Thank you for your help! I really appriciate it!:)

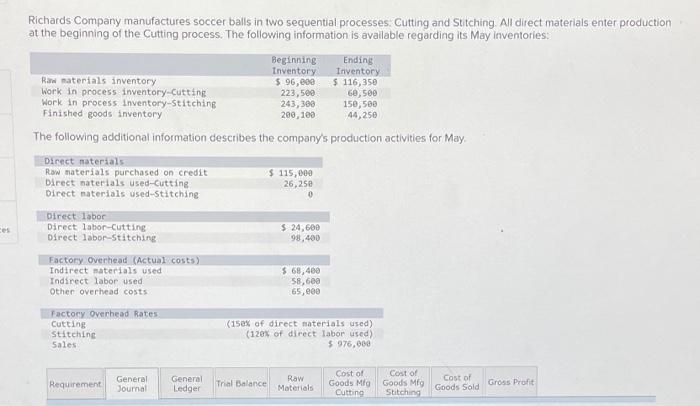

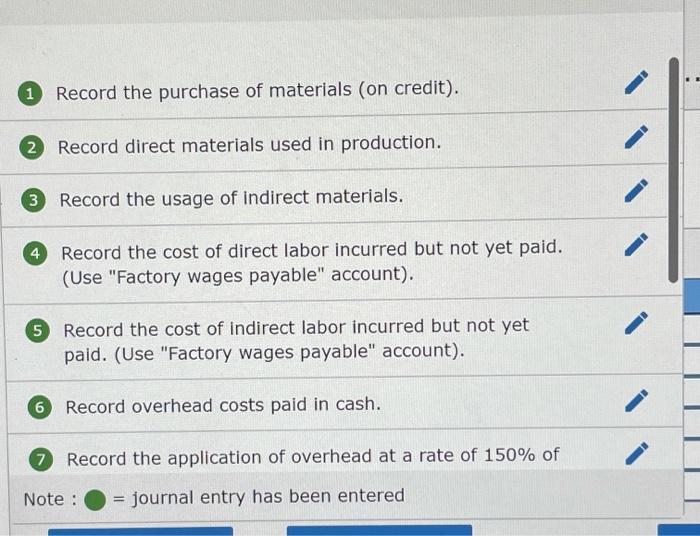

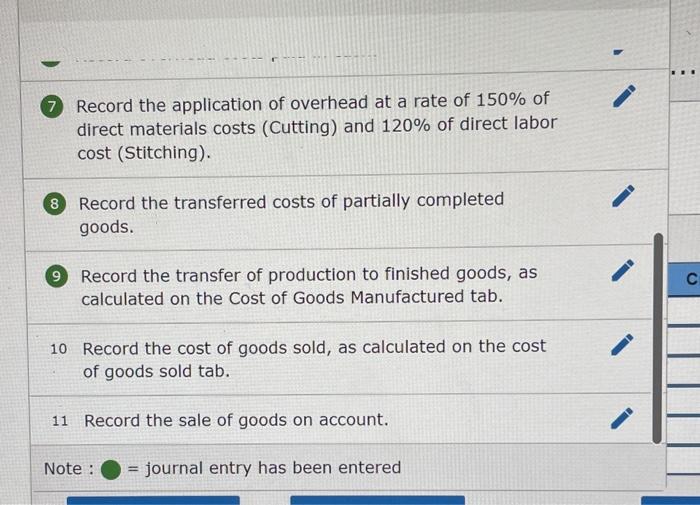

