Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you! Assume that interest rate parity holds and that 45-day risk-free securities yield a nominal annual rate of 5% in the US and a

thank you!

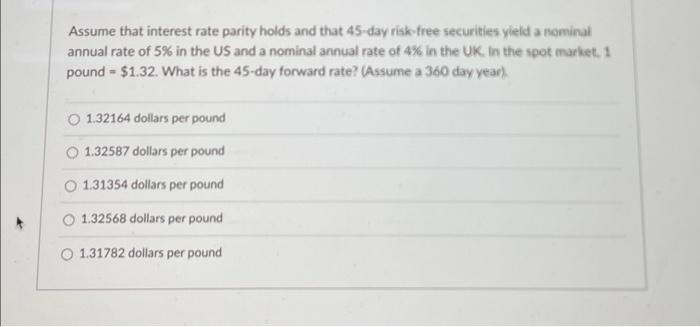

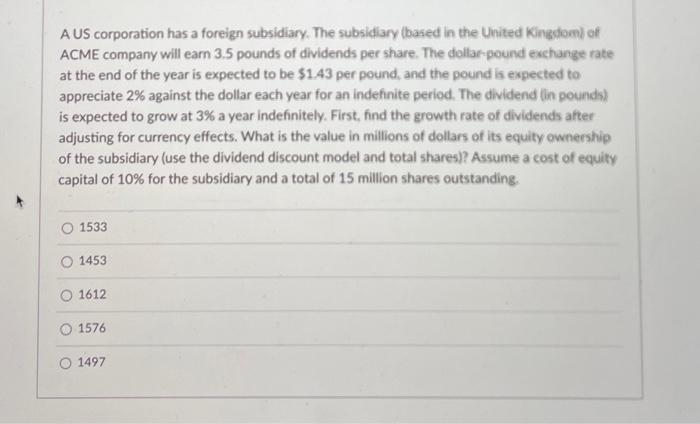

Assume that interest rate parity holds and that 45-day risk-free securities yield a nominal annual rate of 5% in the US and a nominal annual rate of 4% in the UK. In the spot market, 1 pound = $1.32. What is the 45-day forward rate? (Assume a 360 day year). O 1.32164 dollars per pound 1.32587 dollars per pound O 1.31354 dollars per pound 1.32568 dollars per pound O 1.31782 dollars per pound A US corporation has a foreign subsidiary. The subsidiary (based in the United Kingdom) of ACME company will earn 3.5 pounds of dividends per share. The dollar-pound exchange rate at the end of the year is expected to be $1.43 per pound, and the pound is expected to appreciate 2% against the dollar each year for an indefinite period. The dividend (in pounds) is expected to grow at 3% a year indefinitely. First, find the growth rate of dividends after adjusting for currency effects. What is the value in millions of dollars of its equity ownership of the subsidiary (use the dividend discount model and total shares)? Assume a cost of equity capital of 10% for the subsidiary and a total of 15 million shares outstanding. 1533 O 1453 O 1612 1576 O 1497

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started