Question

Teton UTV Works manufactures utility terrain vehicles (UTVs). The firm uses a job-order costing system, and manufacturing overhead is applied on the basis of direct-labor

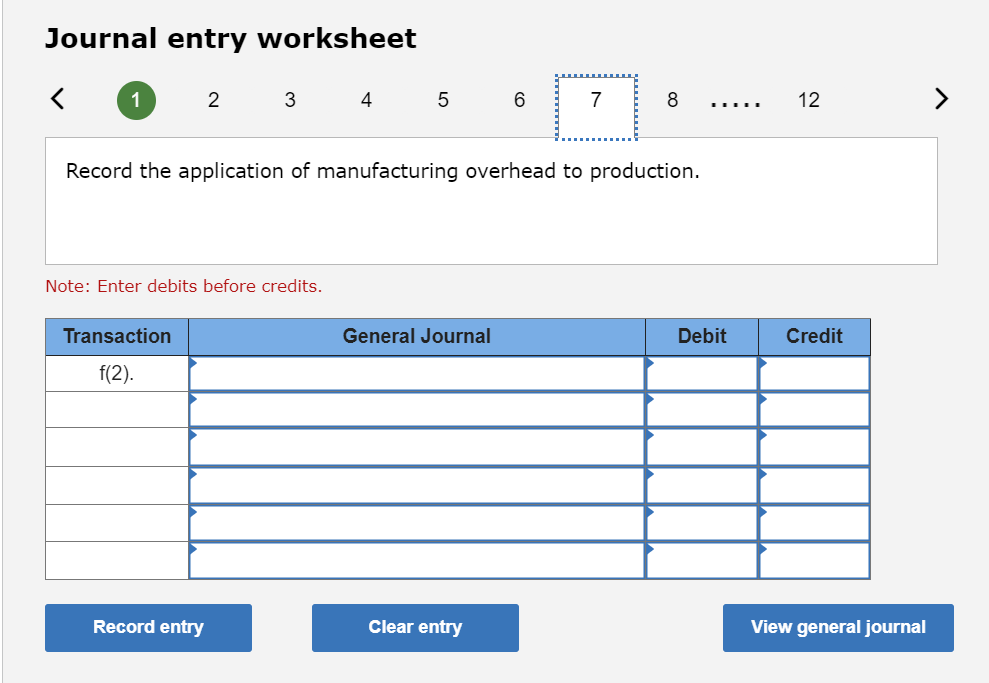

Teton UTV Works manufactures utility terrain vehicles (UTVs). The firm uses a job-order costing system, and manufacturing overhead is applied on the basis of direct-labor hours. Estimated manufacturing overhead for the year is $240,000. The firm employs 10 master assemblers, who constitute the direct-labor force. Each of these employees is expected to work 2,000 hours during the year, which represents each employees practical capacity. The following events occurred during October.

The firm purchased 3,500 feet of stainless steel tubing at $11 per foot.

