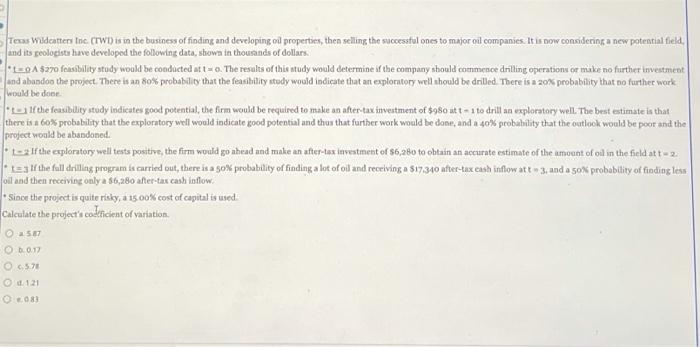

Texas Wildcatters Inc. (TWD) is in the business of finding and developing oil properties, then selling the successtul ones to major oil companies. It is now considering a new potential field, and its peologists have developed the following data, shown in thousands of dollars. LEA 5270 feasibility study would be conducted at t= 0. The results of this study would determine if the company should commence dilling operations or make no further investment and abandon the project. There is an 80% probability that the feasibility study would indicate that an exploratory well should be drilled. There is a 20% probability that no further work would be done If the feasibility study indicates good potential, the firm would be required to make an after-tax investment of $980 utt - 1 to drill an exploratory well. The best estimate is that there is a 60% probability that the exploratory well would indicate good potential and thus that further work would be done, and a 40% probability that the outlook would be poor and the project would be abandoned. * 1-2 If the exploratory well tests positive, the firm would go ahead and make an after-tax investment of 86,280 to obtain an accurate estimate of the amount of oil in the field at t = 2 If the full drilling program is carried out, there is a 50% probability of finding a lot of oil and receiving a $17.300 after-tax cash inflow at t3 and a 50% probability of finding less oil and then receiving only a 86,280 after-tax cash inflow Since the project is quite risky, a 15.00% cost of capital is used Calculate the project's codeficient of variation. 57 O 0.17 6.57 121 @08) Texas Wildcatters Inc. (TWD) is in the business of finding and developing oil properties, then selling the successtul ones to major oil companies. It is now considering a new potential field, and its peologists have developed the following data, shown in thousands of dollars. LEA 5270 feasibility study would be conducted at t= 0. The results of this study would determine if the company should commence dilling operations or make no further investment and abandon the project. There is an 80% probability that the feasibility study would indicate that an exploratory well should be drilled. There is a 20% probability that no further work would be done If the feasibility study indicates good potential, the firm would be required to make an after-tax investment of $980 utt - 1 to drill an exploratory well. The best estimate is that there is a 60% probability that the exploratory well would indicate good potential and thus that further work would be done, and a 40% probability that the outlook would be poor and the project would be abandoned. * 1-2 If the exploratory well tests positive, the firm would go ahead and make an after-tax investment of 86,280 to obtain an accurate estimate of the amount of oil in the field at t = 2 If the full drilling program is carried out, there is a 50% probability of finding a lot of oil and receiving a $17.300 after-tax cash inflow at t3 and a 50% probability of finding less oil and then receiving only a 86,280 after-tax cash inflow Since the project is quite risky, a 15.00% cost of capital is used Calculate the project's codeficient of variation. 57 O 0.17 6.57 121 @08)