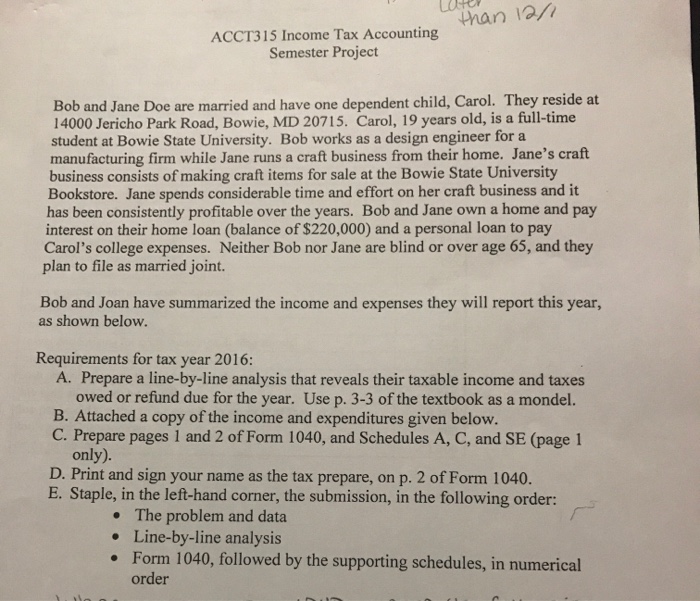

than / ACCT315 Income Tax Accounting Semester Project Bob and Jane Doe are married and have one dependent child, Carol. They reside at 14000 Jericho Park Road, Bowie, MD 20715. Carol, 19 years old, is a full-time student at Bowie State University. Bob works as a design engineer for a manufacturing firm while Jane runs a craft business from their home. Jane's craft business consists of making craft items for sale at the Bowie State University Bookstore. Jane spends considerable time and effort on her craft business and it has been consistently profitable over the years. Bob and Jane own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay Carol's college expenses. Neither Bob nor Jane are blind or over age 65, and they plan to file as married joint. Bob and Joan have summarized the income and expenses they will report this year, as shown below. Requirements for tax year 2016: A. Prepare a line-by-line analysis that reveals their taxable income and taxes owed or refund due for the year. Use p. 3-3 of the textbook as a mondel. B. Attached a copy of the income and expenditures given below. C. Prepare pages 1 and 2 of Form 1040, and Schedules A, C, and SE (page 1 only). D. Print and sign your name as the tax prepare, on p. 2 of Form 1040. E. Staple, in the left-hand corner, the submission, in the following order: The problem and data Line-by-line analysis Form 1040, followed by the supporting schedules, in numerical order than / ACCT315 Income Tax Accounting Semester Project Bob and Jane Doe are married and have one dependent child, Carol. They reside at 14000 Jericho Park Road, Bowie, MD 20715. Carol, 19 years old, is a full-time student at Bowie State University. Bob works as a design engineer for a manufacturing firm while Jane runs a craft business from their home. Jane's craft business consists of making craft items for sale at the Bowie State University Bookstore. Jane spends considerable time and effort on her craft business and it has been consistently profitable over the years. Bob and Jane own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay Carol's college expenses. Neither Bob nor Jane are blind or over age 65, and they plan to file as married joint. Bob and Joan have summarized the income and expenses they will report this year, as shown below. Requirements for tax year 2016: A. Prepare a line-by-line analysis that reveals their taxable income and taxes owed or refund due for the year. Use p. 3-3 of the textbook as a mondel. B. Attached a copy of the income and expenditures given below. C. Prepare pages 1 and 2 of Form 1040, and Schedules A, C, and SE (page 1 only). D. Print and sign your name as the tax prepare, on p. 2 of Form 1040. E. Staple, in the left-hand corner, the submission, in the following order: The problem and data Line-by-line analysis Form 1040, followed by the supporting schedules, in numerical order