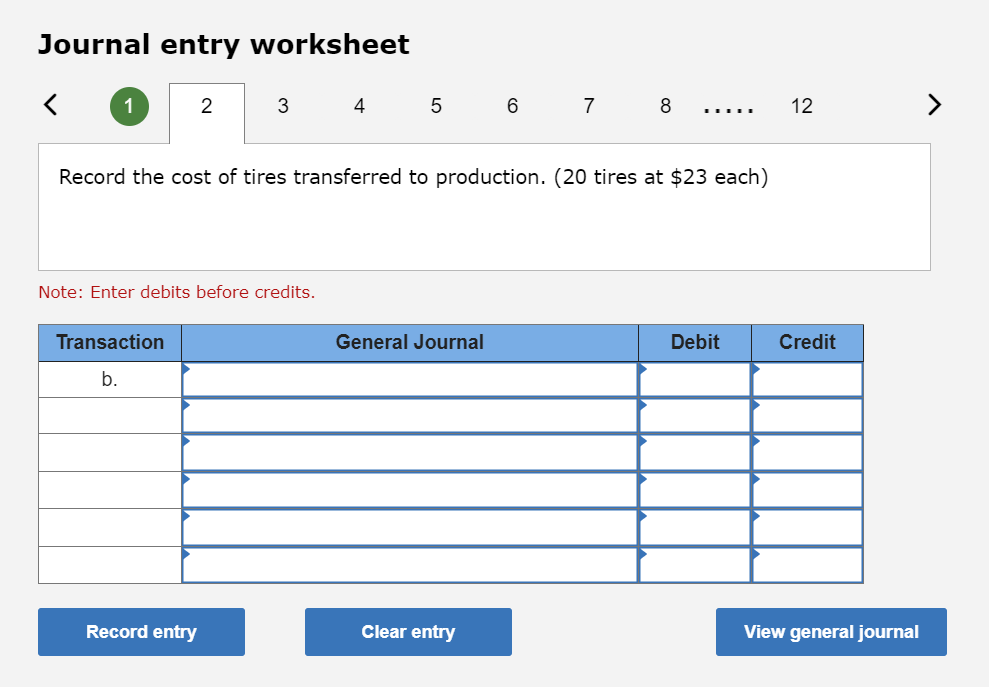

Twenty tires were requisitioned for production. Each tire cost $23.

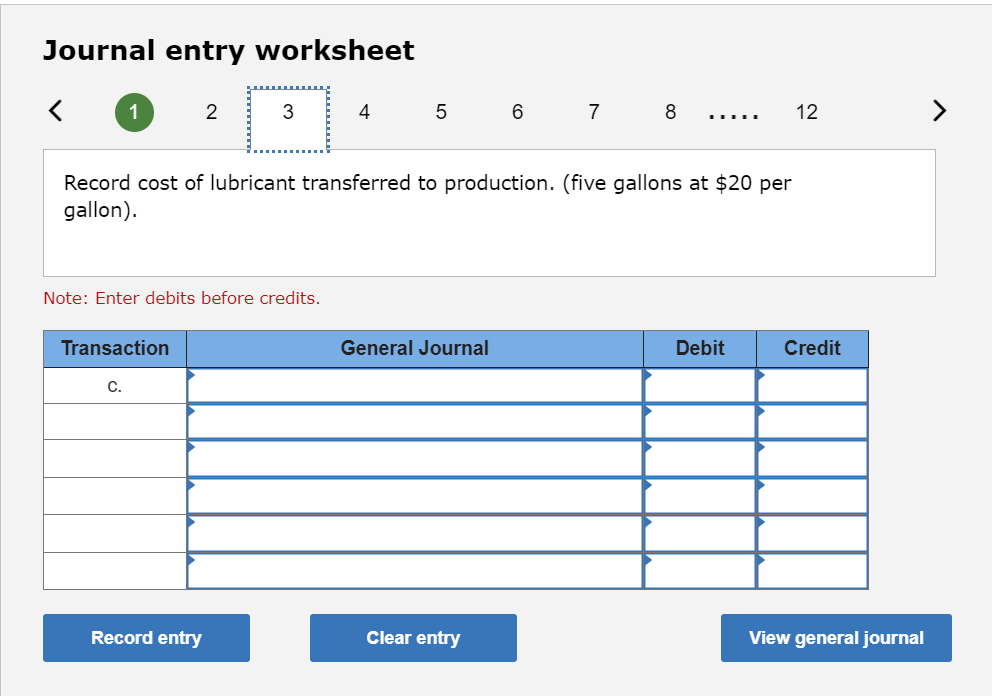

Five gallons of lubricant were requisitioned for production. The lubricant cost $20 per gallon. Lubricant is treated as an indirect material.

