Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank You! 1 WACC 3 4 5 6 7 8 Cost of common equity (s) Before-tax cost of debt (ra) Marginal tax rate (1) Common

Thank You!

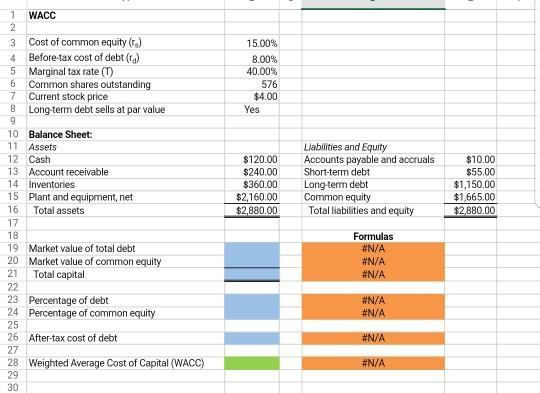

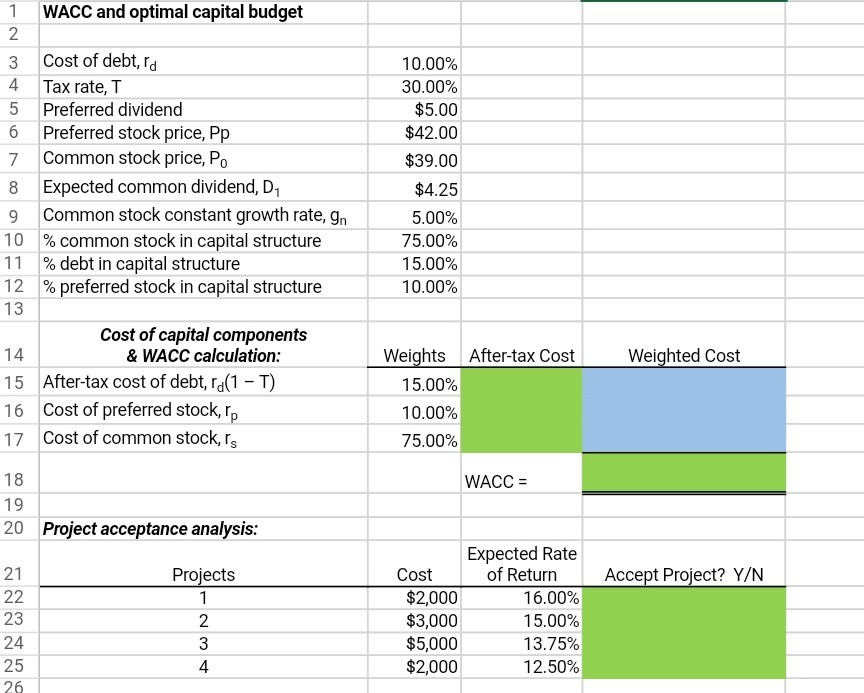

1 WACC 3 4 5 6 7 8 Cost of common equity (s) Before-tax cost of debt (ra) Marginal tax rate (1) Common shares outstanding Current stock price Long-term debt sells at par value 15.00% 8.00% 40.00% 576 $4.00 Yes 10 Balance Sheet: 11 Assets 12 Cash 13 Account receivable 14 Inventories 15 Plant and equipment, net 16 Total assets $120.00 $240.00 $360.00 $2,160.00 $2,880.00 Liabilities and Equity Accounts payable and accruals Short-term debt Long-term debt Common equity Total liabilities and equity $10.00 $55.00 $1,150.00 $1,665.00 $2,880.00 19 Market value of total debt 20 Market value of common equity 21 Total capital Formulas #N/A #N/A #N/A 23 Percentage of debt 24 Percentage of common equity #N/A #N/A After-tax cost of debt #N/A 27 28 Weighted Average Cost of Capital (WACC) #N/A 30 1 WACC and optimal capital budget 6 Cost of debt,ra Tax rate, T 5 Preferred dividend Preferred stock price, Pp 7 Common stock price, P. 8 Expected common dividend, D, 9 Common stock constant growth rate, gn 10 % common stock in capital structure 11 % debt in capital structure 12 % preferred stock in capital structure 13 Cost of capital components & WACC calculation: 15 After-tax cost of debt, ra(1 - T) 16 Cost of preferred stock, rp 17 Cost of common stock, rs 10.00% 30.00% $5.00 $42.00 $39.00 $4.25 5.00% 75.00% 15.00% 10.00% 14 After-tax Cost Weighted Cost Weights 15.00% 10.00% 75.00% 18 WACC = 19 20 Project acceptance analysis: Projects Accept Project? Y/N Expected Rate of Return 16.00% 15.00% 13.75% 12.50% Cost $2,000 $3,000 $5,000 $2,000 23 24 25 26Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started