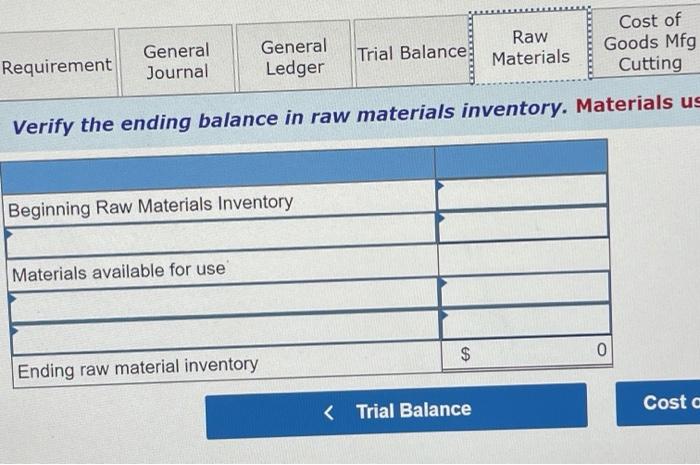

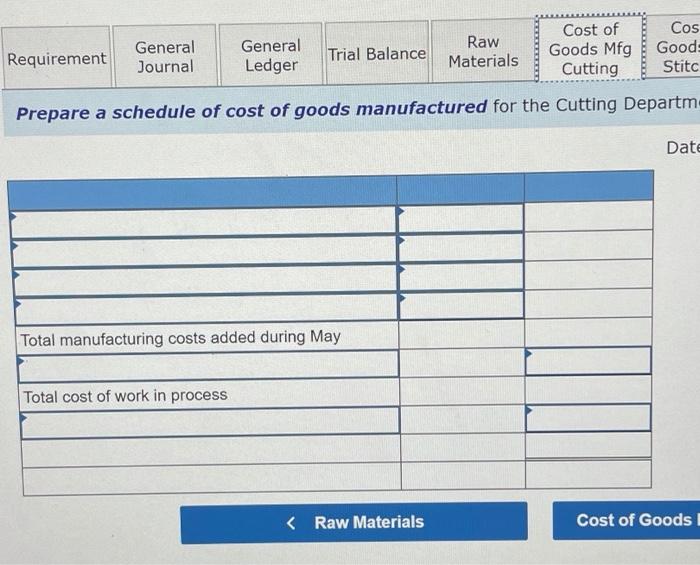

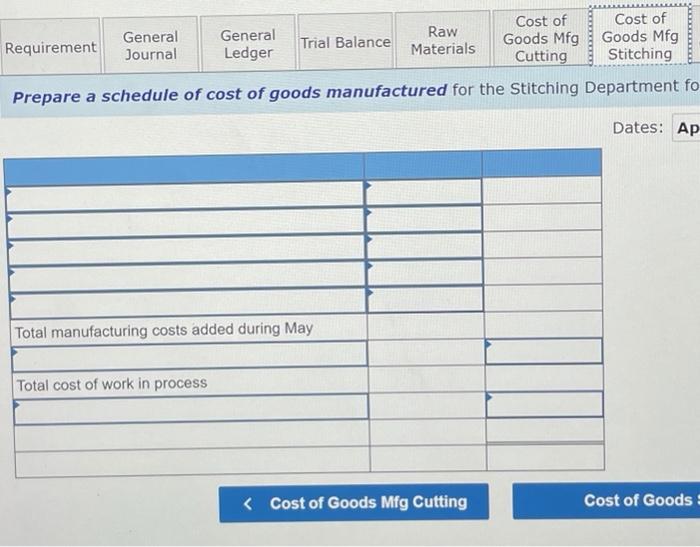

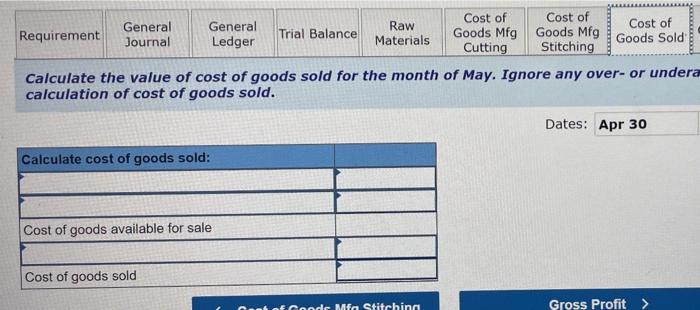

