Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you for solving one question for me ! no need to solve this now ! i updated some new questions ! please have a

thank you for solving one question for me ! no need to solve this now ! i updated some new questions ! please have a look

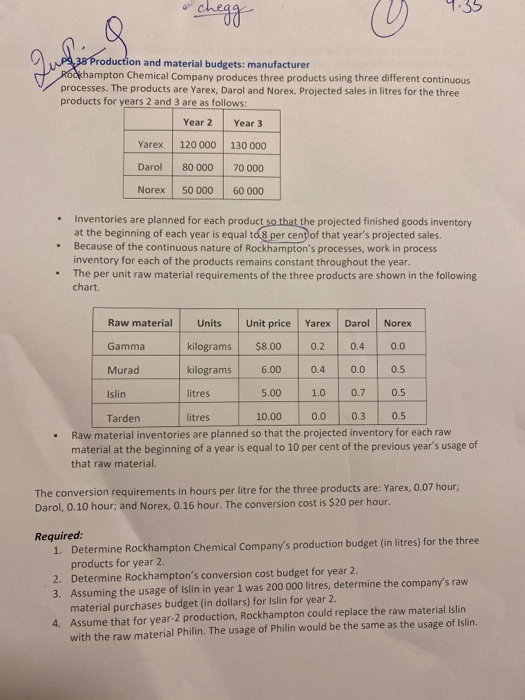

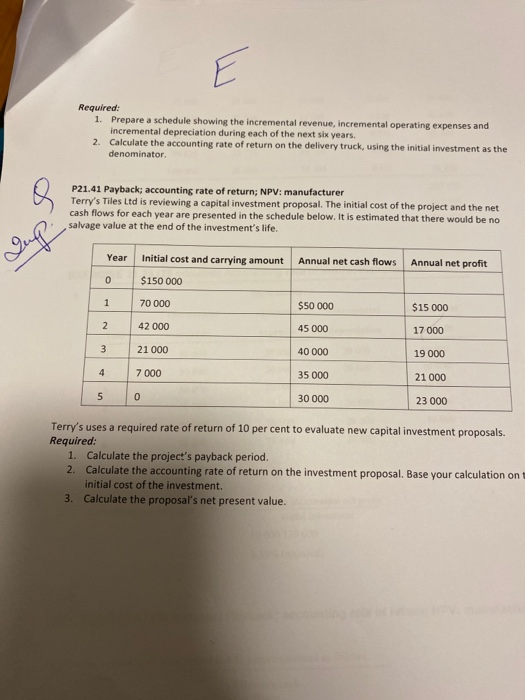

chegg Justin 38 Production and material budgets: manufacturer Rockhampton Chemical Company produces three products using three different continuous processes. The products are Yarex, Darol and Norex. Projected sales in litres for the three products for years 2 and 3 are as follows: Year 2 Year 3 Yarex 120 000 130 000 Darol 80 000 70 000 Norex 50 000 60 000 . Inventories are planned for each product so that the projected finished goods inventory at the beginning of each year is equal to 8 per cent of that year's projected sales. Because of the continuous nature of Rockhampton's processes, work in process inventory for each of the products remains constant throughout the year. The per unit raw material requirements of the three products are shown in the following chart. - Raw material Units Unit price Yarex Darol Norex Gamma kilograms $8.00 0.2 0.4 0.0 Murad kilograms 6.00 0.4 0.0 0.5 Islin litres 5.00 1.0 0.7 0.5 . Tarden litres 10.00 0.0 0.3 0.5 Raw material inventories are planned so that the projected inventory for each raw material at the beginning of a year is equal to 10 per cent of the previous year's usage of that raw material. The conversion requirements in hours per litre for the three products are: Yarex, 0.07 hour; Darol, 0.10 hour; and Norex, 0.16 hour. The conversion cost is $20 per hour. Required: 1. Determine Rockhampton Chemical Company's production budget (in litres) for the three products for year 2. 2. Determine Rockhampton's conversion cost budget for year 2 3. Assuming the usage of Islin in year 1 was 200 000 litres, determine the company's raw material purchases budget (in dollars) for Islin for year 2. 4. Assume that for year-2 production, Rockhampton could replace the raw material Islin with the raw material Philin. The usage of Philin would be the same as the usage of Islin. E Required: 1. Prepare a schedule showing the incremental revenue, incremental operating expenses and incremental depreciation during each of the next six years. 2. Calculate the accounting rate of return on the delivery truck, using the initial investment as the denominator Q P21.41 Payback; accounting rate of return; NPV: manufacturer Terry's Tiles Ltd is reviewing a capital investment proposal. The initial cost of the project and the net cash flows for each year are presented in the schedule below. It is estimated that there would be no salvage value at the end of the investment's life. dup Year Annual net cash flows Initial cost and carrying amount $150 000 Annual net profit 0 1 70 000 $50 000 $15 000 17 000 2 42 000 45 000 3 21 000 40 000 19 000 21 000 7 000 35 000 5 0 30 000 23 000 Terry's uses a required rate of return of 10 per cent to evaluate new capital investment proposals. Required: 1. Calculate the project's payback period. 2. Calculate the accounting rate of return on the investment proposal. Base your calculation on initial cost of the investment. 3. Calculate the proposal's net present value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started