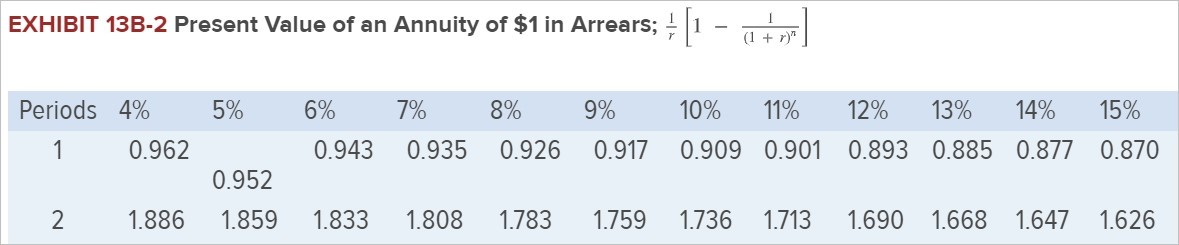

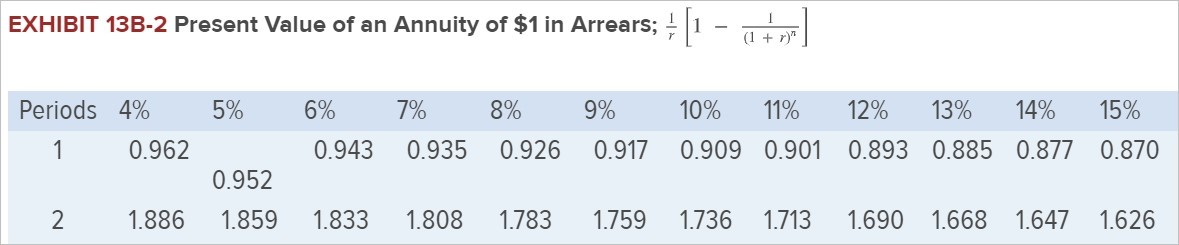

** Textbook Exhibit 13B-2: (chapter talks about involving three methods for a "preference decision"):

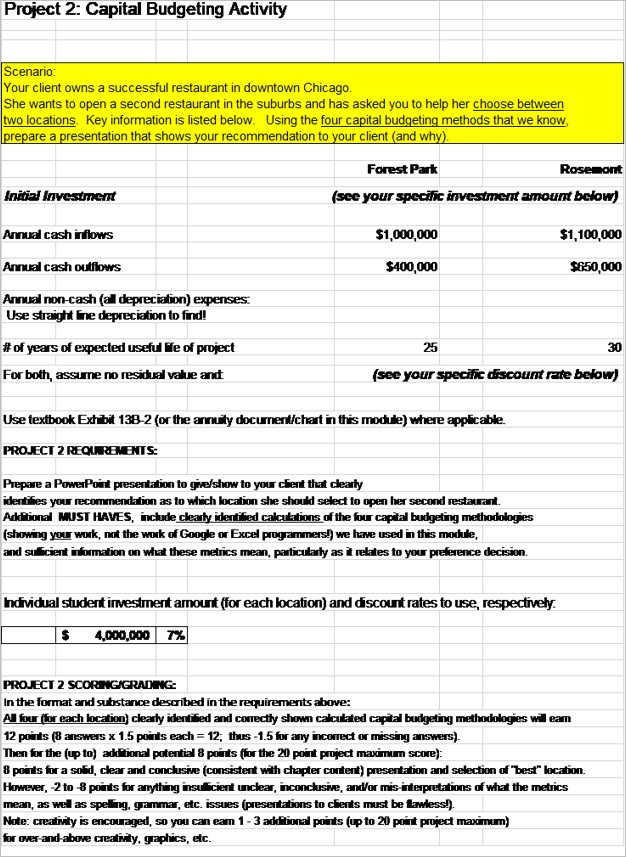

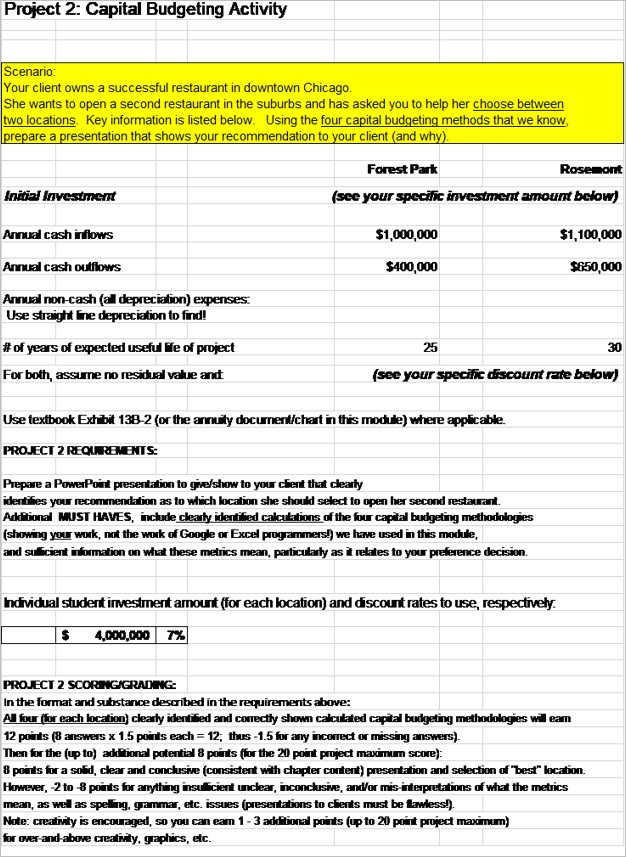

Project 2: Capital Budgeting Activity Scenario Your client owns a successful restaurant in downtown Chicago. She wants to open a second restaurant in the suburbs and has asked you to help her choose between two locations. Key information is listed below. Using the four capital budgeting methods that we know, prepare a presentation that shows your recommendation to your client (and why) Forest Park Rosemont Initial Investment (see your specific investment amount below) Annual cash inflows $1,000,000 $1,100,000 Annual cash outflows $400,000 $850,000 Annual non-cash (al depreciation) expenses. Use straight ne depreciation to find! 25 30 # of years of expected useful fe of project For both, assume no residual value and (see your specific discount rate below) Use textbook Exhibit 138 2 (or the annuity document/chart in this module) where applicable. PROJECT 2 REQUREMENTS: Prepare a PowerPoint presentation to givelshow to your client that clearly identifies your recommendation as to which location she should select to open her second restaurant Additional MUST HAVES, include clearly identified calculations of the four capital budgeting methodologies (showing