Question

TF 1. Variable manufacturing overhead costs are treated as period costs under both absorption and variable costing. A) True B) False 2. The unit product

TF 1. Variable manufacturing overhead costs are treated as period costs under both absorption and variable costing. A) True B) False 2. The unit product cost under absorption costing does not include fixed manufacturing overhead cost. A) True B) False 3. In segment reporting, sales dollars is usually an appropriate allocation base for selling, general, and administrative expenses. A) True B) False MC

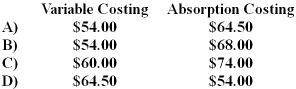

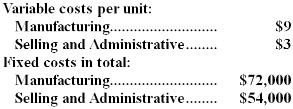

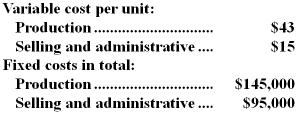

4. TB 131 The following cost formula relates to last year's operations at Lemine Manufacturing Corporation: Y = $84,000 + $60.00X In the formula above, 75% of the fixed cost and 90% of the variable cost are manufacturing costs. Y is the total cost and X is the number of units produced and sold. If Lemine produces and sells only 6,000 units, what is the unit product cost under each of the following methods? A) Option A B) Option B C) Option C D) Option D 5. TB104 Fahey Company manufactures a single product that it sells for $25 per unit. The company has the following cost structure: There were no units in beginning inventory. During the year, 18,000 units were produced and 15,000 units were sold. Under absor TB 104 Fahey Company manufactures a single product that it sells for $25 per unit. The company has the following cost structure:

A) Option A B) Option B C) Option C D) Option D 5. TB104 Fahey Company manufactures a single product that it sells for $25 per unit. The company has the following cost structure: There were no units in beginning inventory. During the year, 18,000 units were produced and 15,000 units were sold. Under absor TB 104 Fahey Company manufactures a single product that it sells for $25 per unit. The company has the following cost structure: There were no units in beginning inventory. During the year, 18,000 units were produced and 15,000 units were sold. Under absorption costing, the unit product cost is: A) $9 B) $12 C) $13 D) $16

There were no units in beginning inventory. During the year, 18,000 units were produced and 15,000 units were sold. Under absorption costing, the unit product cost is: A) $9 B) $12 C) $13 D) $16

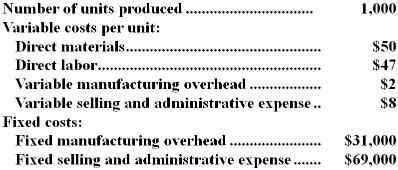

6. TB 40 Olds Inc., which produces a single product, has provided the following data for its most recent month of operations: There were no beginning or ending inventories. The absorption costing unit product cost was: TB 40 Olds Inc., which produces a single product, has provided the following data for its most recent month of operations: There were no beginning or ending inventories. The absorption costing unit product cost was: A) $97 B) $130 C) $99 D) $207

There were no beginning or ending inventories. The absorption costing unit product cost was: A) $97 B) $130 C) $99 D) $207

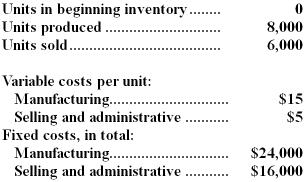

7. TB118 Green Enterprises produces a single product. The following data were provided by the company for the most recent period: For the period above, one would expect the net operating income under absorption costing to be: TB 118 Green Enterprises produces a single product. The following data were provided by the company for the most recent period:  For the period above, one would expect the net operating income under absorption costing to be: A) higher than the net operating income under variable costing. B) lower than the net operating income under variable costing. C) the same as the net operating income under variable costing. D) The relation between absorption costing net operating income and variable costing net operating income cannot be determined.

For the period above, one would expect the net operating income under absorption costing to be: A) higher than the net operating income under variable costing. B) lower than the net operating income under variable costing. C) the same as the net operating income under variable costing. D) The relation between absorption costing net operating income and variable costing net operating income cannot be determined.

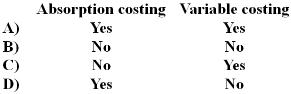

8. TB 22 Fixed manufacturing overhead is included in product costs under: TB 22 Fixed manufacturing overhead is included in product costs under:  A) Option A B) Option B C) Option C D) Option D

A) Option A B) Option B C) Option C D) Option D

9. TB 74 The Pacific Company manufactures a single product. The following data relate to the year just completed: During the last year, 5,000 units were produced and 4,800 units were sold. There were no beginning inventories. Under variable costing, the unit TB 74 The Pacific Company manufactures a single product. The following data relate to the year just completed:  During the last year, 5,000 units were produced and 4,800 units were sold. There were no beginning inventories. Under variable costing, the unit product cost would be: A) $91.00 B) $72.00 C) $58.00 D) $43.00

During the last year, 5,000 units were produced and 4,800 units were sold. There were no beginning inventories. Under variable costing, the unit product cost would be: A) $91.00 B) $72.00 C) $58.00 D) $43.00

10. TB147 Vanstee Corporation manufactures a variety of products. Variable costing net operating income last year was $60,000 and this year was $67,000. Last year, $37,000 in fixed manufacturing overhead costs were deferred in inventory under absorption costi TB 147 Vanstee Corporation manufactures a variety of products. Variable costing net operating income last year was $60,000 and this year was $67,000. Last year, $37,000 in fixed manufacturing overhead costs were deferred in inventory under absorption costing. This year, $8,000 in fixed manufacturing overhead costs were released from inventory under absorption costing. What was the absorption costing net operating income this year? A) $38,000 B) $96,000 C) $75,000 D) $59,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started