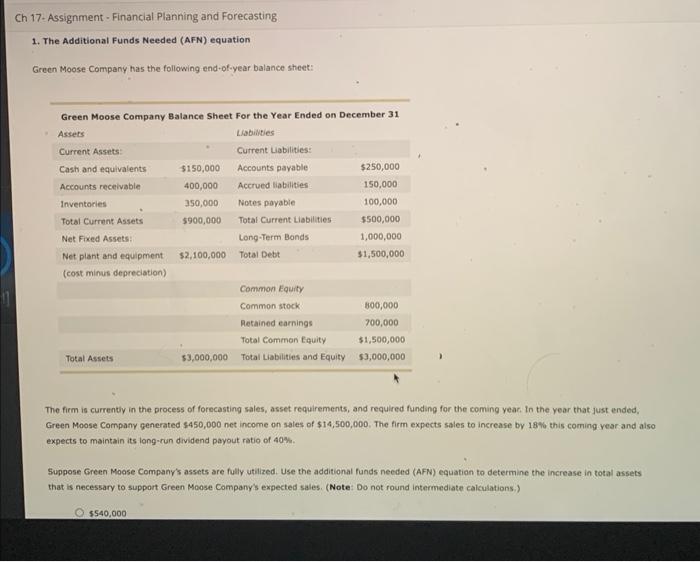

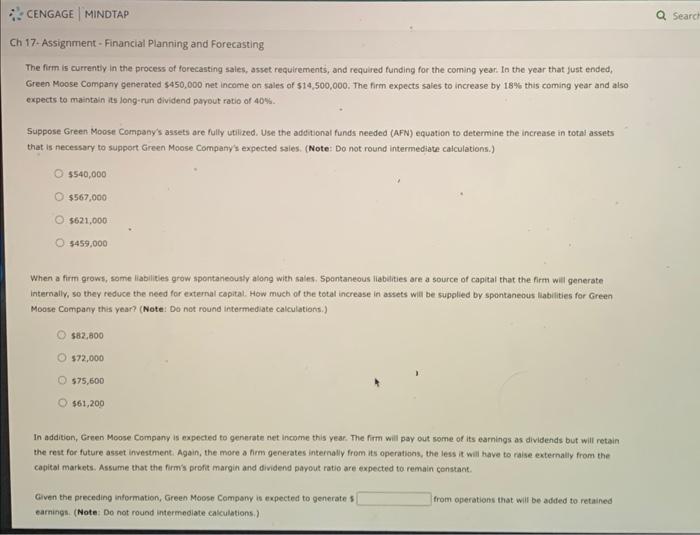

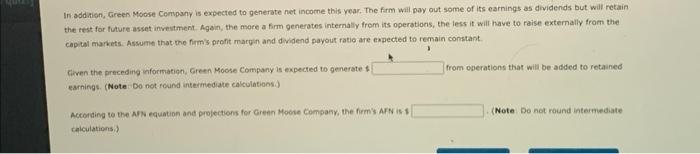

Th 17. Assignment - Financial Planning and Forecasting 1. The Additional Funds Needed (AFN) equation Green Moose Company has the following end-of-year balance sheet: The firm is currentiy in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Company generated $450,000 net income on sales of $14,500,000. The firm expects sales to increase by 187 this coming year and aiso expects to maintain its long-run dividend payout ratio of 40%. Suppose Green Moose Company's assets are fully utilized. Use the additional funds needed (AFN) equation to determine the increase in total assets that is necessary to support Green Moose Company's expected sales. (Note: Do not round intermediate cakulations.) The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Company generated 5450,000 net income on sales of 514,500,000. The firm expects saies to increase by 18% this coming year and also expects to maintain its jong-run dividend payout ratio of 40%. Suppose Green. Moose Company's assets are fully utilized. Use the additional funds needed (AFN) equation to determine the increase in totas assets that is necessary to support Green Moose Company's expected sales. (Note: Do not round intermediate calculations.) $540,000$567,000$621,000$459,000 When a firm grows, some liabilities grow spontaneousty along with sales, 5 pontaneous liabulities are a source of capital that the firm will generate internally, so they reduce the need for external capital. How much of the total increase in assets will be supplied by spontaneous liabilities for Green Moose Company this year? (Note: Do not round intermediate calculations.) 562,600 572,000 575,600 $61,200 In addition, Green Moose Company is expected to generate net income this year. The firm will pay out some of its earnings as dividends but will retain the rest for future asset investmenti Again, the more a firm generates internally from its operations, the less it will have to raise externally from the capitat markets. Assume that the firm's profit margin and dividend payout ratio are expected to remain constant. Civen the preceding information, Green Moose Company is expected to generate 5 . from operations that wil be added to retained earnings. (Note: Do not round intermeolate calculations.) In addation, Green Mose Compony is expected to generate net income this year. The frm will pay out some of its earnings as dividends but will retain the fest for future asset investment. Again, the mare a firm generates internally from its operations, the less it wilt have to raise externally from the. capital markets. Assume that the firm's pront margin and dividend payout ratic are expected to remain constant. Civen the preceding information, Green Moose Company is expected to generate 1 from oberations that will be added to retained esningt. (Note Do not round intermediate calculations.) According to the MNw equation and profections for Grenn Moose Company, the firm's AFN is 1 (Note Do not round intermediate ralculationsi) Th 17. Assignment - Financial Planning and Forecasting 1. The Additional Funds Needed (AFN) equation Green Moose Company has the following end-of-year balance sheet: The firm is currentiy in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Company generated $450,000 net income on sales of $14,500,000. The firm expects sales to increase by 187 this coming year and aiso expects to maintain its long-run dividend payout ratio of 40%. Suppose Green Moose Company's assets are fully utilized. Use the additional funds needed (AFN) equation to determine the increase in total assets that is necessary to support Green Moose Company's expected sales. (Note: Do not round intermediate cakulations.) The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Company generated 5450,000 net income on sales of 514,500,000. The firm expects saies to increase by 18% this coming year and also expects to maintain its jong-run dividend payout ratio of 40%. Suppose Green. Moose Company's assets are fully utilized. Use the additional funds needed (AFN) equation to determine the increase in totas assets that is necessary to support Green Moose Company's expected sales. (Note: Do not round intermediate calculations.) $540,000$567,000$621,000$459,000 When a firm grows, some liabilities grow spontaneousty along with sales, 5 pontaneous liabulities are a source of capital that the firm will generate internally, so they reduce the need for external capital. How much of the total increase in assets will be supplied by spontaneous liabilities for Green Moose Company this year? (Note: Do not round intermediate calculations.) 562,600 572,000 575,600 $61,200 In addition, Green Moose Company is expected to generate net income this year. The firm will pay out some of its earnings as dividends but will retain the rest for future asset investmenti Again, the more a firm generates internally from its operations, the less it will have to raise externally from the capitat markets. Assume that the firm's profit margin and dividend payout ratio are expected to remain constant. Civen the preceding information, Green Moose Company is expected to generate 5 . from operations that wil be added to retained earnings. (Note: Do not round intermeolate calculations.) In addation, Green Mose Compony is expected to generate net income this year. The frm will pay out some of its earnings as dividends but will retain the fest for future asset investment. Again, the mare a firm generates internally from its operations, the less it wilt have to raise externally from the. capital markets. Assume that the firm's pront margin and dividend payout ratic are expected to remain constant. Civen the preceding information, Green Moose Company is expected to generate 1 from oberations that will be added to retained esningt. (Note Do not round intermediate calculations.) According to the MNw equation and profections for Grenn Moose Company, the firm's AFN is 1 (Note Do not round intermediate ralculationsi)