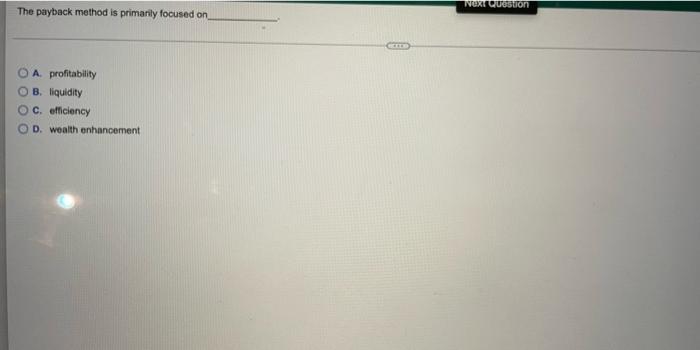

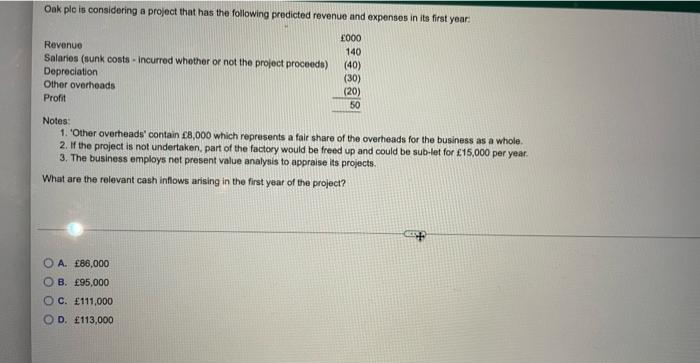

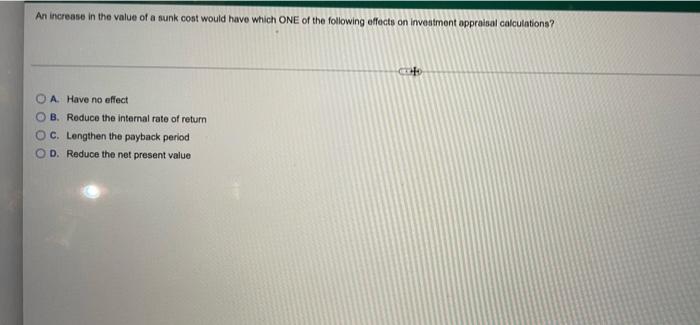

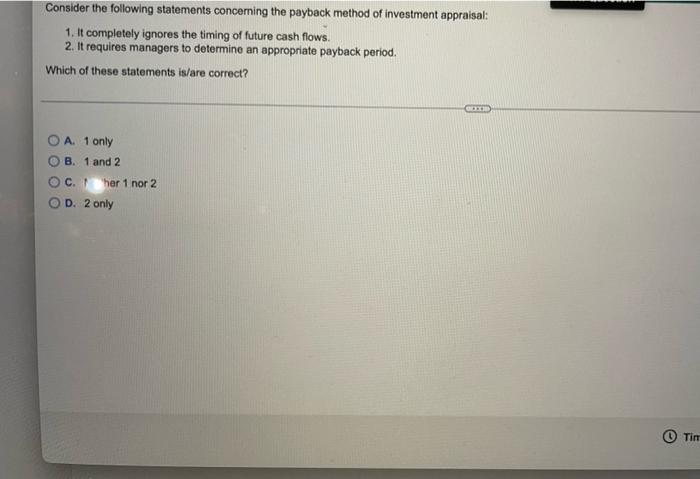

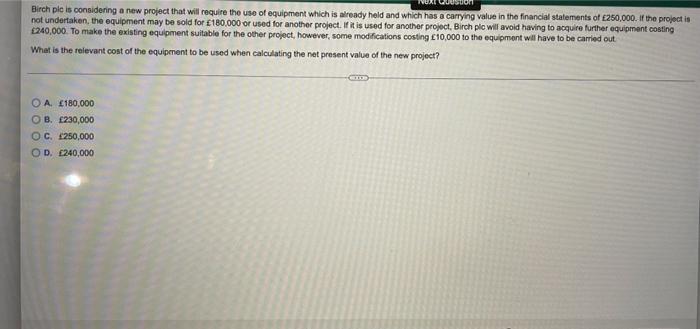

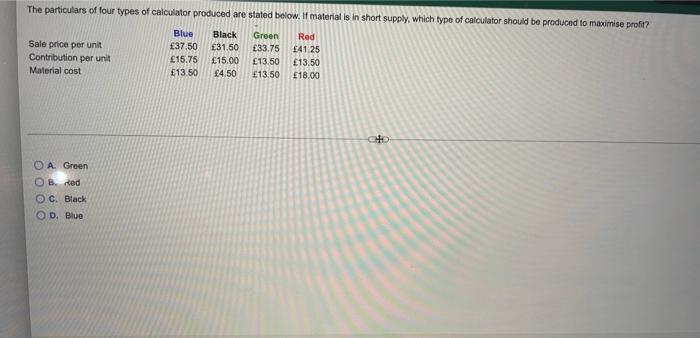

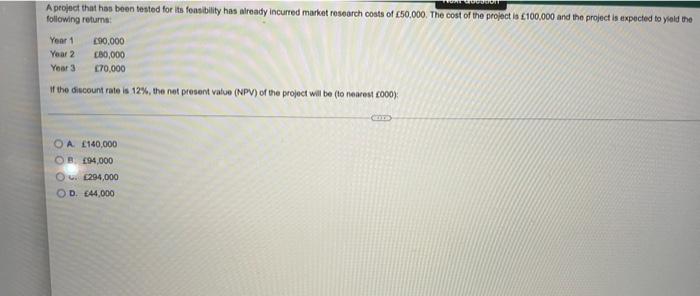

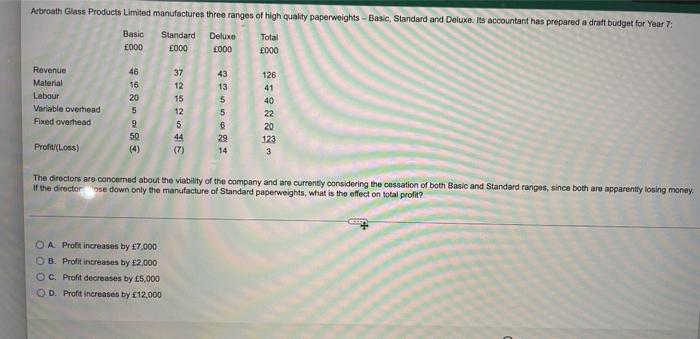

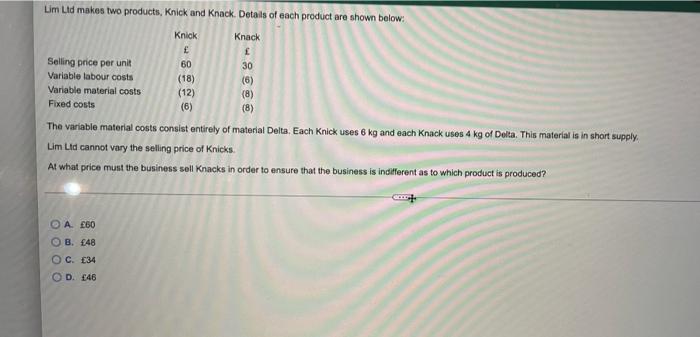

Text Question The payback method is primarily focused on A profitability B. liquidity C. efficiency D. wealth enhancement Ook ple is considering a project that has the following predicted revenue and expenses in its first year: 000 140 Revenue Salaries (sunk costs - incurred whether or not the project proceeds) Depreciation Other overheads Profit (40) (30) (20) 50 Notes 1. Other overheads' contain 8,000 which represents a fair share of the overheads for the business as a whole. 2. If the project is not undertaken, part of the factory would be freed up and could be sub-let for 15,000 per year. 3. The business employs net present value analysis to appraise its projects. What are the relevant cash inflows arising in the first year of the project? A. 86,000 B. 95,000 OC. 111,000 OD 113,000 An increase in the value of a sunk cost would have which ONE of the following effects on Investment oppraisal calculations? 10 A Have no effect B. Reduce the internal rate of return C. Lengthen the payback period OD. Reduce the net present value Consider the following statements concerning the payback method of investment appraisal: 1. It completely ignores the timing of future cash flows. 2. It requires managers to determine an appropriate payback period. Which of these statements is/are correct? A. 1 only B. 1 and 2 @ @ c. her 1 nor 2 D. 2 only Tin Birch plc is considering a new project that will require the use of equipment which is already held and which has a carrying value in the financial statements of 250,000. If the project is not undertaken the equipment may be sold for 180,000 or used for another project. If it is used for another project, Birch plc will avoid having to acquire further equipment costing 240,000. To make the existing equipment suitable for the other project, however, some modifications costing 10,000 to the equipment will have to be carried out What is the relevant cost of the equipment to be used when calculating the net present value of the new project? O A 180,000 OB. 230,000 OC. 250,000 