Thank you for the help!

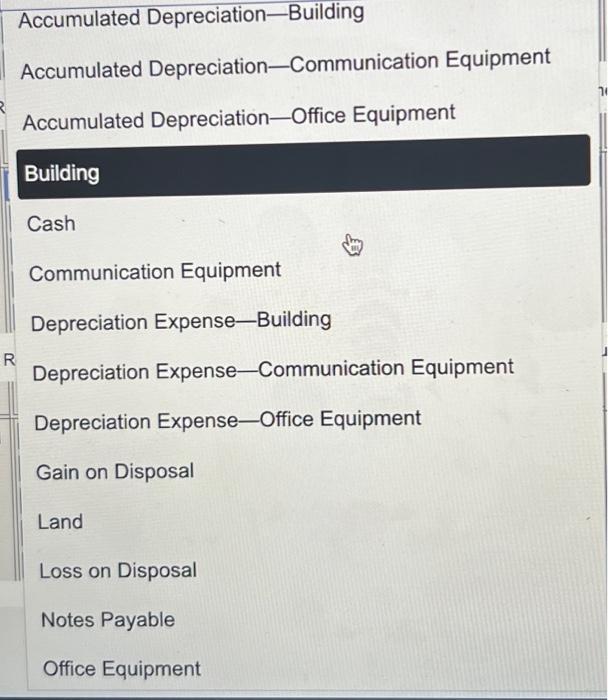

box answer options

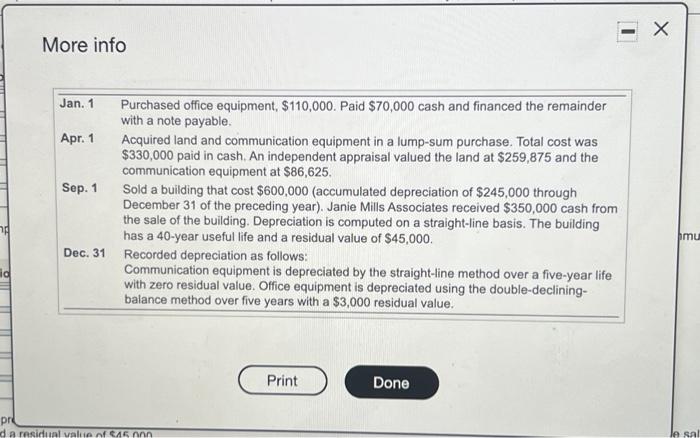

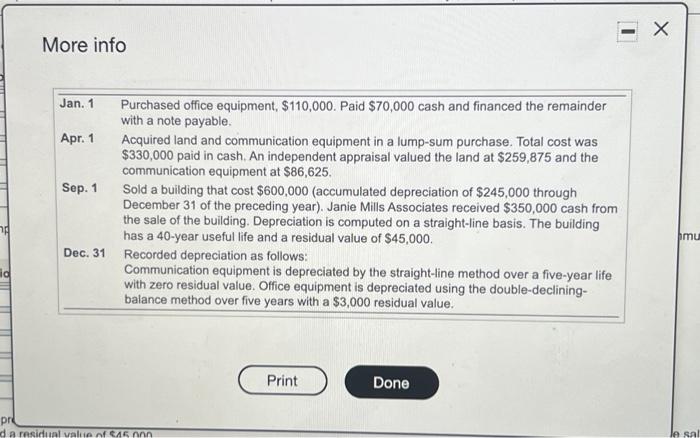

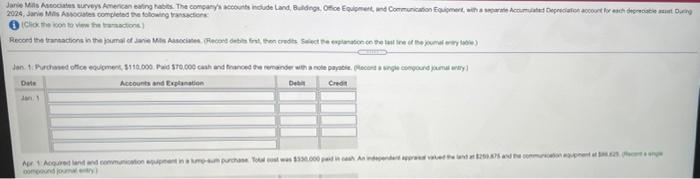

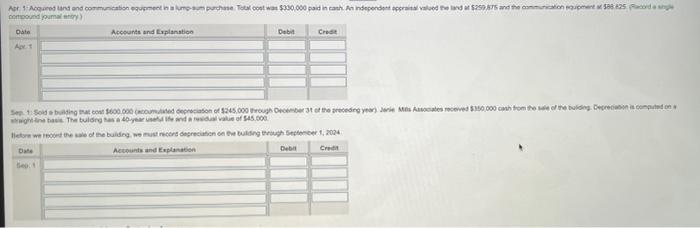

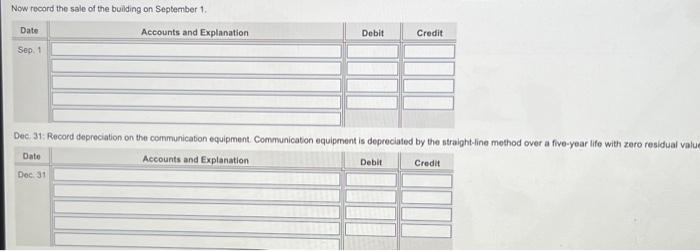

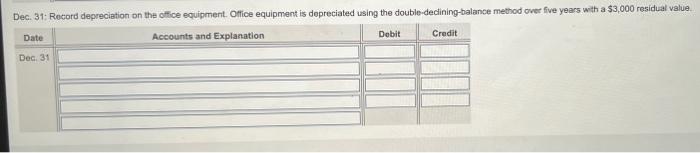

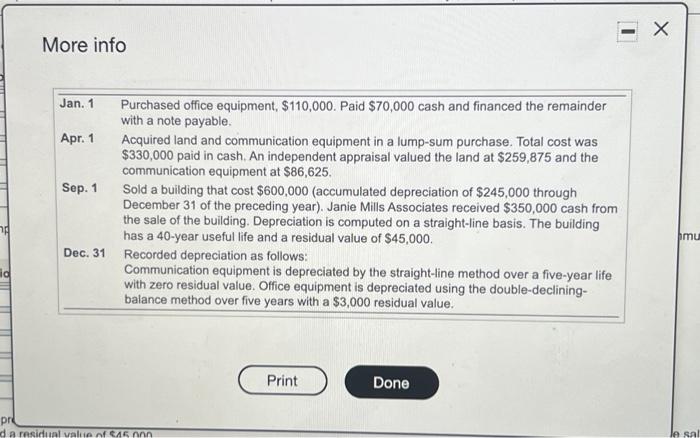

More info Jan. 1 Purchased office equipment, $110,000. Paid $70,000 cash and financed the remainder with a note payable Apr. 1 Acquired land and communication equipment in a lump-sum purchase. Total cost was $330,000 paid in cash. An independent appraisal valued the land at $259,875 and the communication equipment at $86,625. Sep. 1 Sold a building that cost $600,000 (accumulated depreciation of $245,000 through December 31 of the preceding year). Janie Mills Associates received $350,000 cash from the sale of the building. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $45,000 Dec. 31 Recorded depreciation as follows: Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Office equipment is depreciated using the double-declining- balance method over five years with a $3,000 residual value. mu Print Done pre da residual valin Ann IA sal 2024, Mis Associates completed the following Jante la convey American ring has the commons houdeland Buildege. Orice oment and Communication with a counted Depreciate account lv ancho derece martin Click the konto the main Record the transactor in the man is second best, the