Question

Thank you for all that y'all do Project Welcome to Desire, Inc! You have just been hired as the managerial account for the newly formed

Thank you for all that y'all do

Project

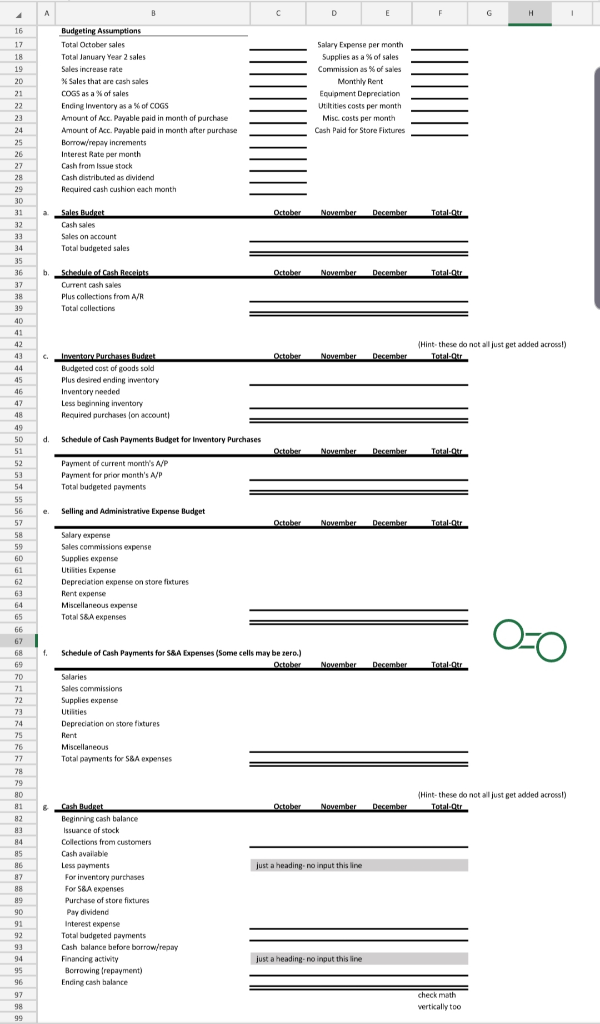

Welcome to Desire, Inc! You have just been hired as the managerial account for the newly formed Desire, Inc. Desire will begin operations on October 1st, Year 1 (i.e., they did not exist before this date). Desire is a merchandising company that retails sporting goods. Your job is to prepare a master budget for Desire for the quarter consisting of October, November, and December Year 1. As part of the budgeting process, you will need to complete the following budget schedules for each of the three months of the quarter:

a. Sales Budget

b. Schedule of Cash Receipts

c. Inventory Purchases Budget

d. Schedule of Cash Payments for Inventory Purchases

e. Selling and Administrative Expense Budget

f. Schedule of Cash Payments for Selling and Admin. Expenses

g. Cash Budget

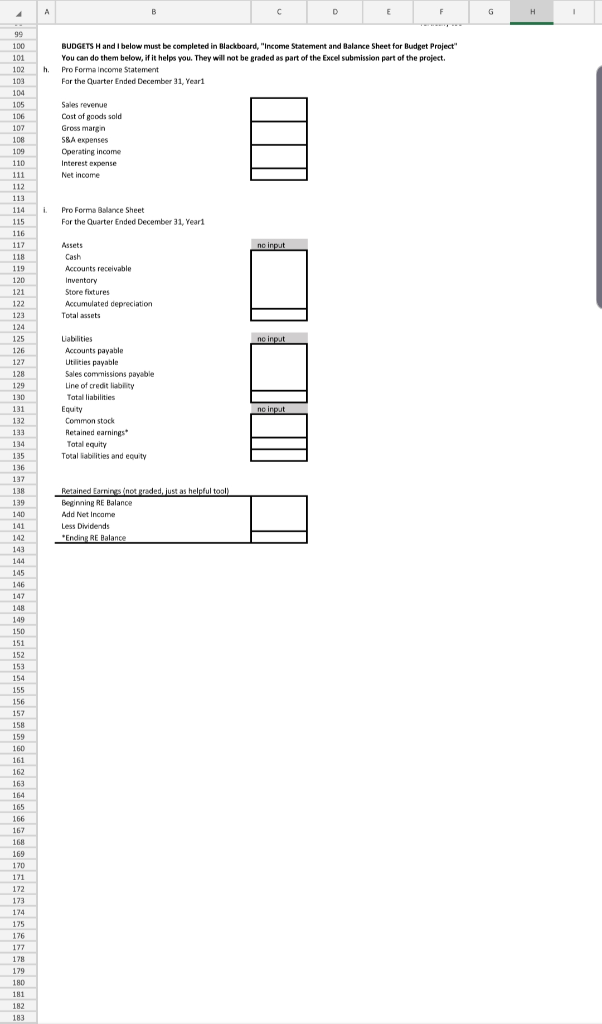

h. Pro-forma Income Statement

i. Pro-forma Balance Sheet

The following budget information and assumptions will help you complete this task.

Desire anticipates total sales to be $295,000 for October.

o 40% of sales made each month are cash sales. The rest of sales are made on account (Accounts Receivable).

o Total sales are expected to increase each month by 17%.

o Cash from cash sales is collected immediately (in the month of the sale). All cash from sales made on account is collected in the month following the sale.

o Desire predicts that total sales in January of Year 2 will be $246,000.

Desire anticipates Cost of Goods Sold for each month to be 72% of total sales for that month.

o Desire requires that ending inventory for each month be 20% of the next months expected cost of goods sold.

o Because Desire is set to begin operations on October 1st, they did not have any beginning inventory at the beginning of October.

o Desire makes all their inventory purchases on account. They will pay for 35% of inventory purchases in the month of purchase, and they will pay for the rest (65%) in the month following the purchase.

Selling and Administrative Expenses are as follows:

o Total salaries expense is $25,000 each month, and Desire pays this expense in the month it is incurred

o Desire has a sales commission expense equal to 3% of total sales for the month. They do not pay their salespeople the commission until the month following when the sales are made. o Supplies expense is 2% of total sales for the month and is paid for in the month of the sale.

o Utilities expense is expected to be $2,250 each month. Utilities are not paid until the month after the expense is incurred.

o Depreciation on store fixtures (purchase details described later) is on a straight-line basis and will be $8,375 each month.

o Rent on the store is $8,500 each month and is paid in the month it is incurred.

o Miscellaneous expenses are $1,500 each month and are paid in the month they are incurred.

Extra notes on the cash budget o Because Desire is set to begin operations on October 1st, they had no beginning cash balance at the beginning of October.

o On October 1st, Desire, Inc. collected $265,000 and issued stock to the owners.

o On October 1st, Desire purchased $450,000 worth of store fixtures (depreciation on the fixtures was described previously).

o Desire declared and paid a $32,000 cash dividend to stockholders on December 31st, Year 1.

o Desire has a policy that requires each months ending cash balance to be at least $22,000. Desires bank requires them to borrow and repay money in increments of $1000. When Desire borrows or repays money, they do so on the last day of the month. If Desire borrows money, they will pay back as much possible in the months when they exceed the $22,000 cash balance minimum.

o The bank charges Desire interest of 1% per month (non-compounding). Desire pays the interest at the end of each month when interest is incurred.

It needs to be inputted into:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started