Answered step by step

Verified Expert Solution

Question

1 Approved Answer

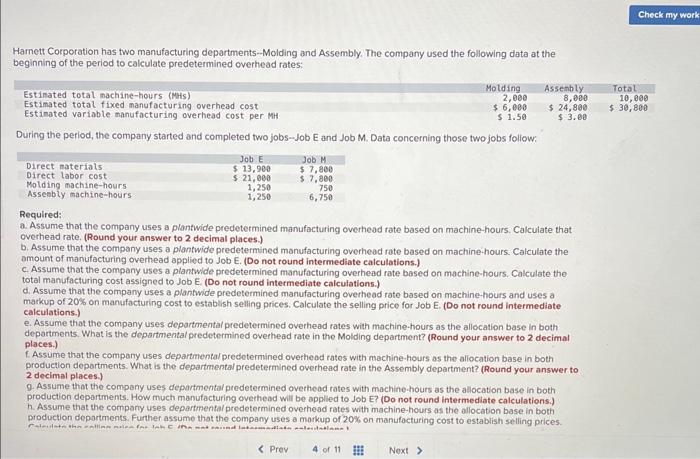

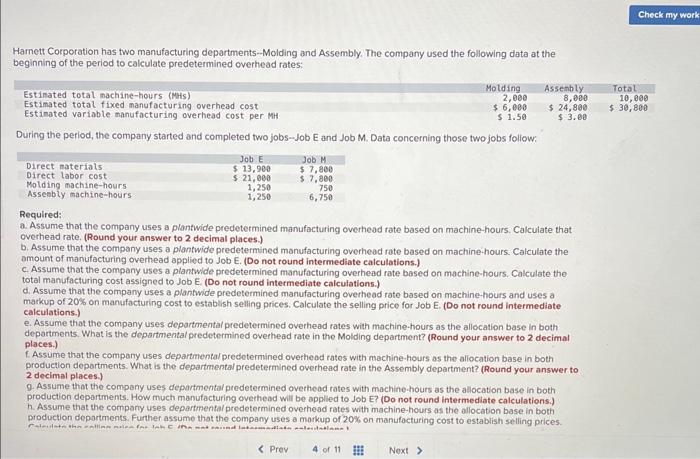

thank you for your help!! Hamett Corporation has two manufacturing departments-Molding and Assembly. The company used the following data at the beginning of the period

thank you for your help!!

