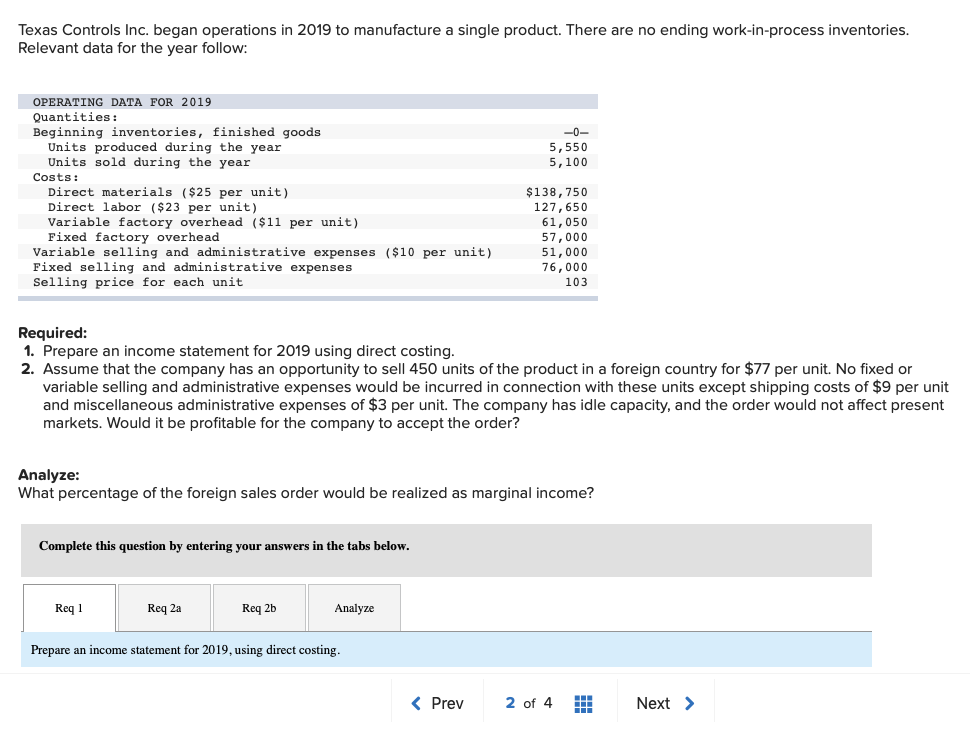

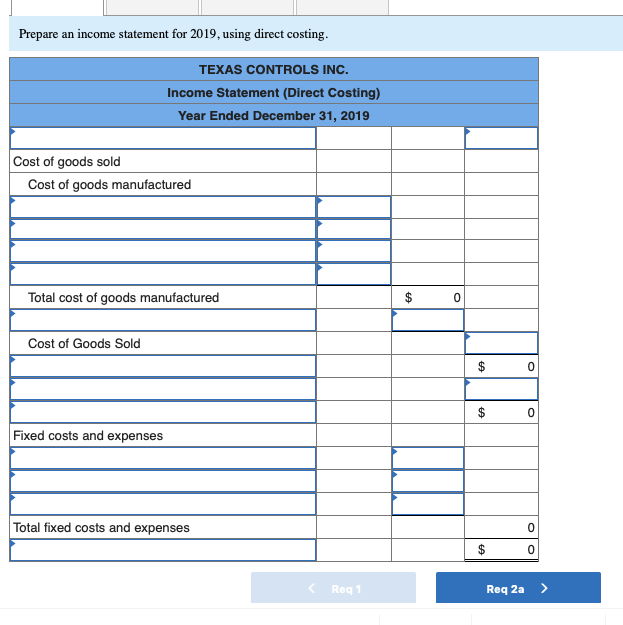

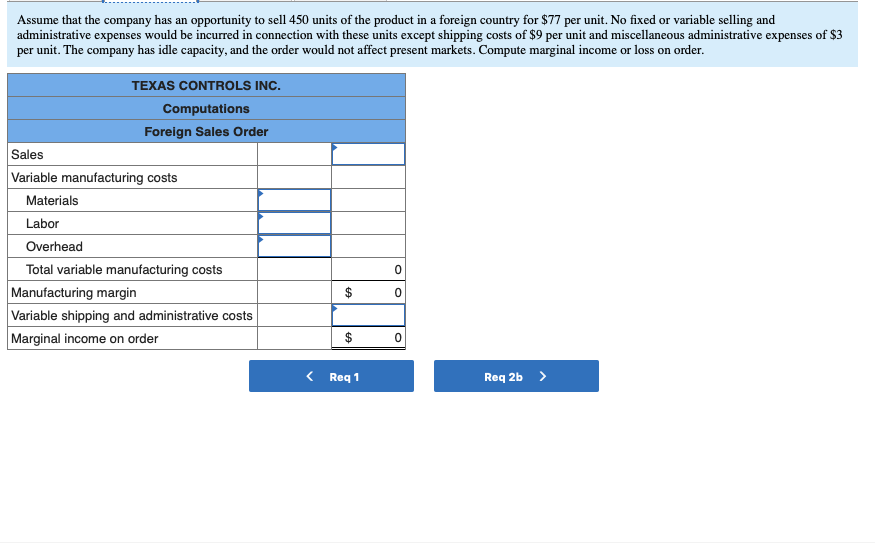

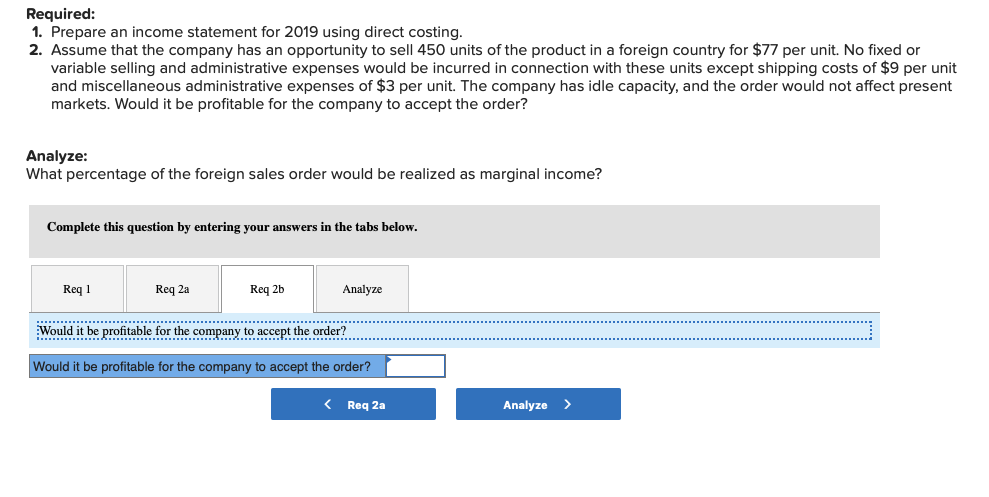

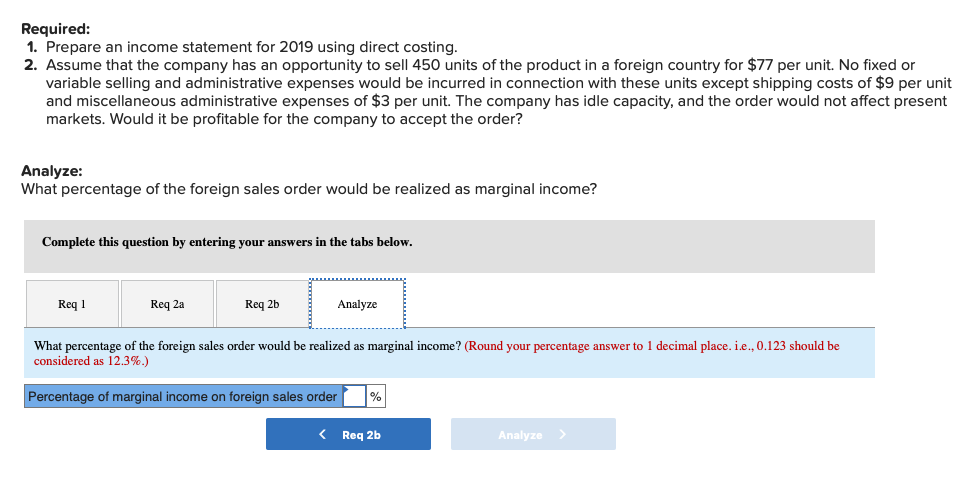

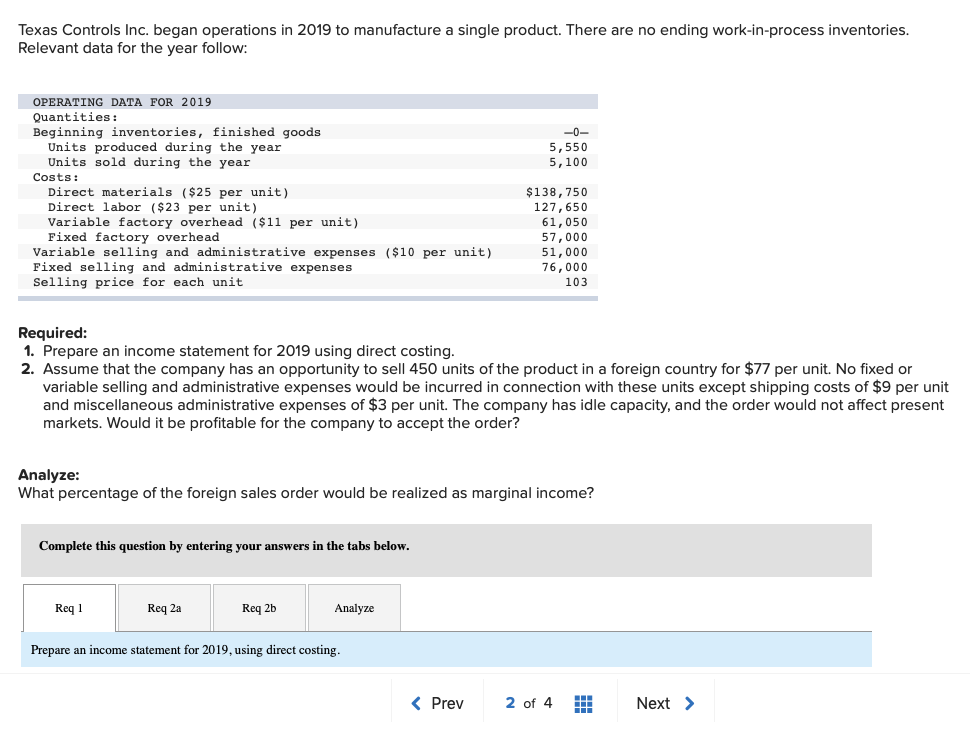

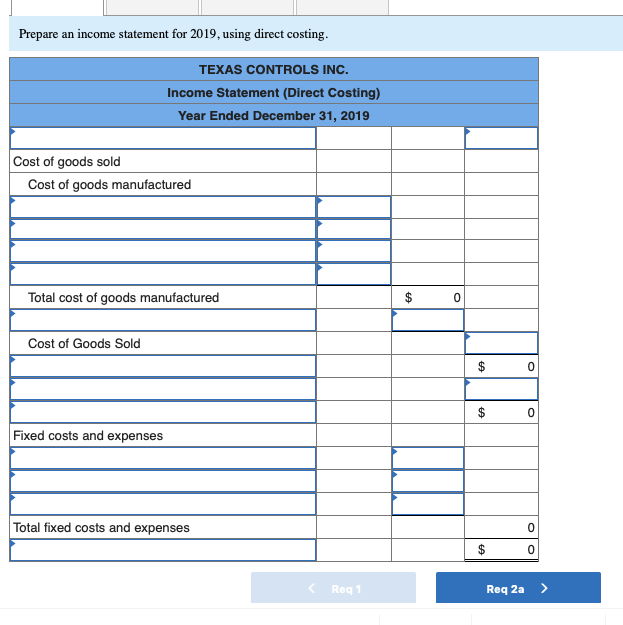

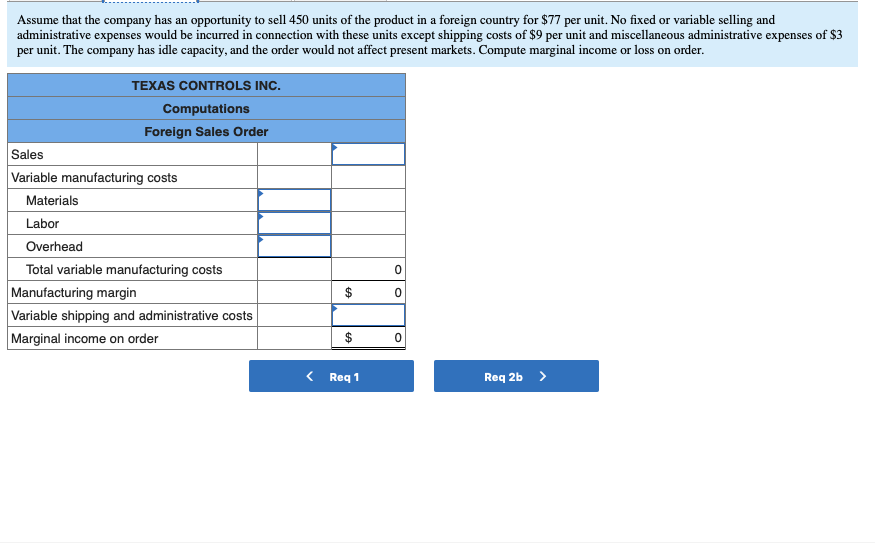

Texas Controls Inc. began operations in 2019 to manufacture a single product. There are no ending work-in-process inventories. Relevant data for the year follow: -0- 5,550 5,100 OPERATING DATA FOR 2019 Quantities: Beginning inventories, finished goods Units produced during the year Units sold during the year Costs: Direct materials ($25 per unit) Direct labor ($23 per unit) Variable factory overhead ($11 per unit) Fixed factory overhead Variable selling and administrative expenses ($10 per unit) Fixed selling and administrative expenses Selling price for each unit $138,750 127,650 61,050 57,000 51,000 76,000 103 Required: 1. Prepare an income statement for 2019 using direct costing. 