Answered step by step

Verified Expert Solution

Question

1 Approved Answer

text me at 8608743820, venmo for some good work multiple questions. Download closing prices using Yahoofinance on two ETFS: BND and VTI for that of

text me at 8608743820, venmo for some good work multiple questions.

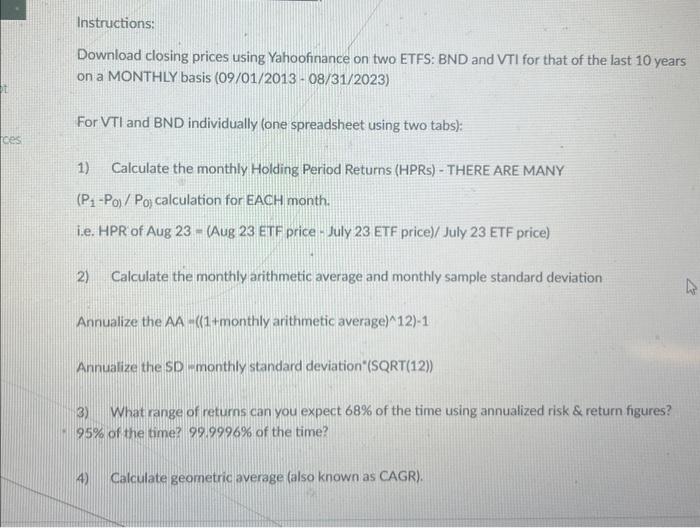

Download closing prices using Yahoofinance on two ETFS: BND and VTI for that of the last 10 years on a MONTHLY basis (09/01/2013 - 08/31/2023) For VTI and BND individually (one spreadsheet using two tabs): 1) Calculate the monthly Holding Period Returns (HPRs) - THERE ARE MANY (P1P0)/P0) calculation for EACH month. i.e. HPR of Aug 23 = (Aug 23 ETF price - July 23 ETF price)/ July 23 ETF price) 2) Calculate the monthly arithmetic average and monthly sample standard deviation Annualize the AA=((1+monthlyarithmeticaverage)12)1 Annualize the SD monthly standard deviation"(SQRT(12)) 3) What range of returns can you expect 68% of the time using annualized risk \& return figures? 95% of the time? 99.9996% of the time? 4) Calculate geometric average (also known as CAGR)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started