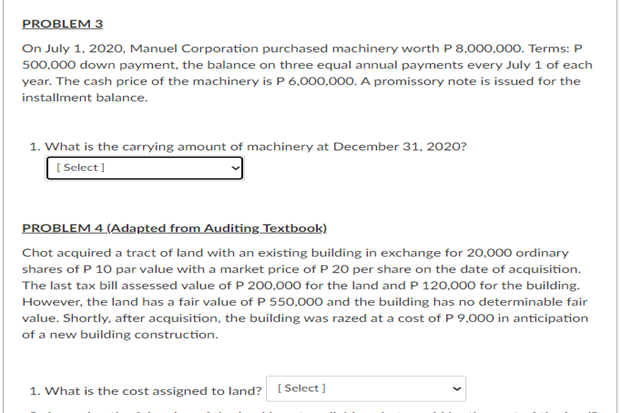

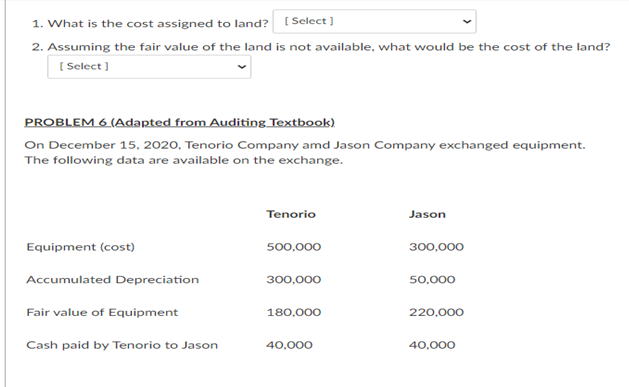

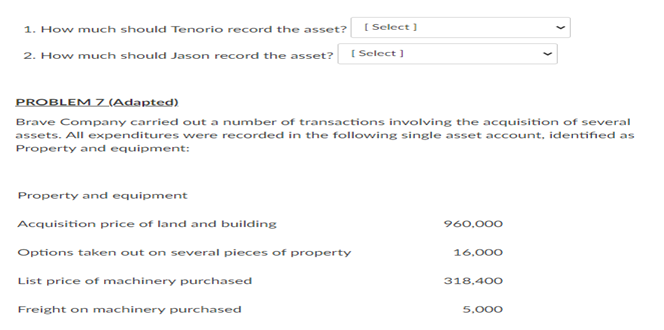

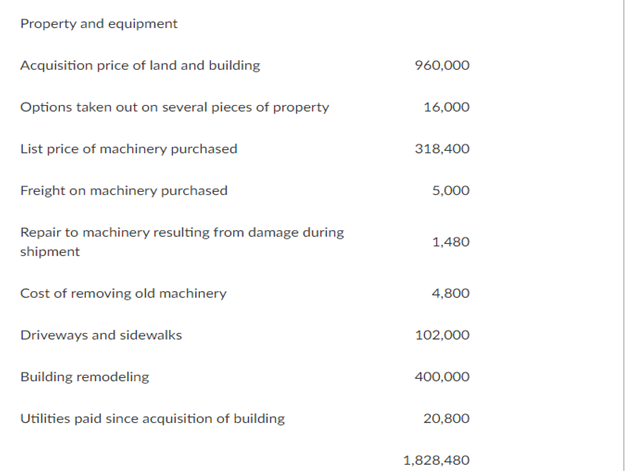

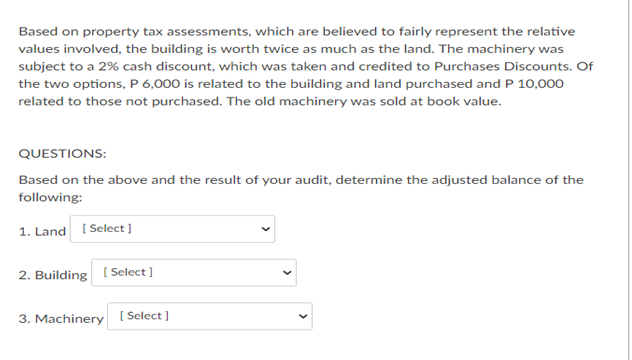

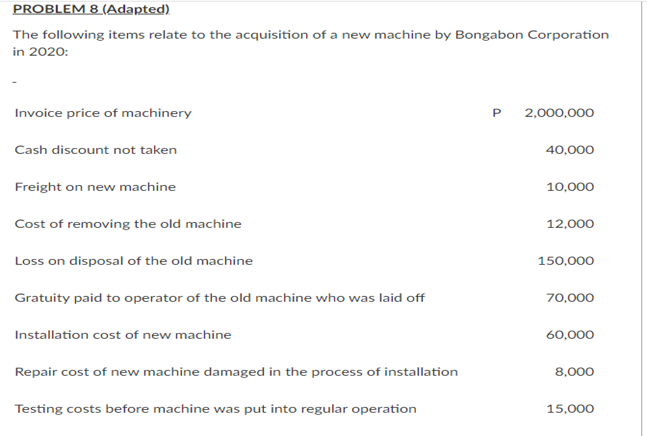

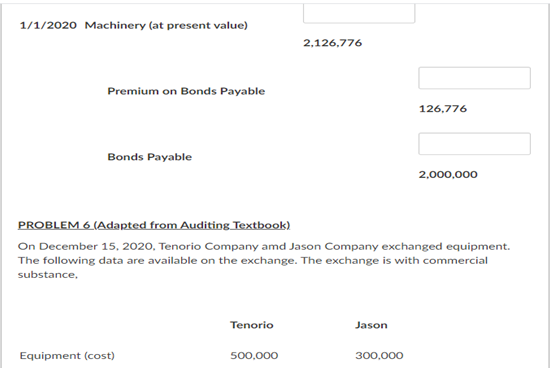

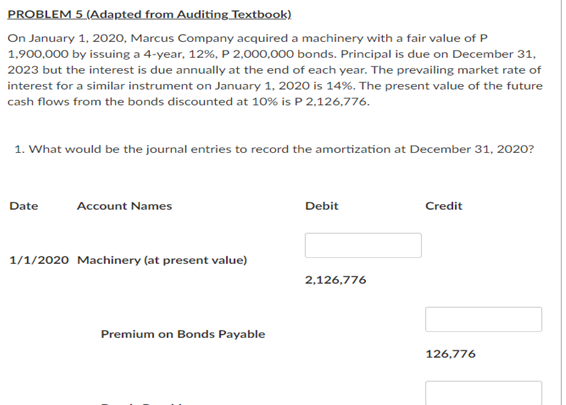

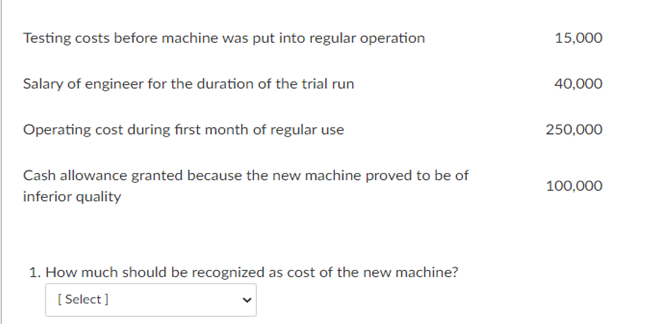

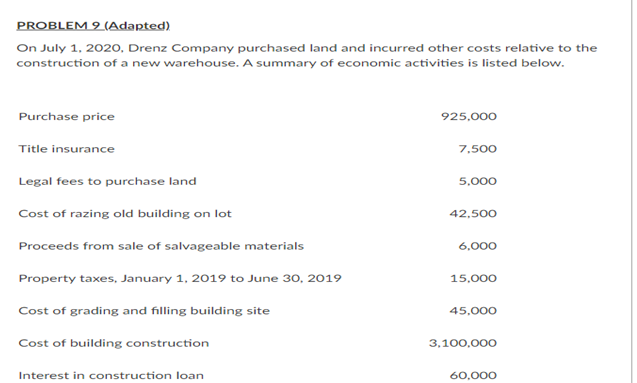

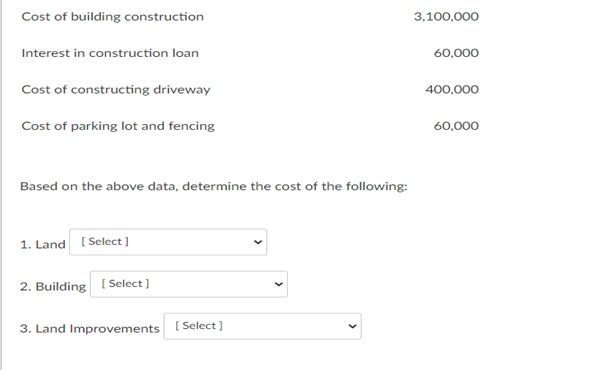

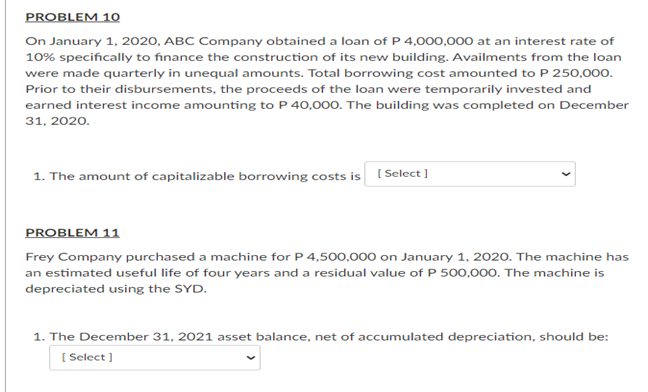

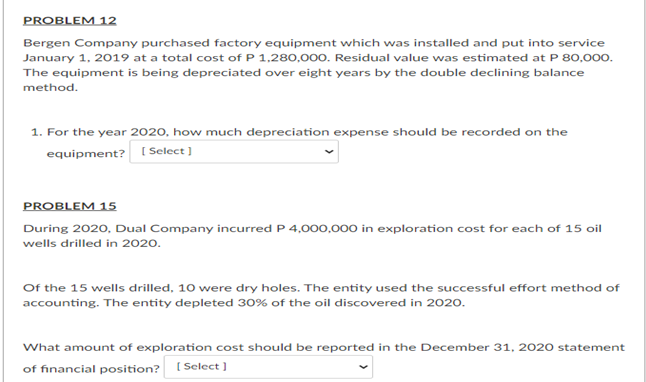

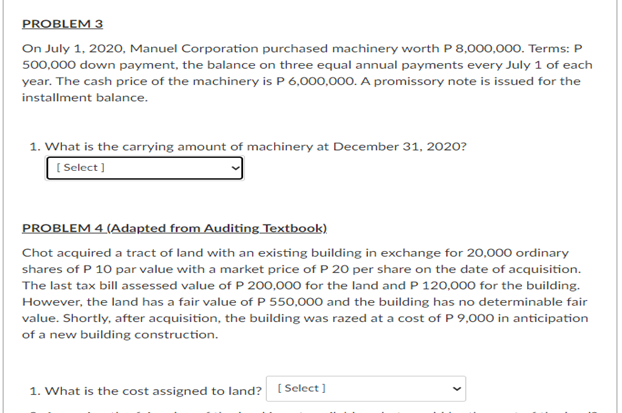

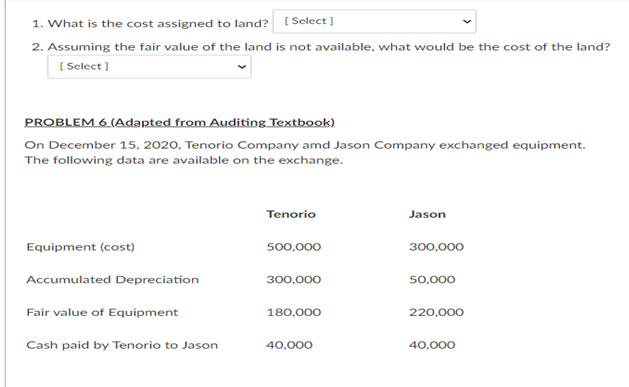

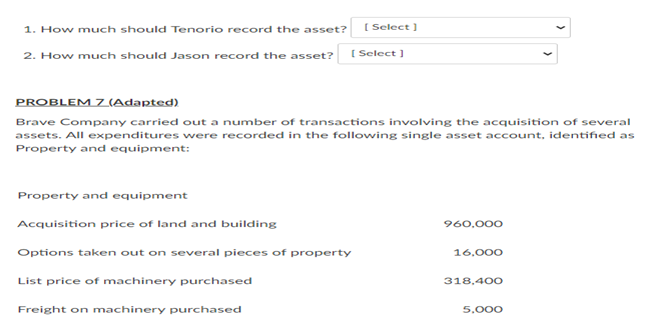

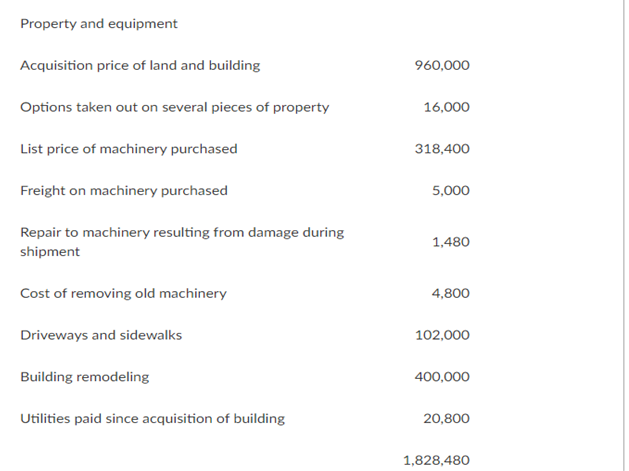

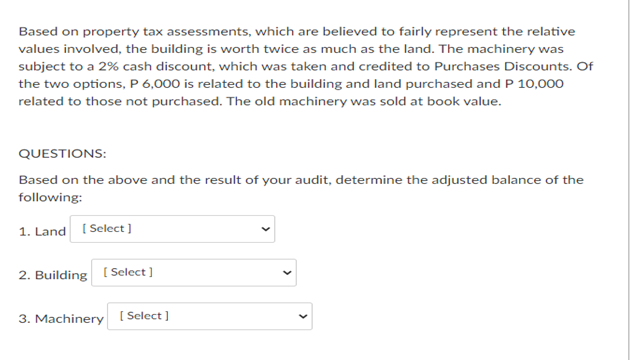

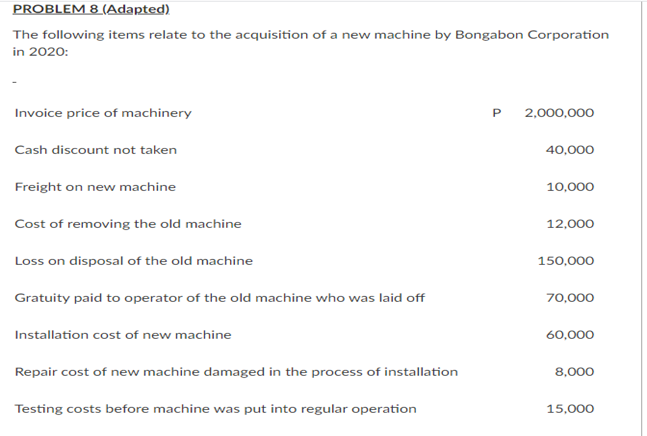

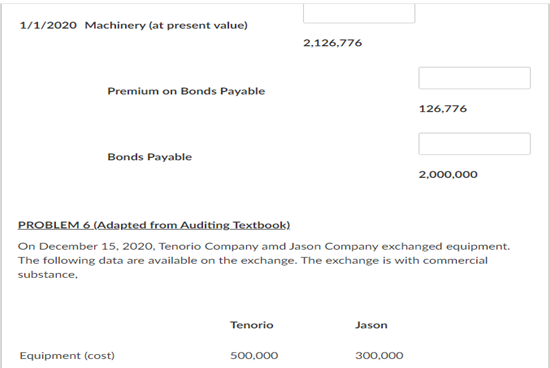

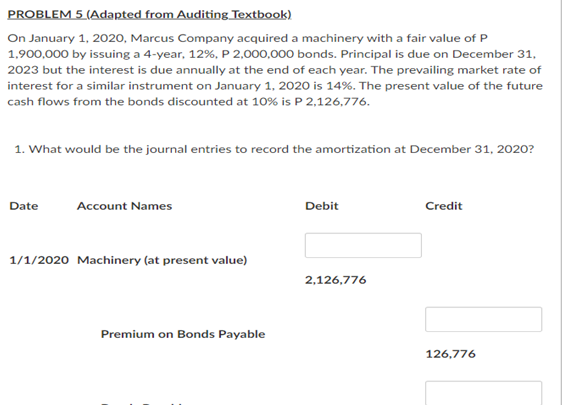

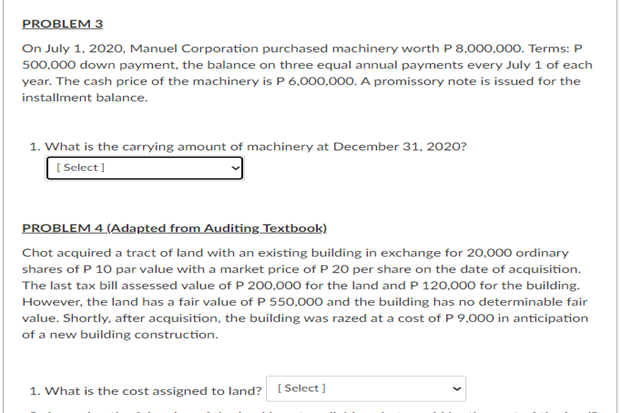

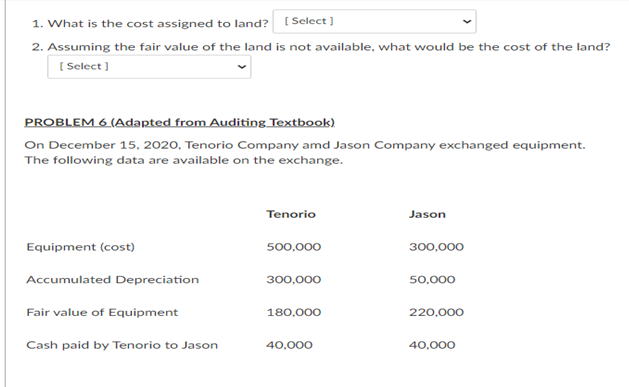

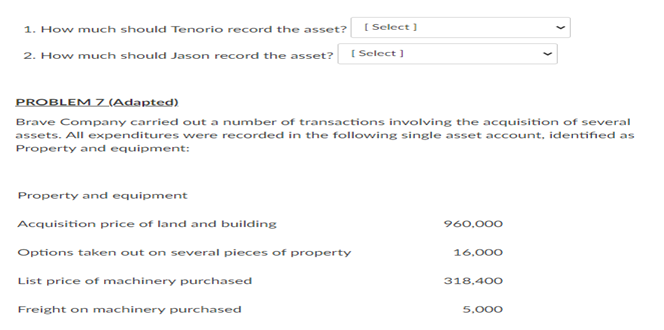

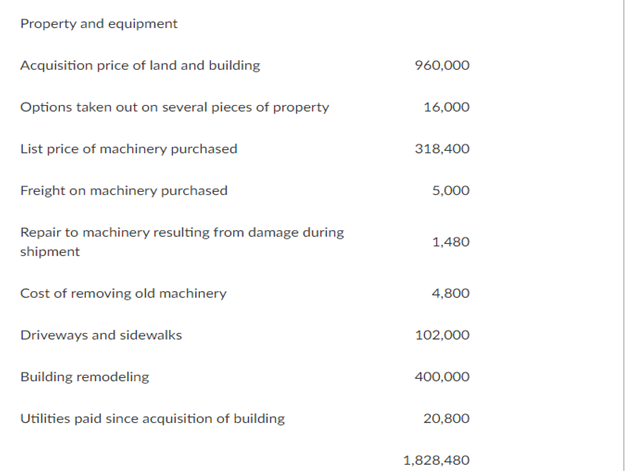

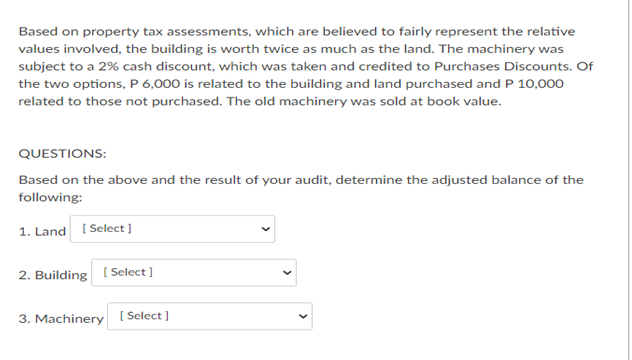

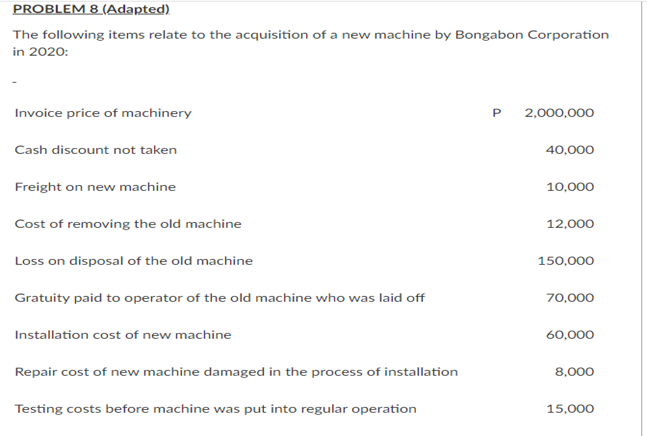

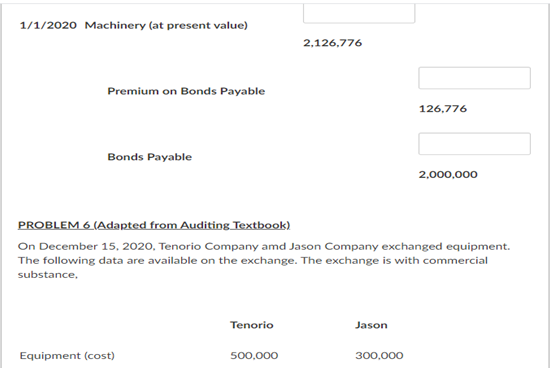

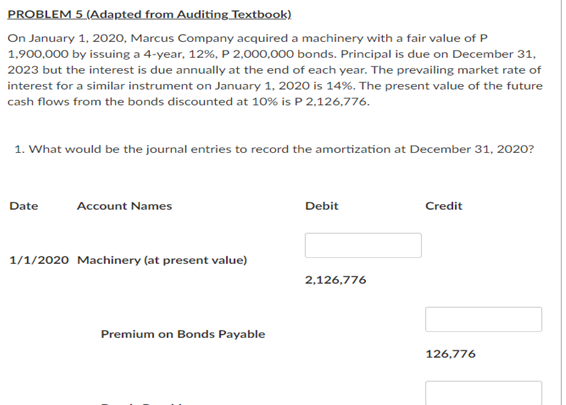

