Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With solutions please Use the following to answer questions 31 - 34: ASSETS 2-year commercial loans, 10 %, $800 million annual fixed rate, at par

With solutions please

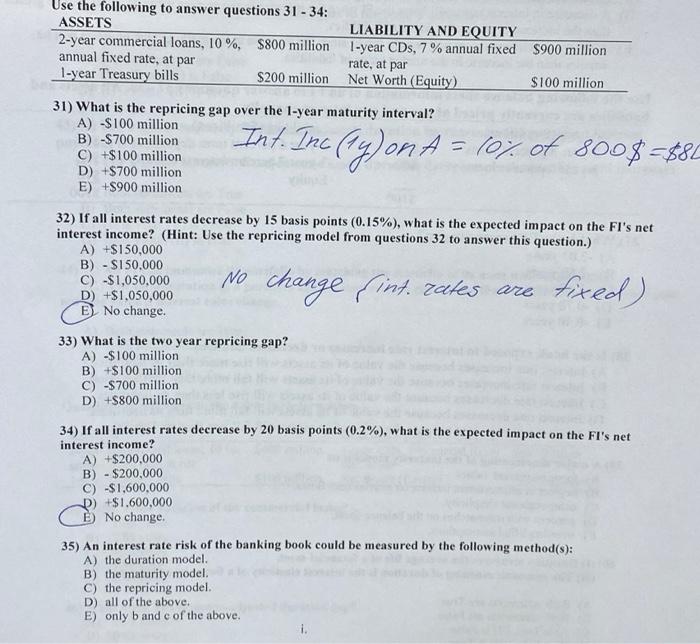

Use the following to answer questions 31 - 34: ASSETS 2-year commercial loans, 10 %, $800 million annual fixed rate, at par 1-year Treasury bills. $200 million 31) What is the repricing gap over the 1-year maturity interval? A) -$100 million B) -$700 million C) +$100 million D) +$700 million E) +$900 million 33) What is the two year repricing gap? A) -$100 million B) +$100 million C) -$700 million D) +$800 million A) +$200,000 B) - $200,000 C) -$1,600,000 D) +$1,600,000 E) No change. LIABILITY AND EQUITY 1-year CDs, 7% annual fixed rate, at par Net Worth (Equity) Int. Inc (1y) on A = 10% of 800$=$80 vil 32) If all interest rates decrease by 15 basis points (0.15%), what is the expected impact on the FI's net interest income? (Hint: Use the repricing model from questions 32 to answer this question.) A) +$150,000 B) - $150,000 C) -$1,050,000 D) +$1,050,000 E No change. No change (int. rates are fixed) $900 million B) the maturity model. C) the repricing model. D) all of the above. E) only b and c of the above. $100 million 34) If all interest rates decrease by 20 basis points (0.2%), what is the expected impact on the FI's net interest income? i. 35) An interest rate risk of the banking book could be measured by the following method(s): A) the duration model.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started