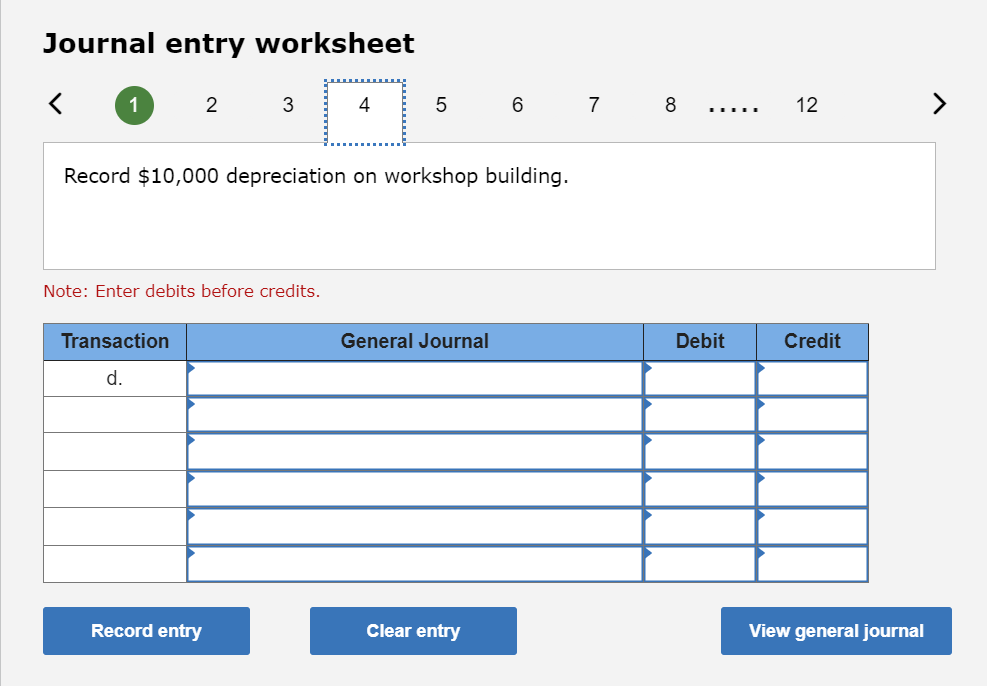

Depreciation on the workshop building for October was $10,000.

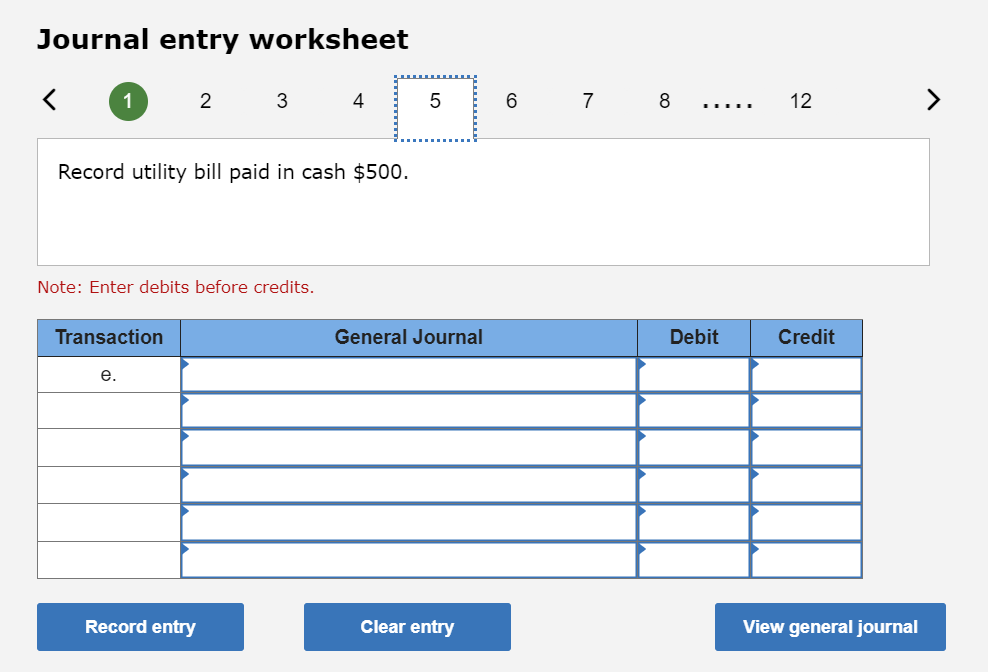

A $500 utility bill was paid in cash.