Testing costs before machine was put into regular operation 15,000 Salary of engineer for the duration of the trial run 40,000 Operating cost during first month of regular use 250,000 Cash allowance granted because the new machine proved to be of 100,000 inferior quality 1. How much should be recognized as cost of the new machine? [ Select ]PROBLEM 9 (Adapted) On July 1, 2020, Drenz Company purchased land and incurred other costs relative to the construction of a new warehouse. A summary of economic activities is listed below. Purchase price 925.000 Title insurance 7.500 Legal fees to purchase land 5,000 Cost of razing old building on lot 42.500 Proceeds from sale of salvageable materials 6.000 Property taxes, January 1, 2019 to June 30, 2019 15,000 Cost of grading and filling building site 45,000 Cost of building construction 3.100,000 Interest in construction loan 60.000Cost of building construction 3,100,000 Interest in construction loan 60,000 Cost of constructing driveway 400,000 Cost of parking lot and fencing 60,000 Based on the above data, determine the cost of the following: 1. Land [ Select ] 2. Building [ Select ] 3. Land Improvements [ Select ]PROBLEM 10 On January 1, 2020, ABC Company obtained a loan of P 4,000,000 at an interest rate of 10% specifically to finance the construction of its new building. Availments from the loan were made quarterly in unequal amounts. Total borrowing cost amounted to P 250,000. Prior to their disbursements, the proceeds of the loan were temporarily invested and earned interest income amounting to P 40,000. The building was completed on December 31, 2020. 1. The amount of capitalizable borrowing costs is [ Select ] PROBLEM 11 Frey Company purchased a machine for P 4,500,000 on January 1, 2020. The machine has an estimated useful life of four years and a residual value of P 500,000. The machine is depreciated using the SYD. 1. The December 31, 2021 asset balance, net of accumulated depreciation, should be: [ Select ]PROBLEM 12 Bergen Company purchased factory equipment which was installed and put into service January 1, 2019 at a total cost of P 1,280,000. Residual value was estimated at P 80,000. The equipment is being depreciated over eight years by the double declining balance method. 