Thank you

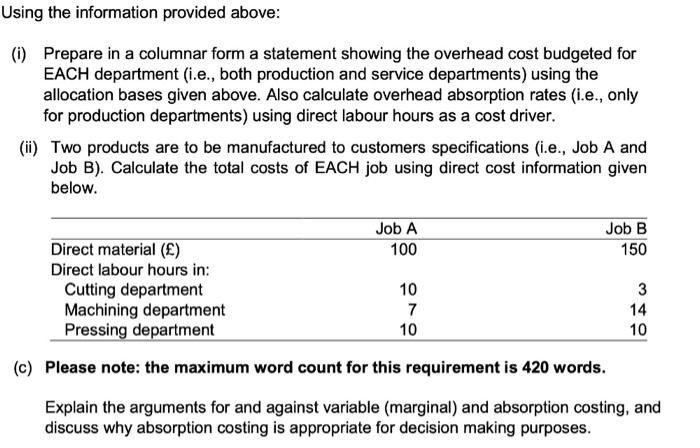

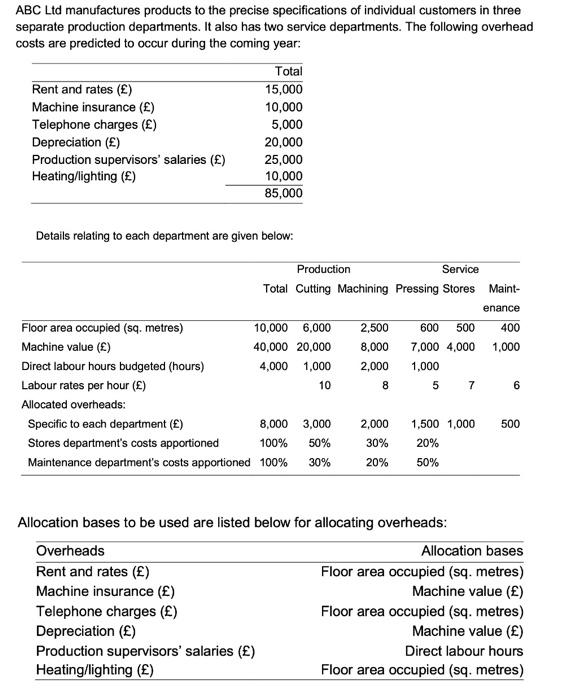

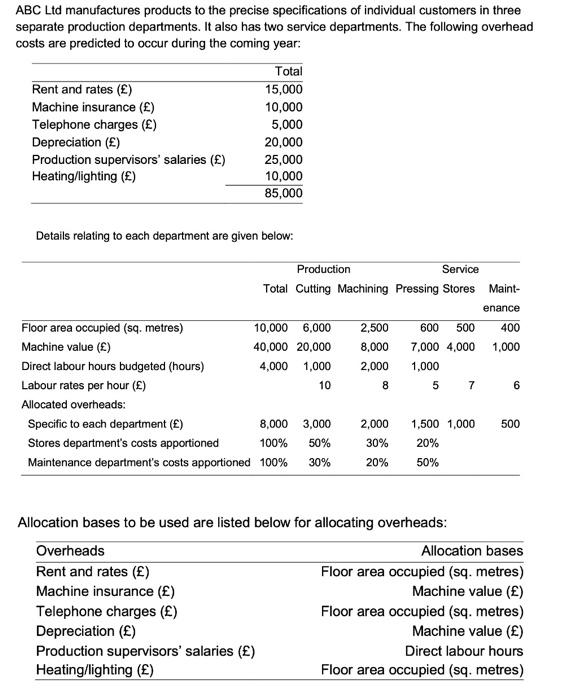

ABC Ltd manufactures products to the precise specifications of individual customers in three separate production departments. It also has two service departments. The following overhead costs are predicted to occur during the coming year: Total Rent and rates () 15,000 Machine insurance () 10,000 Telephone charges () 5,000 Depreciation () 20,000 Production supervisors' salaries () 25,000 Heating/lighting (E) 10,000 85,000 Details relating to each department are given below: Production Service Total Cutting Machining Pressing Stores Maint- enance Floor area occupied (sq. metres) 10,000 6,000 2,500 600 500 400 Machine value (E) 40,000 20,000 8,000 7,000 4,000 1,000 Direct labour hours budgeted (hours) 4,000 1,000 2,000 1,000 Labour rates per hour () 10 8 5 7 6 Allocated overheads: Specific to each department (E) 8,000 3,000 2,000 1,500 1,000 500 Stores department's costs apportioned 100% 50% 30% 20% Maintenance department's costs apportioned 100% 30% 20% 50% Allocation bases to be used are listed below for allocating overheads: Overheads Allocation bases Rent and rates () Floor area occupied (sq. metres) Machine insurance () Machine value () Telephone charges () Floor area occupied (sq. metres) Depreciation (E) Machine value () Production supervisors' salaries () Direct labour hours Heating/lighting () Floor area occupied (sq. metres) Using the information provided above: (1) Prepare in a columnar form a statement showing the overhead cost budgeted for EACH department (i.e., both production and service departments) using the allocation bases given above. Also calculate overhead absorption rates (i.e., only for production departments) using direct labour hours as a cost driver. (ii) Two products are to be manufactured to customers specifications (i.e., Job A and Job B). Calculate the total costs of EACH job using direct cost information given below. Job A Job B Direct material (E) 100 150 Direct labour hours in: Cutting department 10 3 Machining department 7 14 Pressing department 10 10 (c) Please note: the maximum word count for this requirement is 420 words. Explain the arguments for and against variable (marginal) and absorption costing, and discuss why absorption costing is appropriate for decision making purposes

Thank you

Thank you