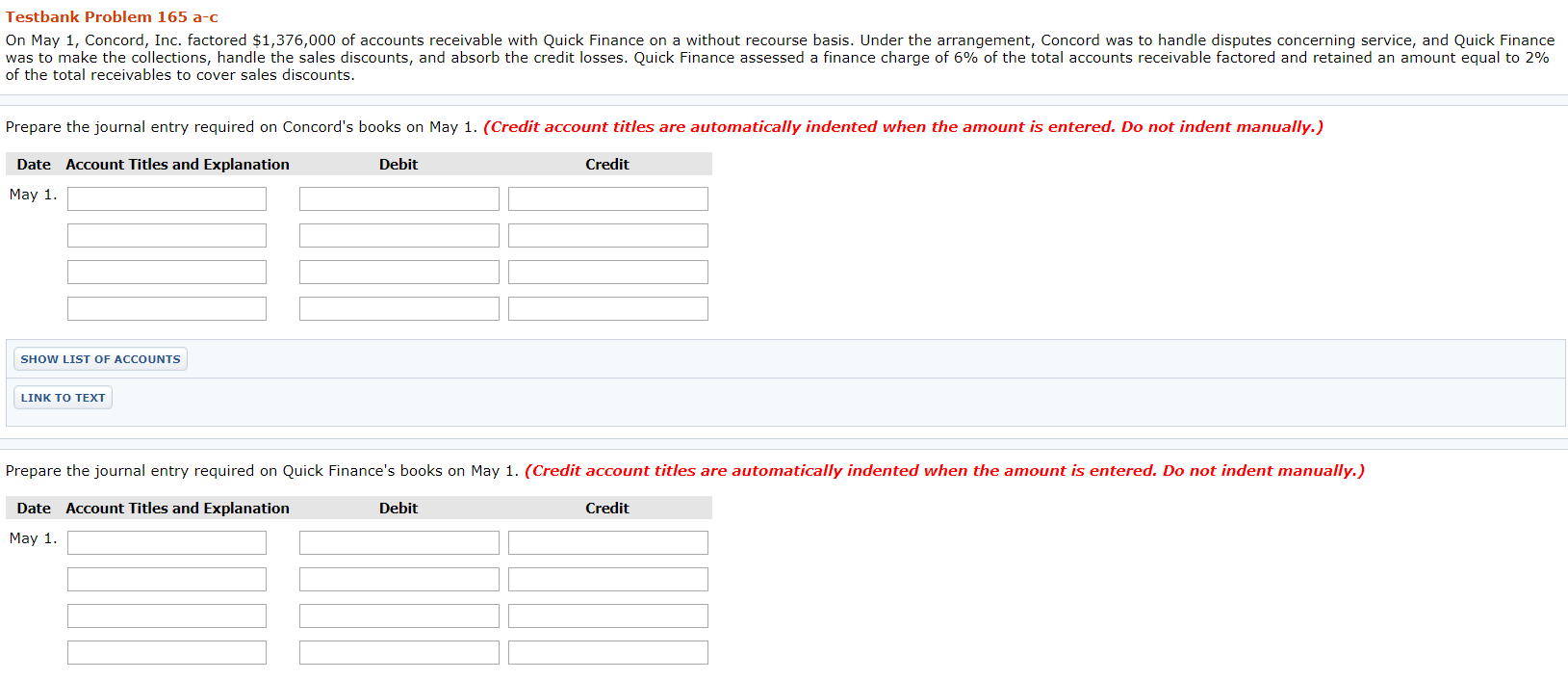

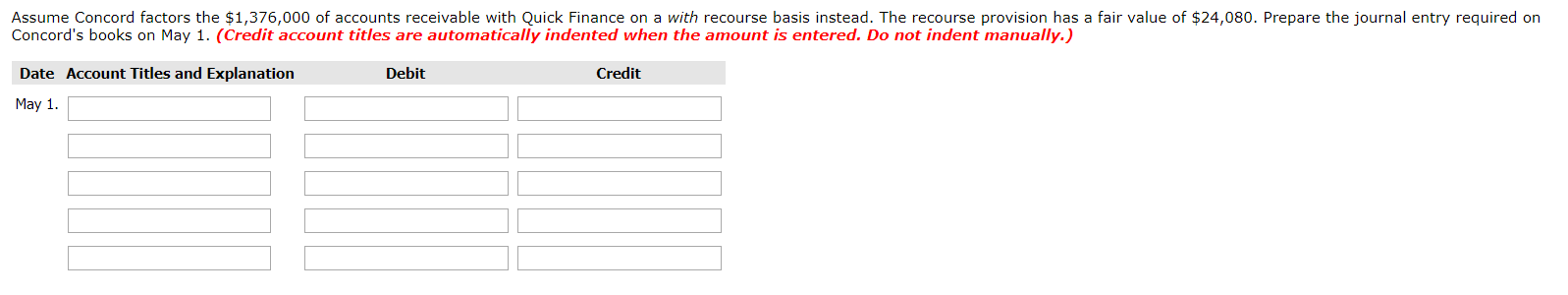

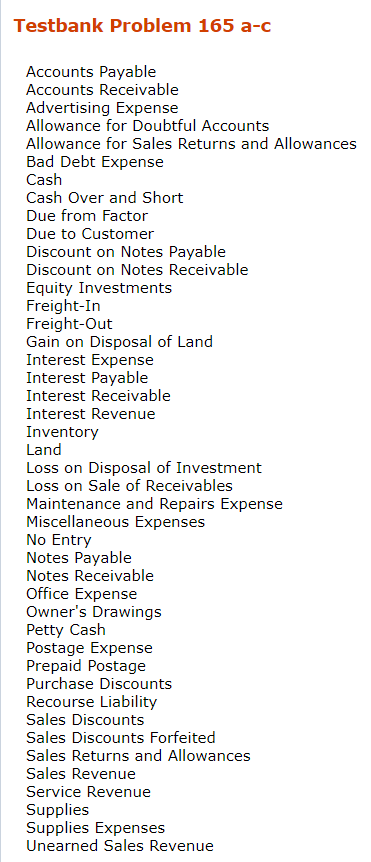

Testbank Problem 165 a-c On May 1, Concord, Inc. factored $1,376,000 of accounts receivable with Quick Finance on a without recourse basis. Under the arrangement, Concord was to handle disputes concerning service, and Quick Finance was to make the collections, handle the sales discounts, and absorb the credit losses. Quick Finance assessed a finance charge of 6% of the total accounts receivable factored and retained an amount equal to 2% of the total receivables to cover sales discounts. Prepare the journal entry required on Concord's books on May 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit May 1. SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entry required on Quick Finance's books on May 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation May 1. Assume Concord factors the $1,376,000 of accounts receivable with Quick Finance on a with recourse basis instead. The recourse provision has a fair value of $24,080. Prepare the journal entry required on Concord's books on May 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit May 1. Testbank Problem 165 a-c Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Allowance for Sales Returns and Allowances Bad Debt Expense Cash Cash Over and Short Due from Factor Due to Customer Discount on Notes Payable Discount on Notes Receivable Equity Investments Freight-In Freight-Out Gain on Disposal of Land Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Investment Loss on Sale of Receivables Maintenance and Repairs Expense Miscellaneous Expenses No Entry Notes Payable Notes Receivable Office Expense Owner's Drawings Petty Cash Postage Expense Prepaid Postage Purchase Discounts Recourse Liability Sales Discounts Sales Discounts Forfeited Sales Returns and allowances Sales Revenue Service Revenue Supplies Supplies Expenses Unearned Sales Revenue