Time cards showed the following usage of labor:

Job number G60: 12 Thor model UTVs, 1,000 hours of direct labor

Job number C81: 20 Loki model UTVs, 700 hours of direct labor

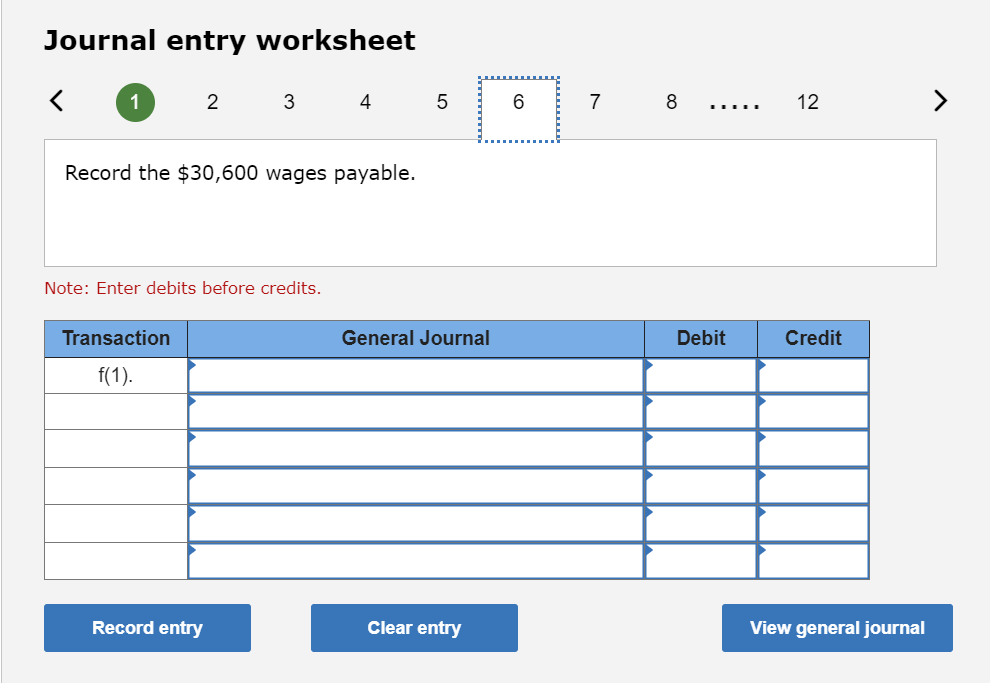

The master assemblers (direct-labor personnel) earn $18 per hour.