your work, not the work of Google or Excel programmers! we have used in this module, and sufficient information on what these metrics mean, particularly as it relates to your preference decision. Individual student investinent amount for each location) and discount rates to use, respectively $ 4,000,000 7% PROJECT 2 SCORING GRADING: In the format and substance described in the requirements above: Al four (for each location clearly identified and correctly shown calculated capital budgeting methodologies will eam 12 points (8 answers x 1.5 points each = 12; thus - 1.5 for any incorrect or missing answers). Then for the (up to) additional potential 8 points for the 20 point project maximum score) 8 points for a solid, clear and conclusive (consistent with chapter content) presentation and selection of best" location. However, 2 to 8 points for anything insuficient unclear, inconclusive, and/or misinterpretations of what the metrics mean, as well as spelling, grammar, etc. issues (presentations to clients must be flawless! Note: creativity is encouraged, so you can eam 1 - 3 additional points (up to 20 point project maximum) for over-and-above creativity, graphics, etc. EXHIBIT 13B-2 Present Value of an Annuity of $1 in Arrears; 1 - alt with 5% Periods 4% 1 0.962 6% 0.943 7% 0.935 8% 0.926 9% 0.917 10% 11% 12% 13% 14% 15% 0.909 0.901 0.893 0.885 0.877 0.870 2 1.886 0.952 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626