Answered step by step

Verified Expert Solution

Question

1 Approved Answer

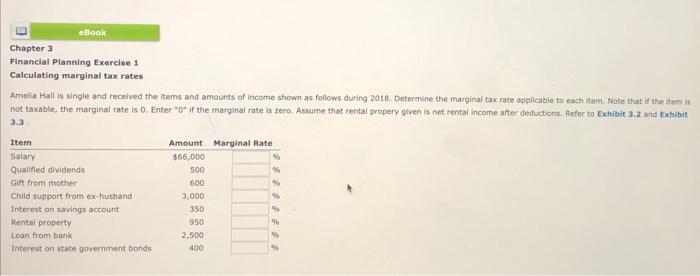

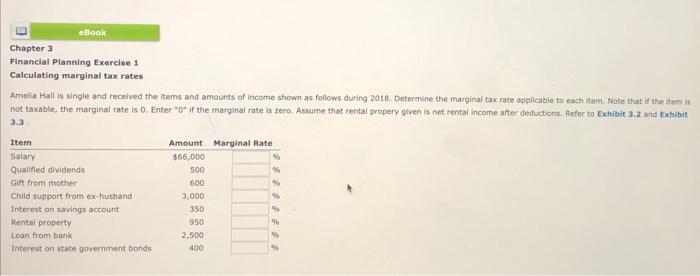

thank you eBook Chapter 3 Financial Planning Exercise 1 Calculating marginal tax rates Amelia Hall is single and received the items and amounts of income

thank you

eBook Chapter 3 Financial Planning Exercise 1 Calculating marginal tax rates Amelia Hall is single and received the items and amounts of income shown as follows during 2018. Determine the marginal tax rate applicable to each item. Note that if the item is not taxable, the marginal rate is 0. Enter "o" if the marginal rate is zero. Assume that rental propery given is net rental income after deductions. Refer to Exhibit 3.2 and Exhibit 3.3 Item Salary Qualified dividends Gift from mother Child support from ex-husband Interest on savings account Rental property Loan from bank Interest on state government bonds Amount Marginal Rate $66,000 500 600 3,000 350 950 2,500 400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started