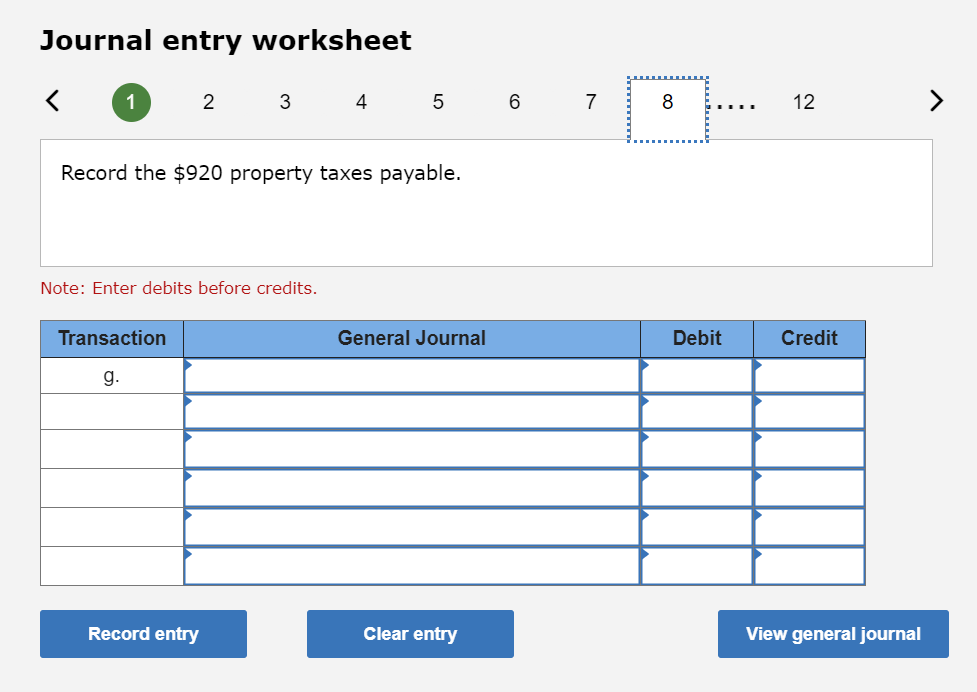

The October property tax bill for $920 was received but has not yet been paid in cash.

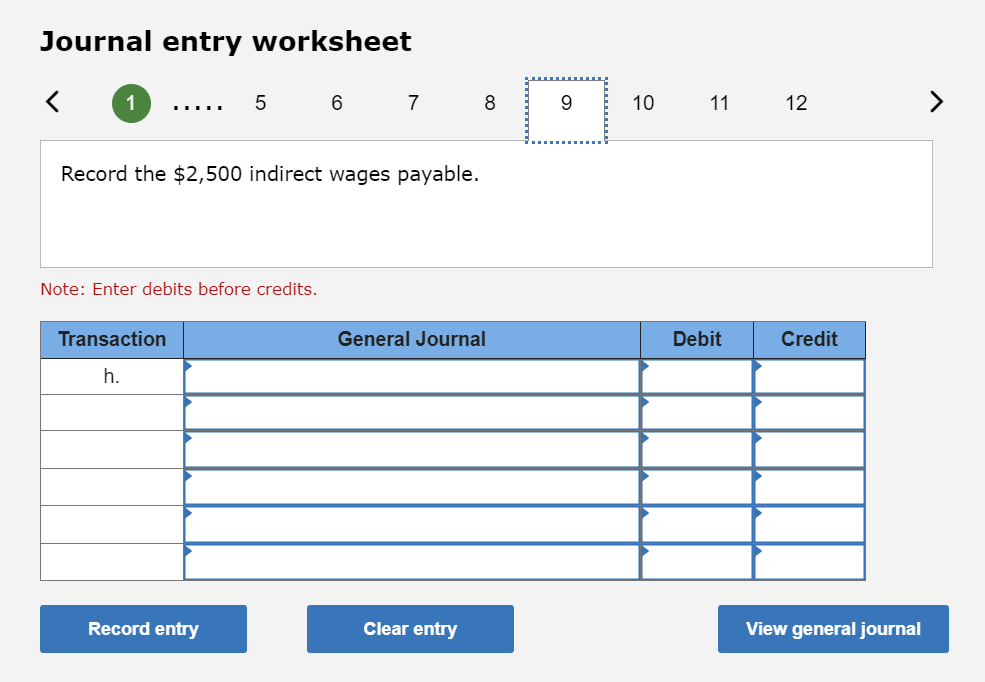

The firm employs laborers (in addition to the master assemblers) who perform various tasks such as material handling and shop cleanup. Their wages for October amounted to $2,500.