credite Sie einen eine und www Jan Bichowed of coment. $118.000. a 370.09 Chand to the reader with separatie ocorre con our party Accounts and explanation De Cred Date and continue 150.000 An 2008 condo Aor Acord tand and communication quement in purchase. To $330.000 paid in cath. An independent valued the $259,875 and the concert 50% 25. corda Compound jumal Accounts and Explanation Debit CH At Set Sold bacon 600.000 comercition of 245.000 To December to the gronding year) are so received $300.000 ton the ting. Derection is computed on The bulding has a year and date of $45.000 tetor were the building, writion on the longer, 2004 Account and Explanation Deb Cro Now record the sale of the building on September 1 Date Accounts and Explanation Debit Credit Sep. 1 Dec. 31. Record depreciation on the communication equipment Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value Dato Accounts and Explanation Debit Credit Dec 31 Dec. 31: Record depreciation on the office equipment Office equipment is depreciated using the double-declining-balance method over five years with a $3,000 residual value Date Accounts and Explanation Credit Debit Dec 31 Accumulated DepreciationBuilding Accumulated DepreciationCommunication Equipment Accumulated DepreciationOffice Equipment Building Cash Communication Equipment Depreciation Expense Building R Depreciation ExpenseCommunication Equipment Depreciation Expense-Office Equipment Gain on Disposal Land Loss on Disposal Notes Payable Office Equipment