OD. 240,000 The particulars of four types of calculator produced are stated below. If material is in short supply, which type of calculator should be produced to maximise profit? Sale price per unit Contribution per unit Material cost Blue 37.50 15.75 13.50 Black 31.50 15.00 4.50 Green 33.75 13.50 13.50 Red 141 25 13.50 18.00 O A Green OB. Red O c. Black OD. Blue A project that has been tested for its feasibility has already incurred market research costs of C50,000. The cost of the project is 100,000 and the project is expected to yield the following returns Year 1 Year 2 Year 3 90,000 180,000 K70,000 If the discount rate is 12%, the not present value (NPV) of the project will be to newest 2000) O A C140,000 OB 104,000 O. 294,000 OD. 44,000 Limiting factor analysis refers to a situation where a business: Next Question O A. Produces products that use the smallest amount of scarce resources OB. Tries to substitute scarce resources to increase production OC. Tries to minimise its costs OD. Tries to maximise contribution subject to resource constraints Arbroath Glass Products Limited manufactures three ranges of high quality paperweights - Basic, Standard and Deluxe. Its accountant has propared a draft budget for Your 7: Basic E000 Standard 000 Deluxe 1000 Total 000 Ravenue Material Labour Variable overhead Fixed overhead 46 16 20 5 9 50 (4) 37 12 15 12 5 44 (7) 43 13 5 5 6 29 14 8888 126 41 40 22 20 123 Profit/(L08) The directors are concerned about the viability of the company and are currently considering the cessation of both Basic and Standard ranges, since both are apparently losing money. If the directors down only the manufacture of Standard paperweights, what is the effect on total profit? O A Profit increases by 7,000 OB. Profit increases by 12,000 OC. Profit decreases by 5,000 D. Profit increases by 12,000 Lim Ltd makes two products, Knick and Knack. Details of each product are shown below: Knick Knack Selling price per unit 60 30 Variable labour costs (18) (6) Variable material costs (12) (8) Fixed costs (6) (8) The variable material costs consist entirely of material Delta, Each Knick uses 6 kg and each Knack uses 4 kg of Delta. This material is in short supply Lim Lid cannot vary the selling price of Knicks At what price must the business soll Knacks in order to ensure that the business is indifferent as to which product is produced? O A 60 B. 48 OC 34 OD 46