Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Texas Bank is based in U.S.A. Texas Bank has given too many loans in Mexican pesos. These loans will mature two years from now. Texas

Texas Bank is based in U.S.A. Texas Bank has given too many loans in Mexican pesos. These loans will mature two years from now. Texas Bank has very few liabilities in Mexican pesos.

What kind of risk is Texas Bank exposed to? Explain.

The manager of Texas Bank would like to do off-balance-sheet hedging to reduce the risk of the bank. What type of off-balance-sheet hedging should he seek? Explain.

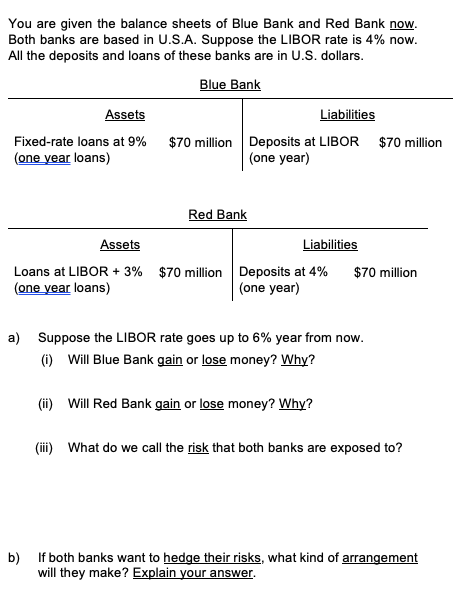

You are given the balance sheets of Blue Bank and Red Bank now. Both banks are based in U.S.A. Suppose the LIBOR rate is 4% now. All the deposits and loans of these banks are in U.S. dollars. a) Suppose the LIBOR rate goes up to 6% year from now. (i) Will Blue Bank gain or lose money? Why? (ii) Will Red Bank gain or lose money? Why? (iii) What do we call the risk that both banks are exposed to? b) If both banks want to hedge their risks, what kind of arrangement will they make? Explain yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started