Answered step by step

Verified Expert Solution

Question

1 Approved Answer

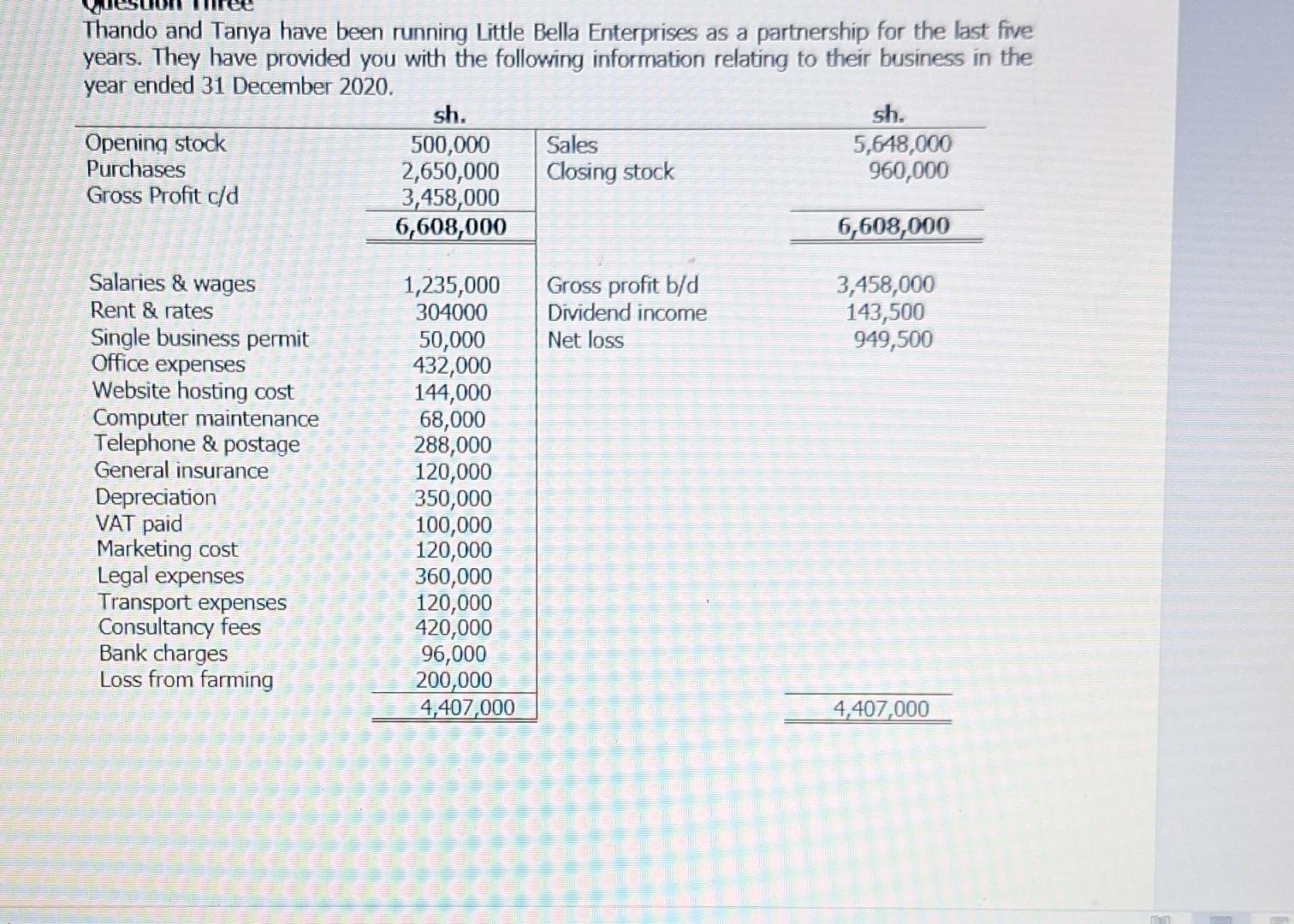

Thando and Tanya have been running Little Bella Enterprises as a partnership for the last five years. They have provided you with the following information