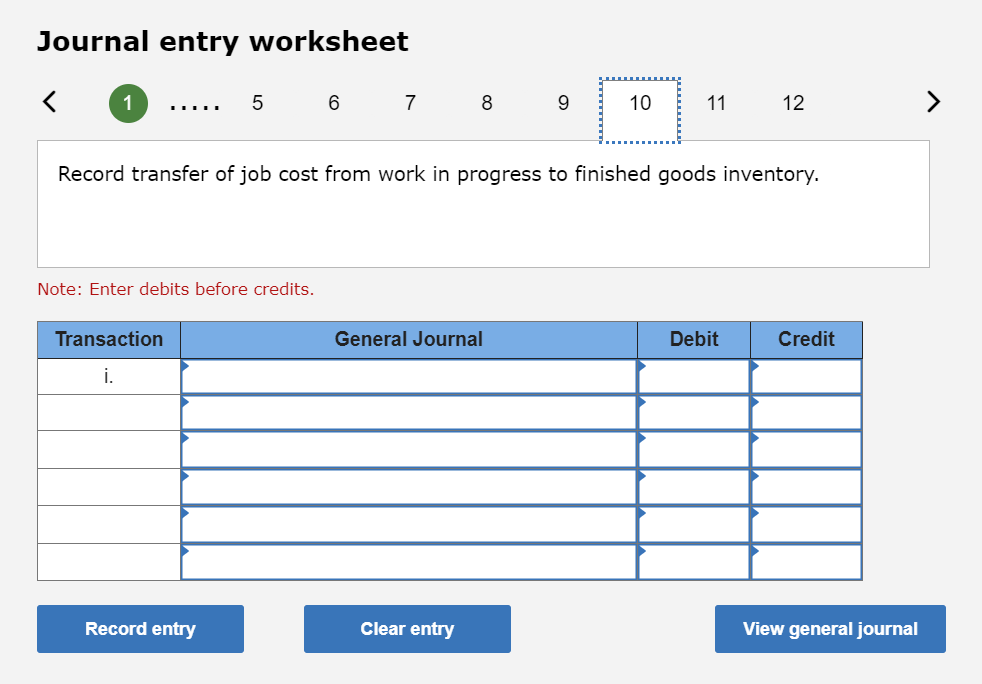

Job number G60, which was started in September, was finished in October. The total cost of the job was $14,400.

