Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you b. Consider the bonds below, all of which pay coupons semi-annually and so in each case the yield to maturity is a semi-annual

Thank you

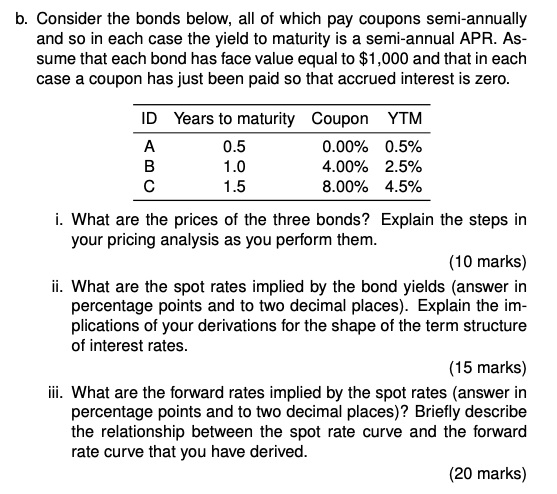

b. Consider the bonds below, all of which pay coupons semi-annually and so in each case the yield to maturity is a semi-annual APR. As- sume that each bond has face value equal to $1,000 and that in each case a coupon has just been paid so that accrued interest is zero. ID Years to maturity Coupon YTM 0.5 0.00% 0.5% B 1.0 4.00% 2.5% 1.5 8.00% 4.5% i. What are the prices of the three bonds? Explain the steps in your pricing analysis as you perform them. (10 marks) ii. What are the spot rates implied by the bond yields (answer in percentage points and to two decimal places). Explain the im- plications of your derivations for the shape of the term structure of interest rates. (15 marks) ii. What are the forward rates implied by the spot rates (answer in percentage points and to two decimal places)? Briefly describe the relationship between the spot rate curve and the forward rate curve that you have derived. (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started