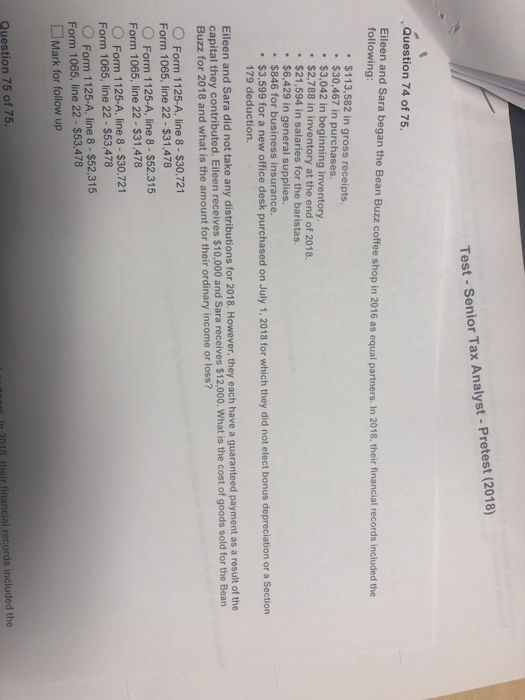

Test-Senior Tax Analyst - Pretest (2018) Question 74 of 75 Eileen and Sara began the Bean Buzz coffee shop in 2016 as equal partners. In following: 2018, their financial records included the $113,582 in gross receipts. $30,467 in purchases. $3,042 in beginning inventory $2,788 in inventory at the end of 2018. $21,594 in salaries for the baristas. . . $6,429 in general supplies. . $846 for business insurance $3,599 for a new office desk purchased on July 1, 2018 for which they did not elect bonus depreciation or a Section 179 deduction. Eileen and Sara did not take any distributions for 2018. However, they each have a guaranteed payment as a result of the capital they con Buzz for 2018 and what is the amount for their ordinary income or loss? tributed. Eileen receives $10,000 and Sara receives $12,000. What is the cost of goods sold for the Bean O Form 1125-A, line 8-$30,721 Form 1065, line 22- $31,478 Form 1065, line 22 $31,478 Form 1065, line 22-$53,478 Form 1065, line 22 - $53,478 Form 1125-A, line 8-$52.315 Form 1125-A, line 8-$30.721 Form 1 125-A, line 8 . S52.315 Mark for follow up Question 75 of 75 In 2018 their financial records included the Test-Senior Tax Analyst - Pretest (2018) Question 74 of 75 Eileen and Sara began the Bean Buzz coffee shop in 2016 as equal partners. In following: 2018, their financial records included the $113,582 in gross receipts. $30,467 in purchases. $3,042 in beginning inventory $2,788 in inventory at the end of 2018. $21,594 in salaries for the baristas. . . $6,429 in general supplies. . $846 for business insurance $3,599 for a new office desk purchased on July 1, 2018 for which they did not elect bonus depreciation or a Section 179 deduction. Eileen and Sara did not take any distributions for 2018. However, they each have a guaranteed payment as a result of the capital they con Buzz for 2018 and what is the amount for their ordinary income or loss? tributed. Eileen receives $10,000 and Sara receives $12,000. What is the cost of goods sold for the Bean O Form 1125-A, line 8-$30,721 Form 1065, line 22- $31,478 Form 1065, line 22 $31,478 Form 1065, line 22-$53,478 Form 1065, line 22 - $53,478 Form 1125-A, line 8-$52.315 Form 1125-A, line 8-$30.721 Form 1 125-A, line 8 . S52.315 Mark for follow up Question 75 of 75 In 2018 their financial records included the