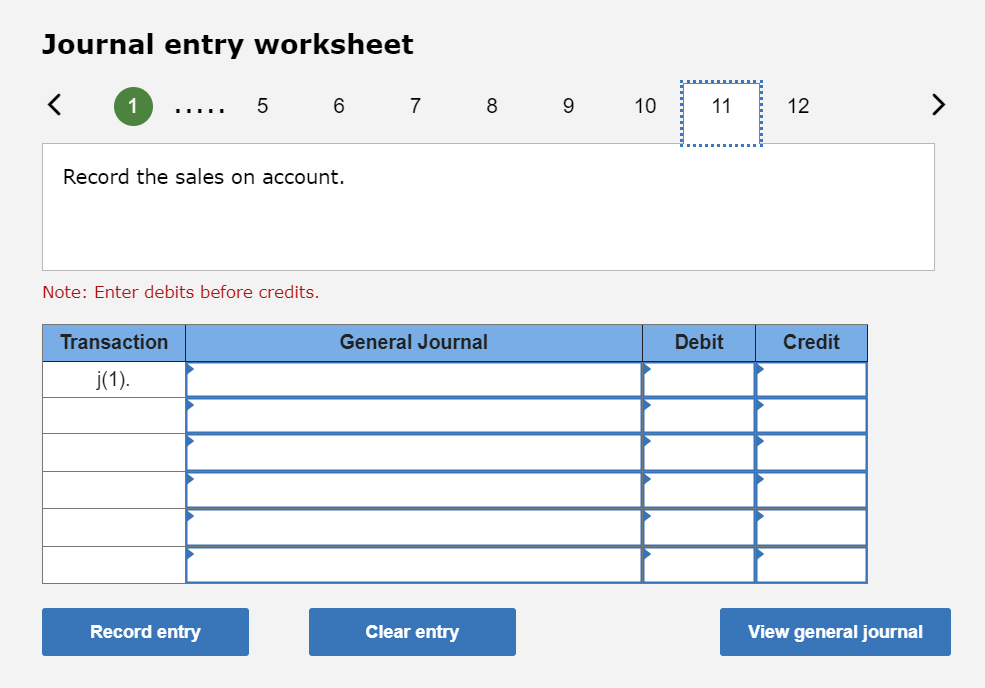

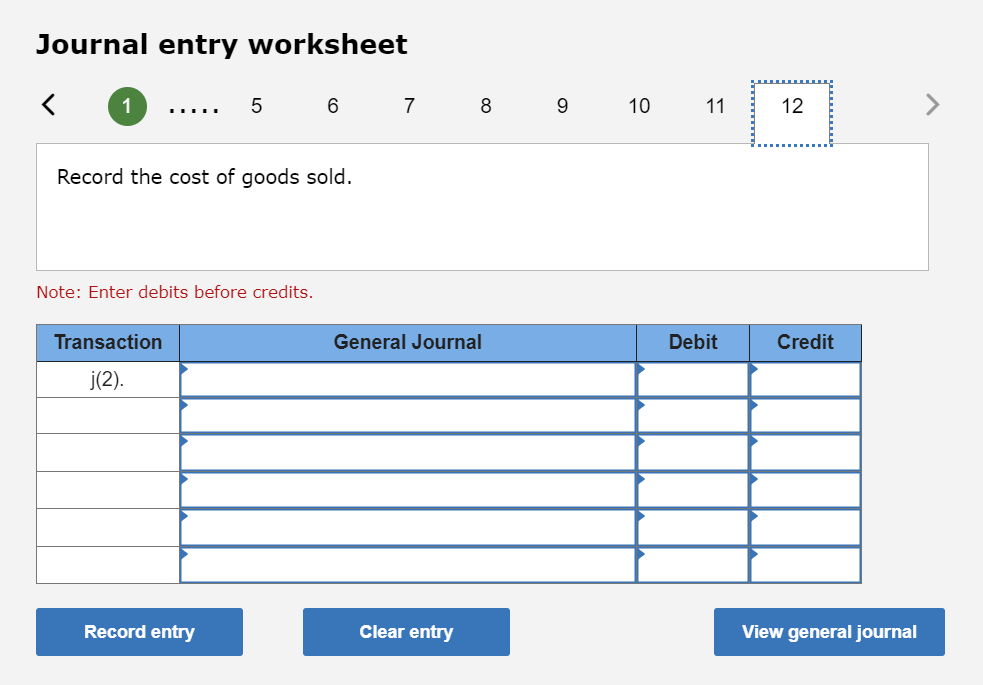

Nine of the Thor models UTVs from job number G60 were sold in October for $1,500 each.

Journal entry worksheet 7812 Record cost of lubricant transferred to production. (five gallons at $20 per gallon). Note: Enter debits before credits. Journal entry worksheet Record the cost of tires transferred to production. (20 tires at $23 each) Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 1 .... 5 7 Record the $2,500 indirect wages payable. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 6 Record $10,000 depreciation on workshop building. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits betore credits. Journal entry worksheet 1 ,5 Record transfer of job cost from work in progress to finished goods inventory. Note: Enter debits before credits. Journal entry worksheet Record the application of manufacturing overhead to production. Note: Enter debits before credits

Journal entry worksheet 7812 Record cost of lubricant transferred to production. (five gallons at $20 per gallon). Note: Enter debits before credits. Journal entry worksheet Record the cost of tires transferred to production. (20 tires at $23 each) Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 1 .... 5 7 Record the $2,500 indirect wages payable. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 6 Record $10,000 depreciation on workshop building. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits betore credits. Journal entry worksheet 1 ,5 Record transfer of job cost from work in progress to finished goods inventory. Note: Enter debits before credits. Journal entry worksheet Record the application of manufacturing overhead to production. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started