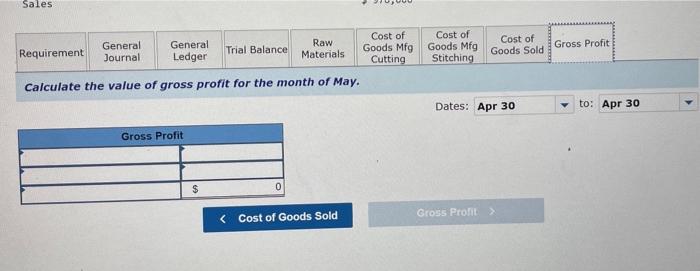

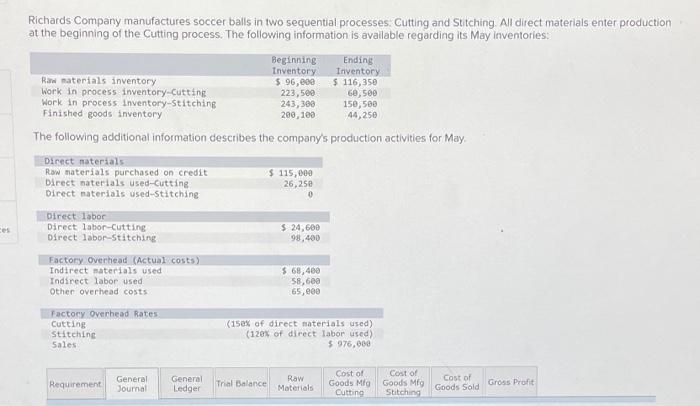

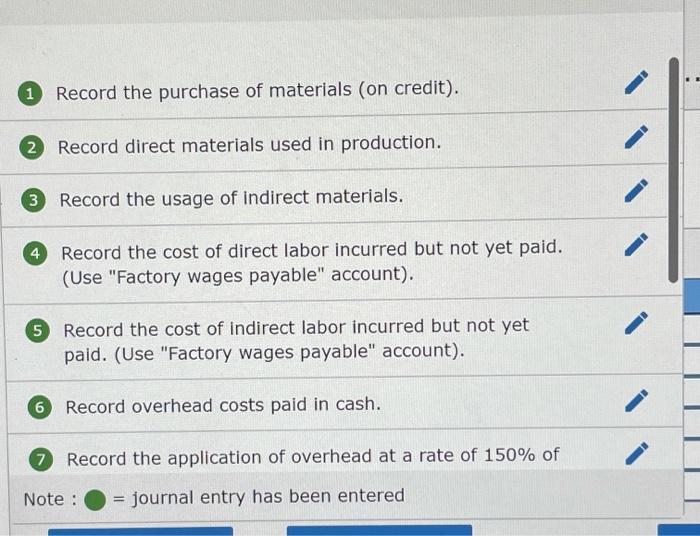

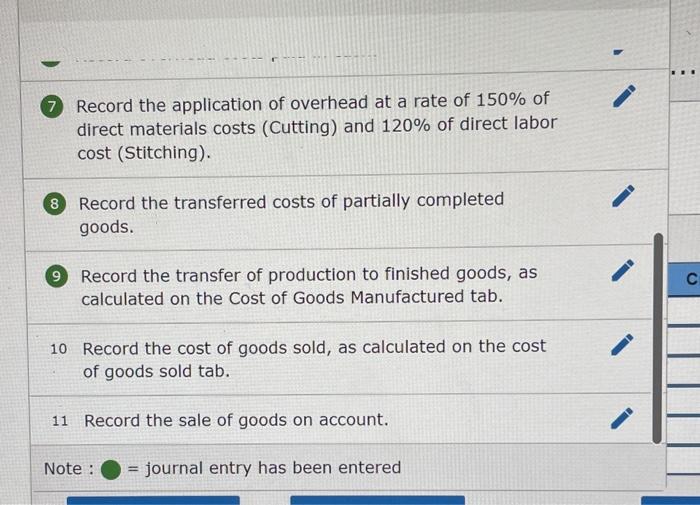

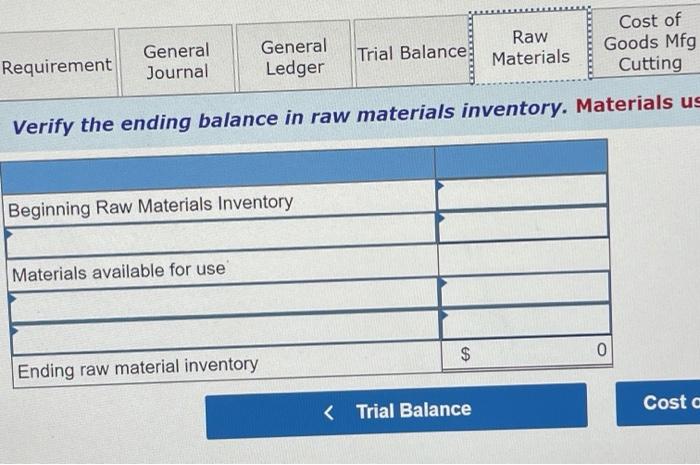