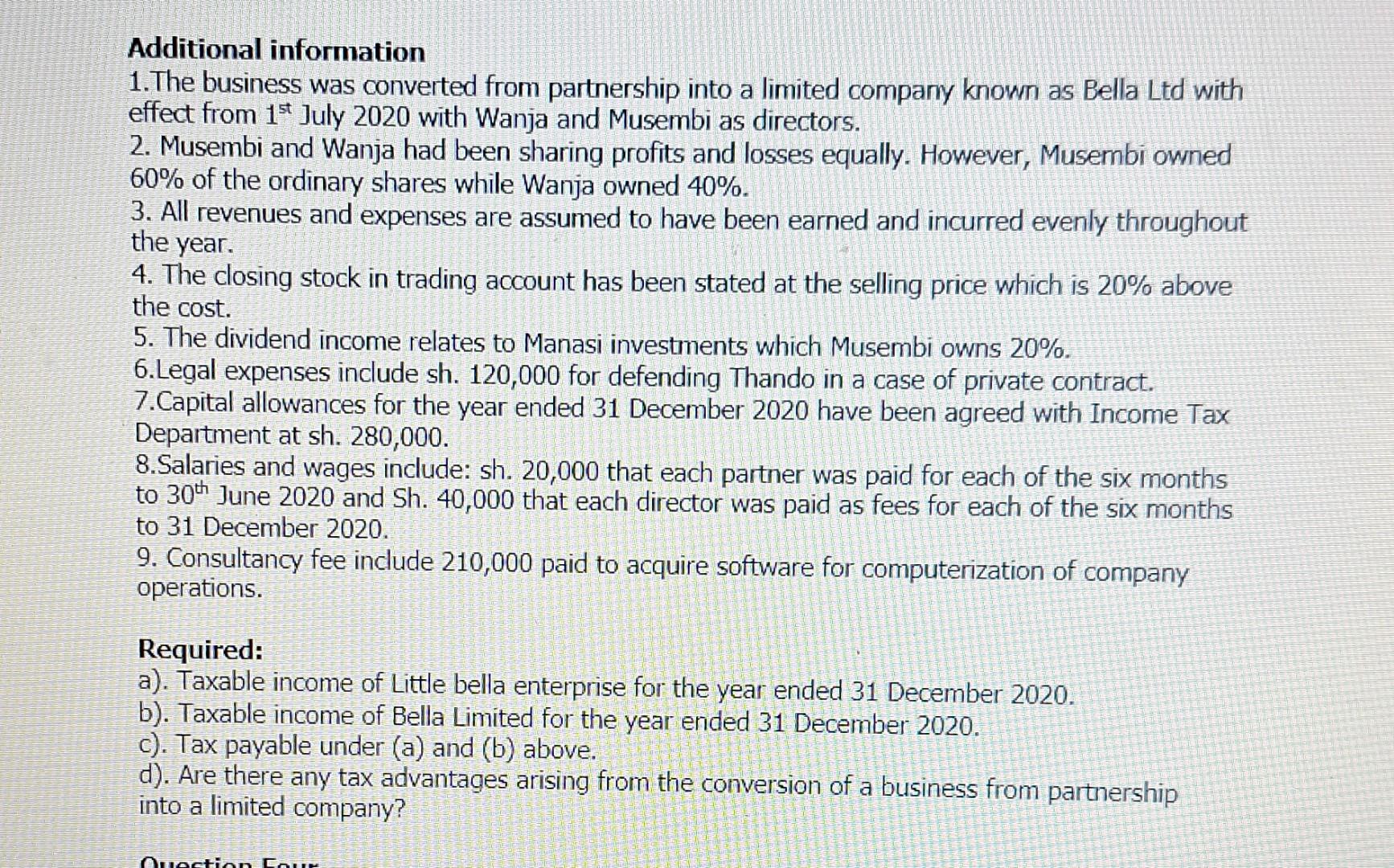

Thando and Tanya have been running Little Bella Enterprises as a partnership for the last five years. They have provided you with the following information relating to their business in the year ended 31 December 2020. Additional information 1. The business was converted from partnership into a limited comparny known as Bella Ltd with effect from 1st July 2020 with Wanja and Musembi as directors. 2. Musembi and Wanja had been sharing profits and losses equally. However, Musembi owned 60% of the ordinary shares while Wanja owned 40%. 3. All revenues and expenses are assumed to have been earned and incurred evenly throughout the year. 4. The closing stock in trading account has been stated at the selling price which is 20% above the cost. 5. The dividend income relates to Manasi investments which Musembi owns 20%. 6.Legal expenses include sh. 120,000 for defending Thando in a case of private contract. 7.Capital allowances for the year ended 31 December 2020 have been agreed with Income Tax Department at sh. 280,000 . 8.Salaries and wages include: sh. 20,000 that each partner was paid for each of the six months to 30th June 2020 and Sh. 40,000 that each director was paid as fees for each of the six months to 31 December 2020. 9. Consultancy fee include 210,000 paid to acquire software for computerization of company operations. Required: a). Taxable income of Little bella enterprise for the year ended 31 December 2020. b). Taxable income of Bella Limited for the year ended 31 December 2020. c). Tax payable under (a) and (b) above. d). Are there any tax advantages arising from the conversion of a business from partnership into a limited company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started