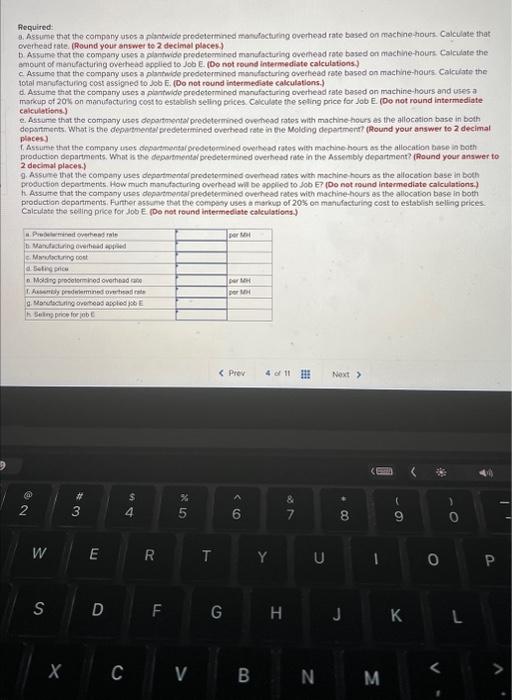

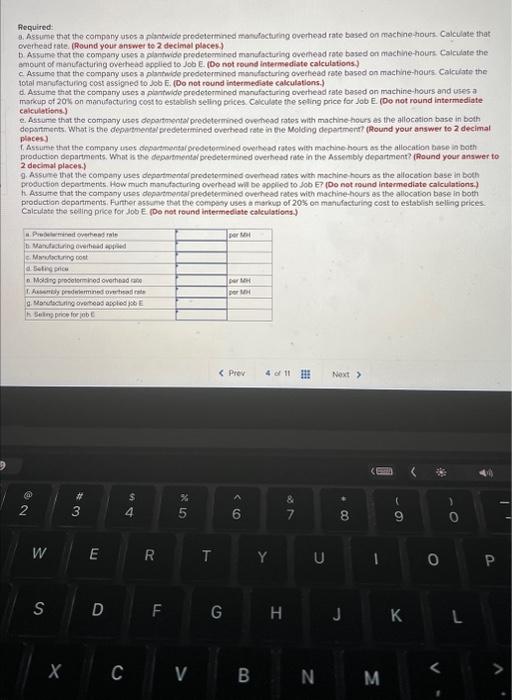

Hamett Corporation has two manufacturing departments-Molding and Assembly. The company used the following data at the beginning of the period to calculate predetermined overhead rates: uuring the period, the company started and completed two jobs-Job E and Job M. Data concerning those two jobs foliow: Required: a. Assume that the company uses a plontwide predetermined manufacturing overheod rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.) b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job E. (Do not round intermediate calculations.) c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours, Calculate the total manufacturing cost assigned to Job E. (Do not round intermediate calculations.) d. Assume that the company uses a plantwide predetermined manufacturing overheod rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job E. (Do not round intermediate caiculations.) e. Assume that the company uses deportmental predetermined overhead rates with machine hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Molding department? (Round your answer to 2 decimal places.) C. Assume that the company uses departmental predetermined overheod tatos with machine-hours as the aliocation base in both produetion deportments. What is the departmental predetermined overhead rate in the Assembly department? (Round your answer to 2 decimal places.) 9. Assume that the compory uses departmental predetermined overheod rates with machine-hours as the allocation base in both production departments. How much manufacturing ovetheod will be applied to Job E ? (Do not round intermediate calculations.) h. Assume that the comparty uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume thot the company uses a markup of 20% on manufocturing cost to establish selling prices. Aecuired: cretthe ad tate. (Round your answer te 2 dectimal ploces.) t. Assarpe that the compary uros a plantwide predeteonsined mancfacturitog avemedd rate based on machile hours. Foleulate the bmount of mencfacturing overhe dd applied to Job E. (0o not round internediate calculations.) c. Assume that the compary uses al phanhide predoterminnd manufncturing drephead rate based on machine-hours. Caicidate the Tolal mandiacturing cost assigned to Job E. (Do not round intermediafe calculations.) d. Assume thot the company uscs a phanhide predetermingd manufscturing ovhrtiebd fate besed an machine: hours and ages a markup of 201 on manudacturing cost ti establish seling prites. Caltulate the seling price for dob E. (De not round intermediatecalculatisis-3 e. Assurte that the company utps deportmental peodetermined owhthegd rates with machinc hours as the allocstion base in beth pincest f. Astume ihat the compary tises dostarmentar prodetomined oweitwad ragos with machine hours as the aliocation base in both prodoctice departmeats. What is the departmental predetermined overthedsd fade in the Assemby degurtment? (found yose anawer to 2 decimat places.l 9. Asstre that Hie company uses doportmcindai prodescrmined overtesd rates wath machine hours as the allocation base it beth Producton depertmenks, How much manufacturing owvhesd wil be appled to Job E? (Do not round intermediate calculations.) H. Assume that the compony ures clopartmont predetermindod ovethedd rates with machine-hours. as the allocaton base in both Caleuthte the seling price for job E (Do net round intermediste calculations.]

Hamett Corporation has two manufacturing departments-Molding and Assembly. The company used the following data at the beginning of the period to calculate predetermined overhead rates: uuring the period, the company started and completed two jobs-Job E and Job M. Data concerning those two jobs foliow: Required: a. Assume that the company uses a plontwide predetermined manufacturing overheod rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.) b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job E. (Do not round intermediate calculations.) c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours, Calculate the total manufacturing cost assigned to Job E. (Do not round intermediate calculations.) d. Assume that the company uses a plantwide predetermined manufacturing overheod rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job E. (Do not round intermediate caiculations.) e. Assume that the company uses deportmental predetermined overhead rates with machine hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Molding department? (Round your answer to 2 decimal places.) C. Assume that the company uses departmental predetermined overheod tatos with machine-hours as the aliocation base in both produetion deportments. What is the departmental predetermined overhead rate in the Assembly department? (Round your answer to 2 decimal places.) 9. Assume that the compory uses departmental predetermined overheod rates with machine-hours as the allocation base in both production departments. How much manufacturing ovetheod will be applied to Job E ? (Do not round intermediate calculations.) h. Assume that the comparty uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume thot the company uses a markup of 20% on manufocturing cost to establish selling prices. Aecuired: cretthe ad tate. (Round your answer te 2 dectimal ploces.) t. Assarpe that the compary uros a plantwide predeteonsined mancfacturitog avemedd rate based on machile hours. Foleulate the bmount of mencfacturing overhe dd applied to Job E. (0o not round internediate calculations.) c. Assume that the compary uses al phanhide predoterminnd manufncturing drephead rate based on machine-hours. Caicidate the Tolal mandiacturing cost assigned to Job E. (Do not round intermediafe calculations.) d. Assume thot the company uscs a phanhide predetermingd manufscturing ovhrtiebd fate besed an machine: hours and ages a markup of 201 on manudacturing cost ti establish seling prites. Caltulate the seling price for dob E. (De not round intermediatecalculatisis-3 e. Assurte that the company utps deportmental peodetermined owhthegd rates with machinc hours as the allocstion base in beth pincest f. Astume ihat the compary tises dostarmentar prodetomined oweitwad ragos with machine hours as the aliocation base in both prodoctice departmeats. What is the departmental predetermined overthedsd fade in the Assemby degurtment? (found yose anawer to 2 decimat places.l 9. Asstre that Hie company uses doportmcindai prodescrmined overtesd rates wath machine hours as the allocation base it beth Producton depertmenks, How much manufacturing owvhesd wil be appled to Job E? (Do not round intermediate calculations.) H. Assume that the compony ures clopartmont predetermindod ovethedd rates with machine-hours. as the allocaton base in both Caleuthte the seling price for job E (Do net round intermediste calculations.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started