2. Assume that the company has an opportunity to sell 450 units of the product in a foreign country for $77 per unit. No fixed or variable selling and administrative expenses would be incurred in connection with these units except shipping costs of $9 per unit and miscellaneous administrative expenses of $3 per unit. The company has idle capacity, and the order would not affect present markets. Would it be profitable for the company to accept the order? Analyze: What percentage of the foreign sales order would be realized as marginal income? Complete this question by entering your answers in the tabs below. Req1 Req 2a Req 25 Analyze Prepare an income statement for 2019, using direct costing. Prepare an income statement for 2019, using direct costing. TEXAS CONTROLS INC. Income Statement (Direct Costing) Year Ended December 31, 2019 Cost of goods sold Cost of goods manufactured Total cost of goods manufactured $ 0 Cost of Goods Sold $ 0 $ 0 Fixed costs and expenses Total fixed costs and expenses 0 $ 0 Req1 Req 2a Assume that the company has an opportunity to sell 450 units of the product in a foreign country for $77 per unit. No fixed or variable selling and administrative expenses would be incurred in connection with these units except shipping costs of $9 per unit and miscellaneous administrative expenses of $3 per unit. The company has idle capacity, and the order would not affect present markets. Compute marginal income or loss on order. TEXAS CONTROLS INC. Computations Foreign Sales Order Sales Variable manufacturing costs Materials Labor Overhead Total variable manufacturing costs Manufacturing margin Variable shipping and administrative costs Marginal income on order 0 $ 0 0 Required: 1. Prepare an income statement for 2019 using direct costing. 2. Assume that the company has an opportunity to sell 450 units of the product in a foreign country for $77 per unit. No fixed or variable selling and administrative expenses would be incurred in connection with these units except shipping costs of $9 per unit and miscellaneous administrative expenses of $3 per unit. The company has idle capacity, and the order would not affect present markets. Would it be profitable for the company to accept the order? Analyze: What percentage of the foreign sales order would be realized as marginal income? Complete this question by entering your answers in the tabs below. Req1 Req 2a Req 21 Analyze Would it be profitable for the company to accept the order? Would it be profitable for the company to accept the order? Required: 1. Prepare an income statement for 2019 using direct costing. 2. Assume that the company has an opportunity to sell 450 units of the product in a foreign country for $77 per unit. No fixed or variable selling and administrative expenses would be incurred in connection with these units except shipping costs of $9 per unit and miscellaneous administrative expenses of $3 per unit. The company has idle capacity, and the order would not affect present markets. Would it be profitable for the company to accept the order? Analyze: What percentage of the foreign sales order would be realized as marginal income? Complete this question by entering your answers in the tabs below. Req 1 Req 2a Req 2b Analyze What percentage of the foreign sales order would be realized as marginal income? (Round your percentage answer to 1 decimal place. i.e., 0.123 should be considered as 12.3%.) Percentage of marginal income on foreign sales order % Regis