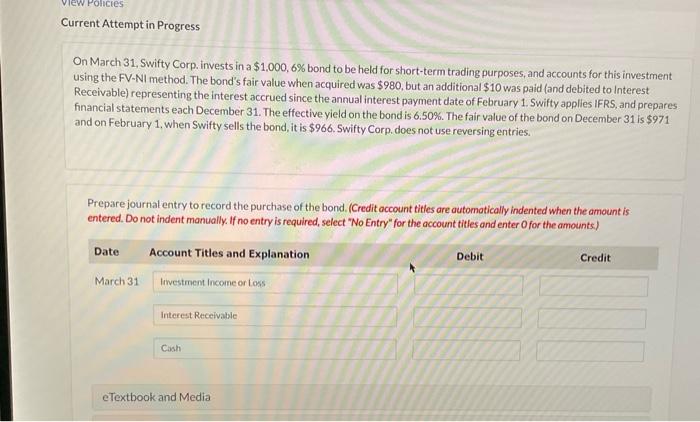

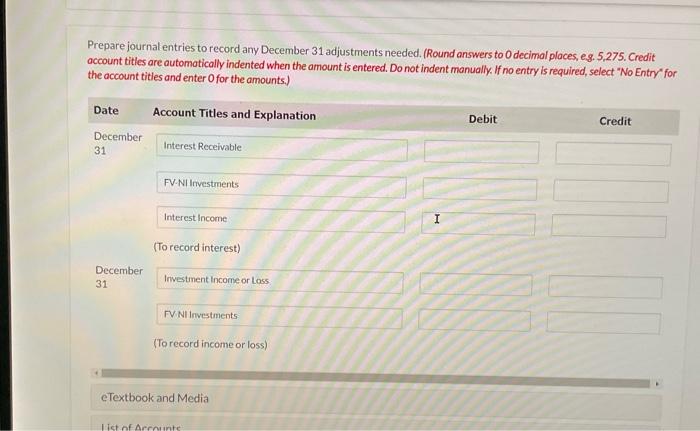

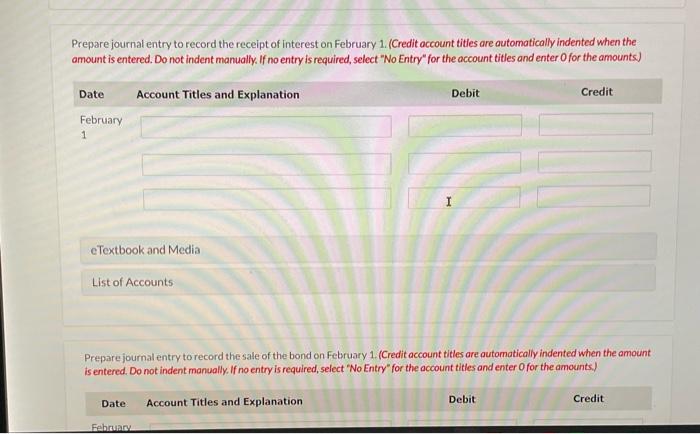

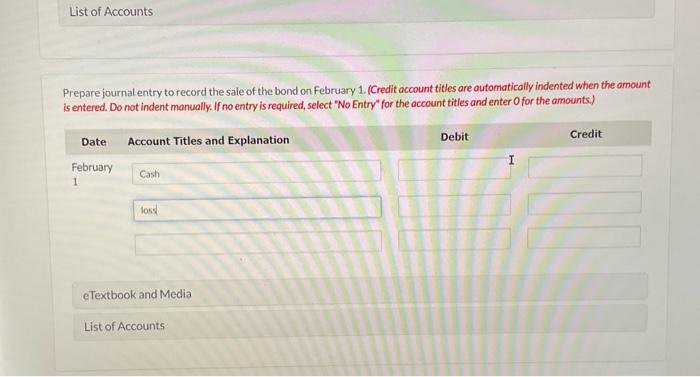

Tew Policies Current Attempt in Progress On March 31, Swifty Corp. invests in a $1,000,6% bond to be held for short-term trading purposes, and accounts for this investment using the FV-NI method. The bond's fair value when acquired was $980, but an additional $10 was paid (and debited to interest Receivable) representing the interest accrued since the annual interest payment date of February 1. Swifty applies IFRS, and prepares financial statements each December 31. The effective yield on the bond is 6.50%. The fair value of the bond on December 31 is $971 and on February 1, when Swifty sells the bond, it is $966. Swifty Corp. does not use reversing entries. Prepare journal entry to record the purchase of the bond. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit March 31 Inwestment Income or loss Interest Receivable Cash e Textbook and Media Prepare journal entries to record any December 31 adjustments needed. (Round answers to decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Date December 31 Interest Receivable FV.NI Investments Interest Income (To record interest) December 31 Investment Income or Loss FV. Ni Investments (To record income or loss) e Textbook and Media List of Arrunt Prepare journal entry to record the receipt of Interest on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit February 1 e Textbook and Media List of Accounts Prepare journal entry to record the sale of the bond on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select 'No Entry" for the account titles and enter for the amounts.) Debit Account Titles and Explanation Date Credit Feh List of Accounts Prepare journal entry to record the sale of the bond on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts) Date Credit Debit Account Titles and Explanation February 1 Cash tos e Textbook and Media List of Accounts