1. For the year 2020, how much depreciation expense should be recorded on the equipment? [ Select ] PROBLEM 15 During 2020, Dual Company incurred P 4,000,000 in exploration cost for each of 15 oil wells drilled in 2020. Of the 15 wells drilled, 10 were dry holes. The entity used the successful effort method of accounting. The entity depleted 30% of the oil discovered in 2020. What amount of exploration cost should be reported in the December 31, 2020 statement of financial position? [ Select ]PROBLEM 3 On July 1, 2020, Manuel Corporation purchased machinery worth P 8,000,000. Terms: P 500,000 down payment, the balance on three equal annual payments every July 1 of each year. The cash price of the machinery is P 6,000,000. A promissory note is issued for the installment balance. 1. What is the carrying amount of machinery at December 31, 2020? [ Select ] PROBLEM 4 (Adapted from Auditing Textbook) Chot acquired a tract of land with an existing building in exchange for 20,000 ordinary shares of P 10 par value with a market price of P 20 per share on the date of acquisition. The last tax bill assessed value of P 200,000 for the land and P 120,000 for the building. However, the land has a fair value of P 550,000 and the building has no determinable fair value. Shortly, after acquisition, the building was razed at a cost of P 9,000 in anticipation of a new building construction. 1. What is the cost assigned to land? [ Select ]1. What is the cost assigned to land? [ Select ] 2. Assuming the fair value of the land is not available, what would be the cost of the land? [ Select ] PROBLEM & (Adapted from Auditing Textbook) On December 15, 2020, Tenorio Company amd Jason Company exchanged equipment. The following data are available on the exchange. Tenorio Jason Equipment (cost) 500,000 300,000 Accumulated Depreciation 300,000 50,000 Fair value of Equipment 180,000 220,000 Cash paid by Tenorio to Jason 40.000 40,0001. How much should Tenorio record the asset? [ Select ] 2. How much should Jason record the asset? [ Select ] PROBLEM 7 (Adapted) Brave Company carried out a number of transactions involving the acquisition of several assets. All expenditures were recorded in the following single asset account, identified as Property and equipment: Property and equipment Acquisition price of land and building 960,000 Options taken out on several pieces of property 16.000 List price of machinery purchased 318,400 Freight on machinery purchased 5.000Property and equipment Acquisition price of land and building 960,000 Options taken out on several pieces of property 16,000 List price