Question

TEXTBOOK: Options, futures, and other derivitives Chapter 3 Hedging using futures 1. What are short or long hedges with futures contracts? What do these hedging

TEXTBOOK: Options, futures, and other derivitives

Chapter 3 Hedging using futures

1. What are short or long hedges with futures contracts? What do these hedging techniques do to the traders?

2. What is the futures basis and what is the basis risk? Why does it occur?

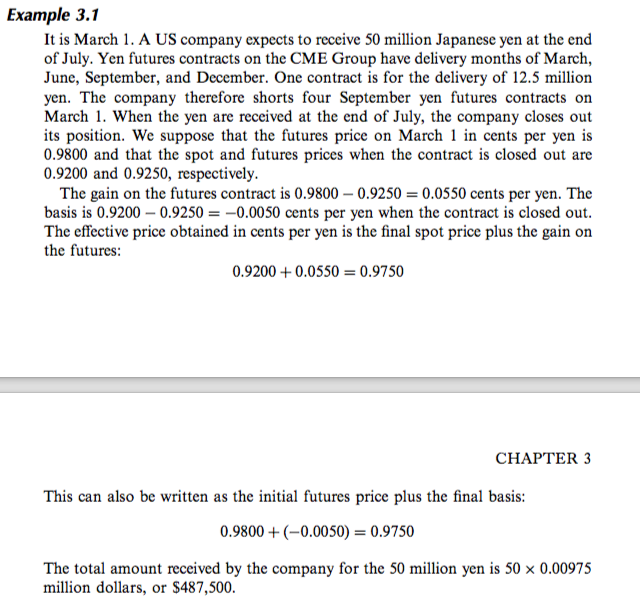

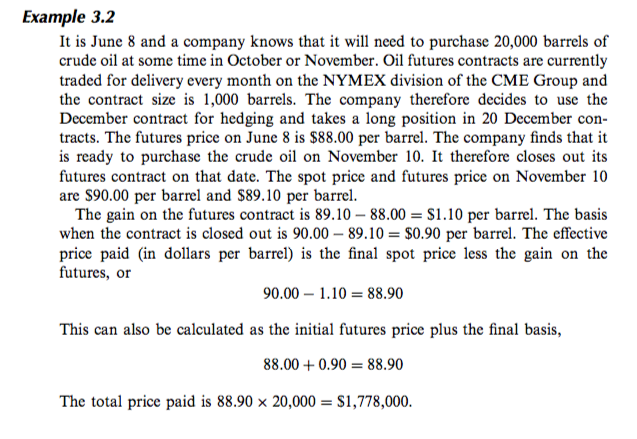

3. How does the choice of contract impact the basis? Do Examples (3.1) and (3.2).

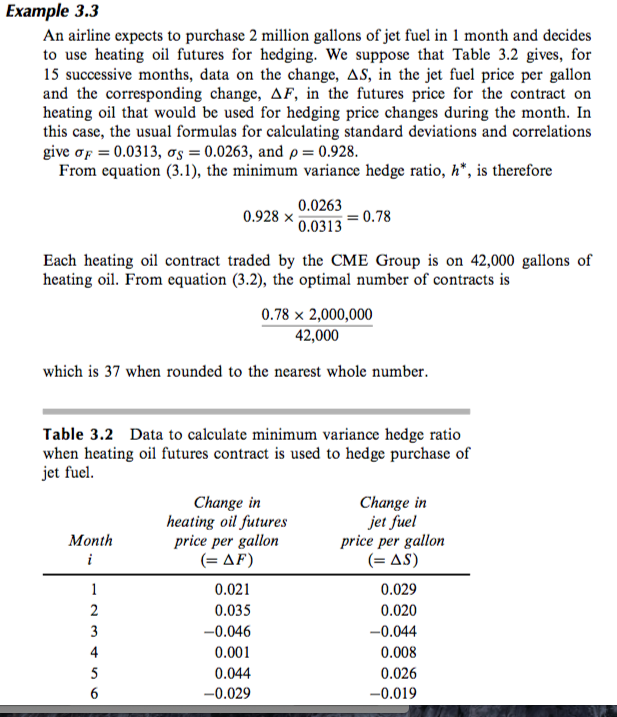

4. What is the cross hedging and what is the optimal hedging? Give an example of the use of futures when airliners try to management risk. Do Example 3.3.

5. What do we mean by trailing the hedge?

6. Understand the section on Hedging an Equity Portfolio. Do Example on Pages 65 and 66.

7. How would you change your portfolios beta using futures contracts

8. What do we mean by stack and roll? What could be the possible danger?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started