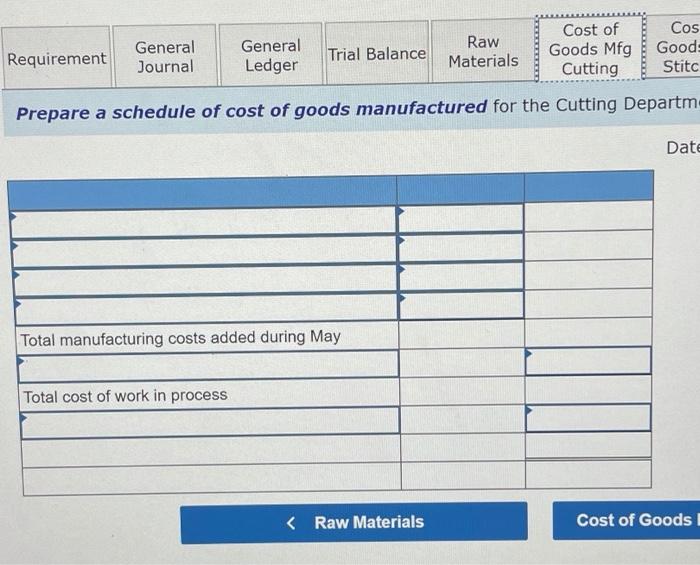

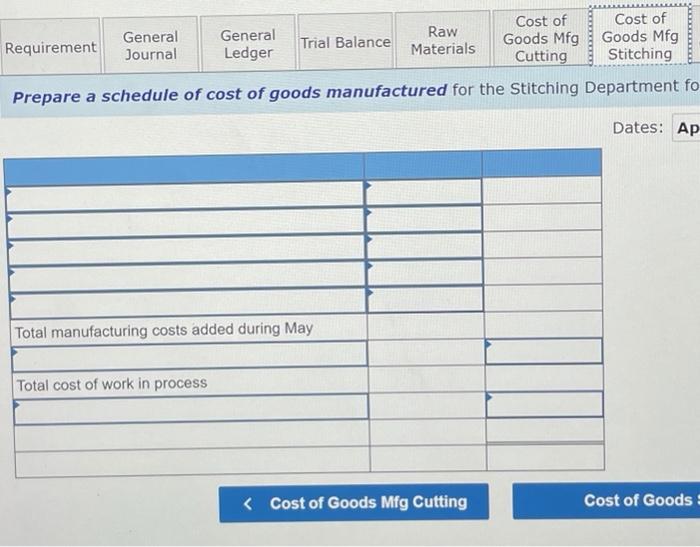

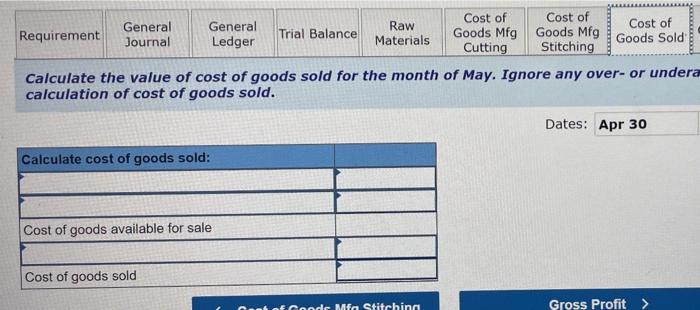

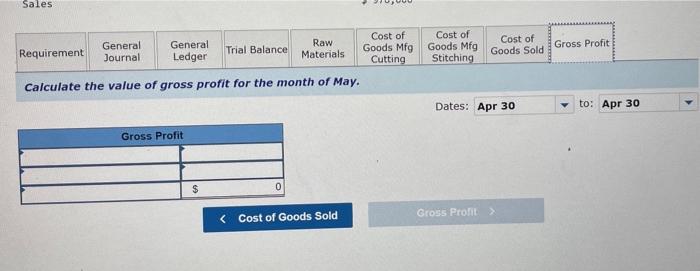

