Answered step by step

Verified Expert Solution

Question

1 Approved Answer

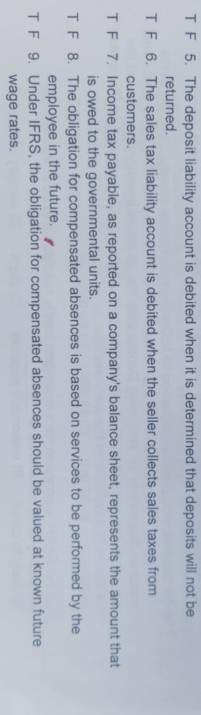

TF 5. The deposit liability account is debited when it is determined that deposits will not be TF 6. The sales tax liability account is

TF 5. The deposit liability account is debited when it is determined that deposits will not be TF 6. The sales tax liability account is debited when the seller collects sales taxes from TF 7. Income tax payable, as reported on a company's balance sheet, represents the amount that TF 8. The obligation for compensated absences is based on services to be performed by the T F 9. Under IFRS, the obligation for compensated absences should be valued at known future returned. customers is owed to the governmental units employee in the future. wage rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started