Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you 1 Calculate current yield, conversion ratio, and yield to maturity A 5% convertible bond (maturing in 15 years) is convertible into 30 shares

thank you

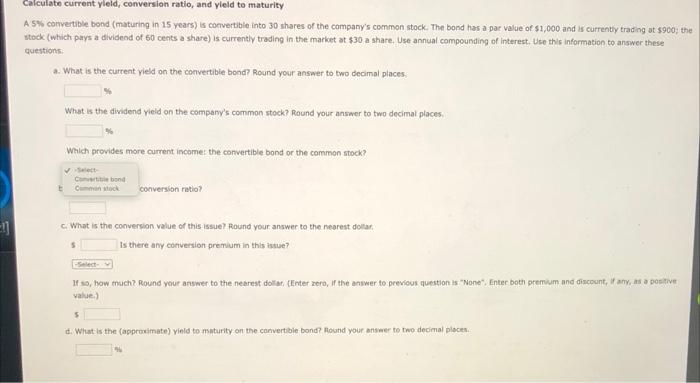

1 Calculate current yield, conversion ratio, and yield to maturity A 5% convertible bond (maturing in 15 years) is convertible into 30 shares of the company's common stock. The bond has a par value of $1,000 and is currently trading at $900; the stock (which pays a dividend of 60 cents a share) is currently trading in the market at $30 a share. Use annual compounding of interest. Use this information to answer these questions a. What is the current yield on the convertible bond? Round your answer to two decimal places. What is the dividend yield on the company's common stock? Round your answer to two decimal places, Which provides more current income: the convertible bond or the common stock? Convertible bond E Comman stock conversion ratio? c. What is the conversion value of this issue? Round your answer to the nearest dollar S Is there any conversion premium in this issue? -Select- If so, how much? Round your answer to the nearest dollar, (Enter zero, If the answer to previous question is "None". Enter both premium and discount, if any, as a positive value.) S d. What is the (approximate) yield to maturity on the convertible bond? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started