of machinery purchased 318,400 Freight on machinery purchased 5,000 Repair to machinery resulting from damage during 1,480 shipment Cost of removing old machinery 4.800 Driveways and sidewalks 102,000 Building remodeling 400,000 Utilities paid since acquisition of building 20,800 1,828,480Based on property tax assessments, which are believed to fairly represent the relative values involved, the building is worth twice as much as the land. The machinery was subject to a 2% cash discount, which was taken and credited to Purchases Discounts. Of the two options, P 6,000 is related to the building and land purchased and P 10,000 related to those not purchased. The old machinery was sold at book value. QUESTIONS: Based on the above and the result of your audit, determine the adjusted balance of the following: 1. Land [ Select ] 2. Building [ Select ] 3. Machinery [ Select ]Weiss!!! The following items relate to the acquisition of a new machine by Bongabon Corporation in 2020: Invoice price of machineryr F' 2.000.000 Cash discount not taken 40.000 Freight on new machine 10.000 Cost of removing the old machine 12.000 Loss on disposal of the old machine 150.000 Gratuity paid to operator of the old machine who was laid off ?0.000 Installation cost of new machine 60.000 Repair cost of new machine damaged in the process of installation 3.000 Testing costs before machine was put into regular operation 15.000 1/1/2020 Machinery (at present value) 2,126,776 Premium on Bonds Payable 126.776 Bonds Payable 2.000,000 PROBLEM 6 (Adapted from Auditing Textbook) On December 15, 2020. Tenorio Company amd Jason Company exchanged equipment. The following data are available on the exchange. The exchange is with commercial substance, Tenorio Jason Equipment (cost) 500.000 300,000PROBLEM 5 (Adapted from Auditing Textbook) On January 1, 2020, Marcus Company acquired a machinery with a fair value of P 1,900,000 by issuing a 4-year, 12%, P 2,000,000 bonds. Principal is due on December 31, 2023 but the interest is due annually at the end of each year. The prevailing market rate of interest for a similar instrument on January 1, 2020 is 14%. The present value of the future cash flows from the bonds discounted at 10% is P 2,126,776. 1. What would be the journal entries to record the amortization at December 31, 2020? Date Account Names Debit Credit 1/1/2020 Machinery (at present value) 2,126.776 Premium on Bonds Payable 126.776