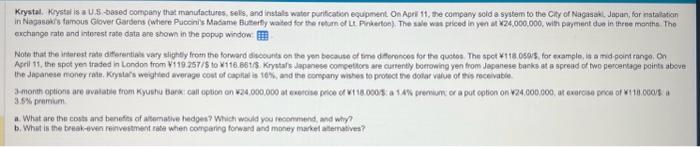

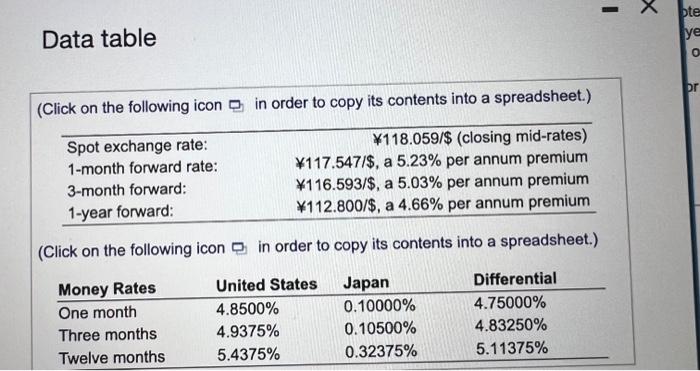

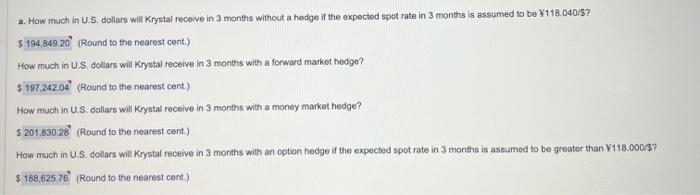

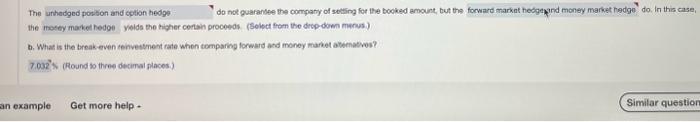

euchange rate and intorest rate data ane shown in the popop window: Note that the intereat rate ditbrentiak vary silighey from the forward dwoounts on the yen because of time diforencos for the quebos. The spot *its. Ososs, for example, is a mid-point range. On the Jaganese money rale. Kryalars weightied average coet of caphit is 10\%, and the company wishes to protect the dotar value of this rocenable. 3.5\% pramium a. What are the costa ans benefis of atomative hedges? Which would you moonsmend, and why? b. Whit is the break-twen reinveitment rate when comparing forward and money maked atematives? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) a. How much in U.S. dollars will Krystal receive in 3 months without a hedge if the expected spot rate in 3 months is assumed to be $118.040/3 ? (Round to the nearest cent.) How much in U.S, dollars will Krystal receive in 3 months with a forward market hedge? (Round to the nearest cent.) How much in U.S. dollars will Krystal receive in 3 months with a money market hodge? (Round to the nearest cent.) How much in U.S. dollars will Krystal receive in 3 months with an option hedge if the expected spot rate in 3 months is assumed to be greater than Y118.000.\$? (Round to the nearest cent.) The do nok guarandes the company of seling for the booked amount, but the forward markak hedgemand money market hedgo do. In this case, the yelids the bigher certah proceeds (Seloct from the drap-doen merus). b. What is the break even teivettment rate whon tomparing forward and money tharket ateenativos? 7.032 (Round io three decimal places.) euchange rate and intorest rate data ane shown in the popop window: Note that the intereat rate ditbrentiak vary silighey from the forward dwoounts on the yen because of time diforencos for the quebos. The spot *its. Ososs, for example, is a mid-point range. On the Jaganese money rale. Kryalars weightied average coet of caphit is 10\%, and the company wishes to protect the dotar value of this rocenable. 3.5\% pramium a. What are the costa ans benefis of atomative hedges? Which would you moonsmend, and why? b. Whit is the break-twen reinveitment rate when comparing forward and money maked atematives? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) a. How much in U.S. dollars will Krystal receive in 3 months without a hedge if the expected spot rate in 3 months is assumed to be $118.040/3 ? (Round to the nearest cent.) How much in U.S, dollars will Krystal receive in 3 months with a forward market hedge? (Round to the nearest cent.) How much in U.S. dollars will Krystal receive in 3 months with a money market hodge? (Round to the nearest cent.) How much in U.S. dollars will Krystal receive in 3 months with an option hedge if the expected spot rate in 3 months is assumed to be greater than Y118.000.\$? (Round to the nearest cent.) The do nok guarandes the company of seling for the booked amount, but the forward markak hedgemand money market hedgo do. In this case, the yelids the bigher certah proceeds (Seloct from the drap-doen merus). b. What is the break even teivettment rate whon tomparing forward and money tharket ateenativos? 7.032 (Round io three decimal places.)