Question

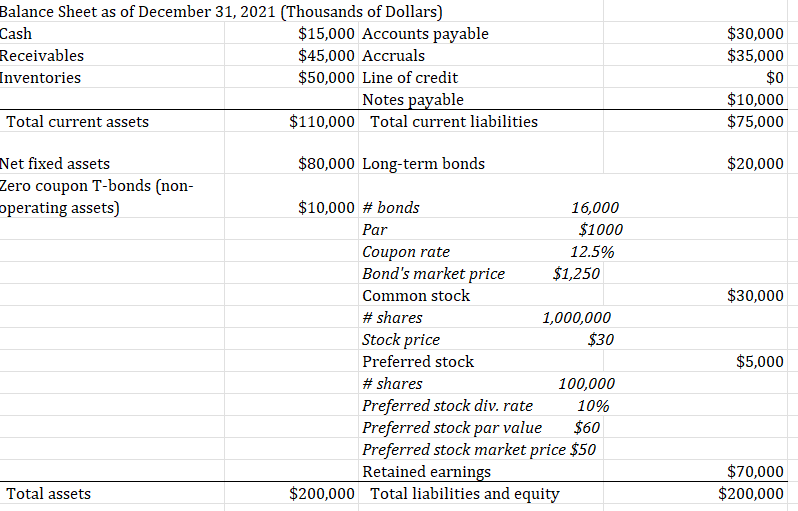

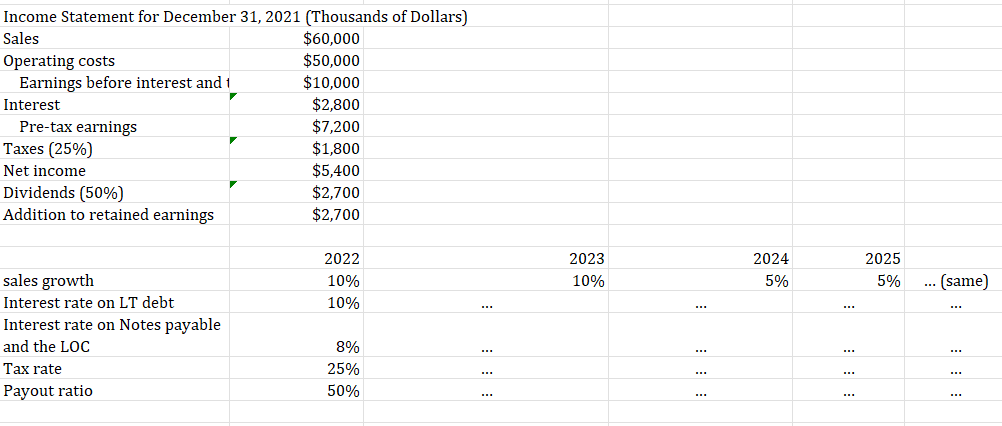

Texas Tile Corporations 2021 balance sheet and income statement are shown below. Sales are expected to grow to grow by 10% in 2022, 10% in

Texas Tile Corporations 2021 balance sheet and income statement are shown below. Sales are expected to grow to grow by 10% in 2022, 10% in 2023, and 5% a year in 2024 and every year after. Forecast Texas Tiles balance sheet and income statement for December 31 of the years 2022, 2023, and 2024. If a line of credit has to be used, it is added at the end of the year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. If excess income is generated, it is used to retire the previously used line of credit and the remainder is paid out as extra dividend. The interest rate that the line of credit carries is 8%. Assume that the company was operating at 80% capacity in 2021, that it cannot sell off any of its fixed assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales.

Dividend payout ratio is 50%. Corporate profit tax rate is 25%. Texas Tile has $10 mil. in zero coupon T-bonds they hold as a reserve and not use for their current operations. Those bonds pay no interest.

Data on Texas Tile bonds, common and preferred stock is in the balance sheet. Texas Tile common stock has the beta of 1.3. Risk free rate is 3%, and the market risk premium is 10%.

a. Forecast Texas Tile financial statements for 2022, 2023, 2024. Any additional funds needed will be financed with a line of credit.

b. What are the FCFs for those years?

c. Assume that Texas Tile's current capital structure is close to its target, calculate the weights for the WACC calculation.

d. What are the cost of debt (after-tax), cost of preferred stock, and cost of common equity?

e. Calculate the WACC, using your answers from parts (c) and (d).

f. Using your results from parts (b) and e) calculate the value of Texas Tile and estimate the intrinsic value of the the stock at the end of each of the years 2022, 2023, 2024.

g. Using the forecasted income statement, and assuming that the dividend payout ratio stays at 50%, forecast the dividend Texas Tile is going to pay in 2022, 2023, 2024? Assume that the number of common shares stays the same and the stock price is equal to the intrinsic value in each of those years.

h. What is the forecasted dividend yield for those years? What is the capital gains yield?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started