Answered step by step

Verified Expert Solution

Question

1 Approved Answer

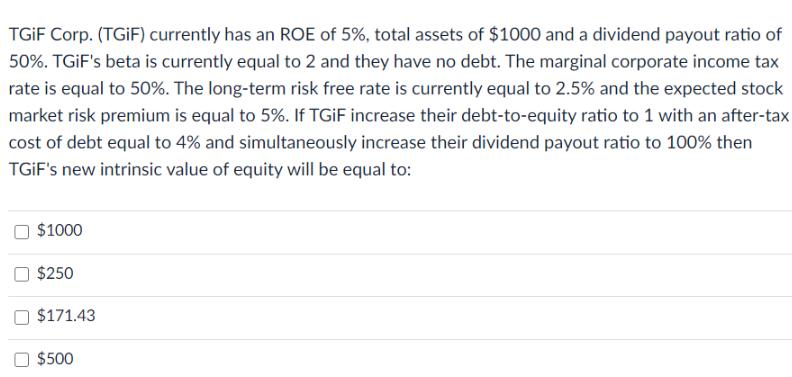

TGIF Corp. (TGIF) currently has an ROE of 5%, total assets of $1000 and a dividend payout ratio of 50%. TGIF's beta is currently

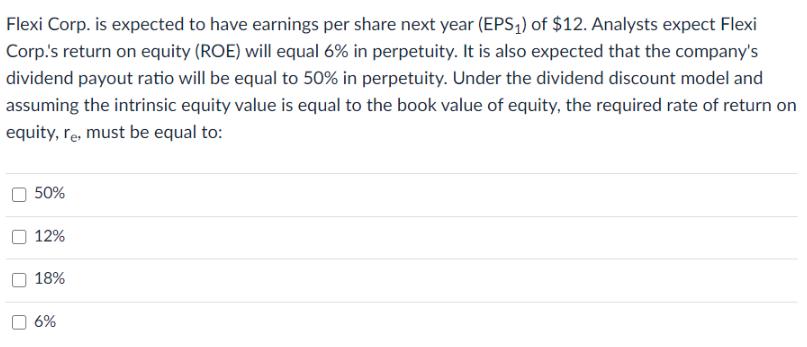

TGIF Corp. (TGIF) currently has an ROE of 5%, total assets of $1000 and a dividend payout ratio of 50%. TGIF's beta is currently equal to 2 and they have no debt. The marginal corporate income tax rate is equal to 50%. The long-term risk free rate is currently equal to 2.5% and the expected stock market risk premium is equal to 5%. If TGIF increase their debt-to-equity ratio to 1 with an after-tax cost of debt equal to 4% and simultaneously increase their dividend payout ratio to 100% then TGIF's new intrinsic value of equity will be equal to: $1000 $250 $171.43 $500 Flexi Corp. is expected to have earnings per share next year (EPS) of $12. Analysts expect Flexi Corp.'s return on equity (ROE) will equal 6% in perpetuity. It is also expected that the company's dividend payout ratio will be equal to 50% in perpetuity. Under the dividend discount model and assuming the intrinsic equity value is equal to the book value of equity, the required rate of return on equity, re, must be equal to: 50% 12% 18% 6%

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Option D is the correct Answer ie 500 Required Rate of Return x M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started