Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you for assistance 1.) Nick Williams owns a 3-stock portfolio with a total investment value equal to $200,000. Stock Investment Beta Return A $50,000

Thank you for assistance

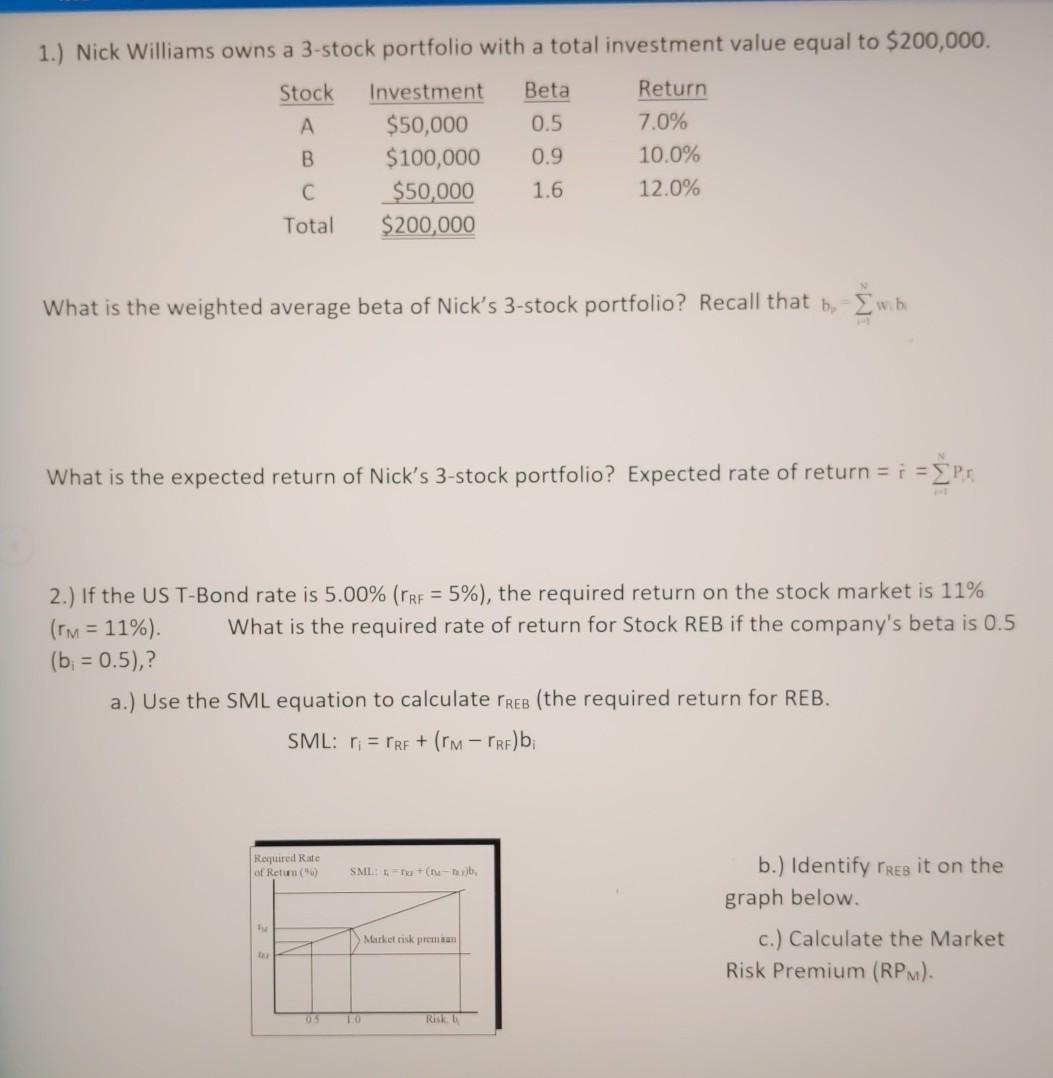

1.) Nick Williams owns a 3-stock portfolio with a total investment value equal to $200,000. Stock Investment Beta Return A $50,000 0.5 7.0% B $100,000 0.9 10.0% $50,000 1.6 12.0% Total $200,000 What is the weighted average beta of Nick's 3-stock portfolio? Recall that b w.b What is the expected return of Nick's 3-stock portfolio? Expected rate of return = * = SP 2.) If the US T-Bond rate is 5.00% (rre = 5%), the required return on the stock market is 11% (rm = 11%). What is the required rate of return for Stock REB if the company's beta is 0.5 (b; = 0.5),? a.) Use the SML equation to calculate free (the required return for REB. SML: r = rre+ (rm -rfb; Required Rate of Reun (6 SML Trene-tab, b.) Identify rres it on the graph below. c.) Calculate the Market Risk Premium (RPM). Market risk premsa 0 10 RE d.) What is beta for the market portfolio? e.) Is REB more or less risky than the stock marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started