Question

Texas oil man, James Jimmie Swaggert, is evaluating whether to bid on Federal Government land that is opening for oil exploration. He understands that under

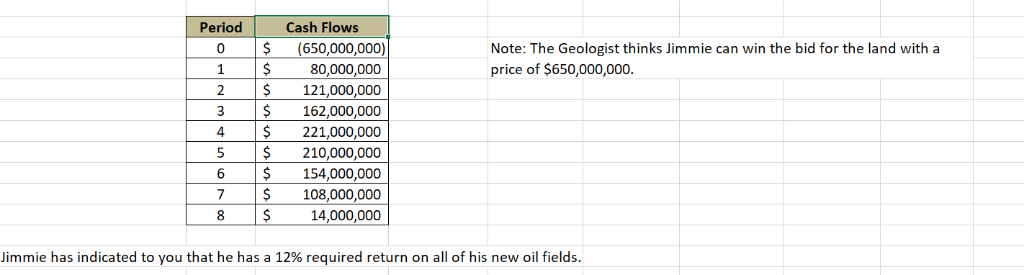

Texas oil man, James "Jimmie" Swaggert, is evaluating whether to bid on Federal Government land that is opening for oil exploration. He understands that under the new President, Donald Trump, domestic oil exploration and production will be opened up into new territories in land formerly owned and operated as US National Parks. Jimmie's Chief Geologist has taken a look at the land that is immediately for sale and he estimates that this new oil field could be productive for 8 years and then sold to another driller to finish it out. An estimate of the cash flows associated with this project are presented below:

1. Calculate the Payback Period for this project. Please show your calculation.

2. Calculate the NPV of this project

3. Calculate the IRR for this project.

4. Calculate the Profitability Index of this project.

5. Based on the analysis above, should Jimmie accept this project?

Period Cash Flows (650,000,000) Note: The Geologist thinks Jimmie can win the bid for the land with a price of $650,000,000. 0 1 S 80,000,000 121,000,000 162,000,000 221,000,000 210,000,000 6 154,000,000 7 108,000,000 14,000,000 Jimmie has indicated to you that he has a 12% required return on all of his new oil fieldsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started