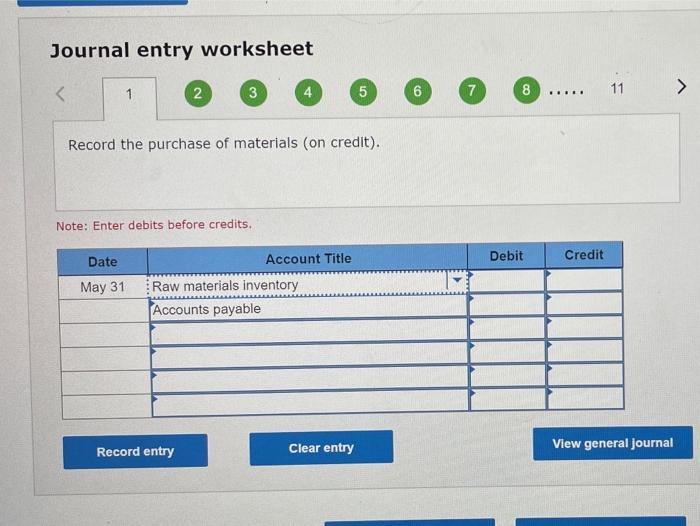

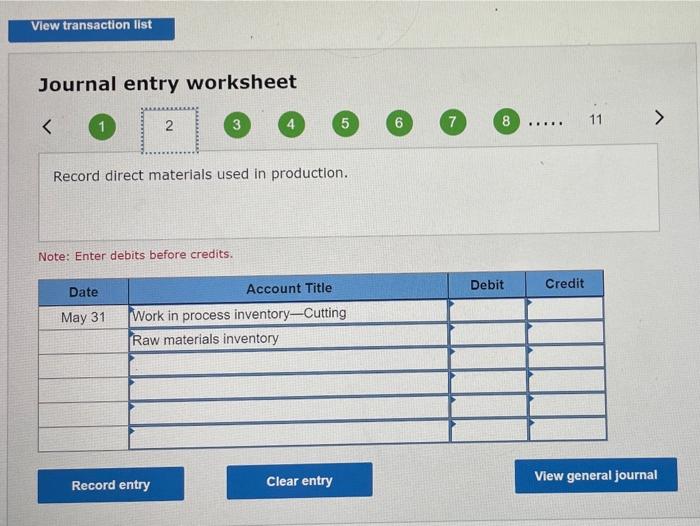

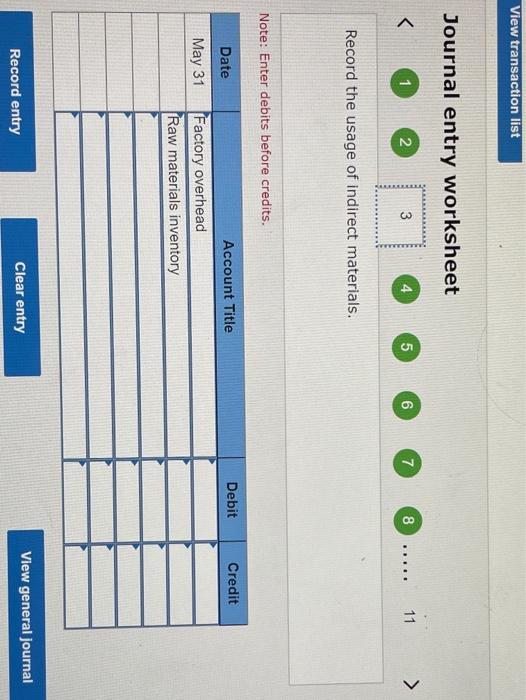

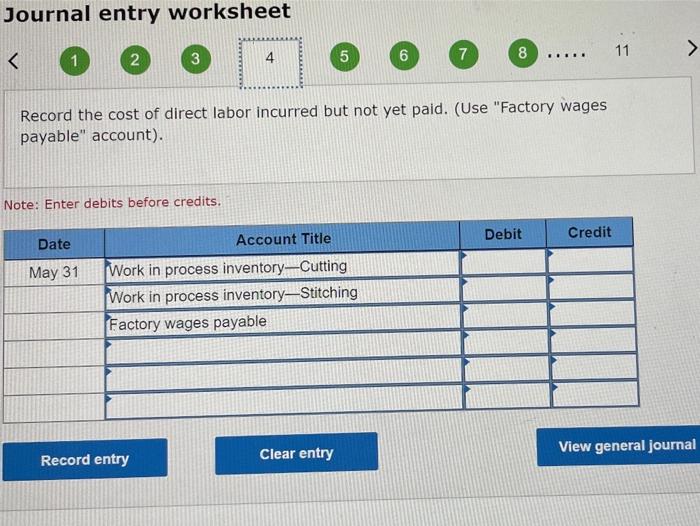

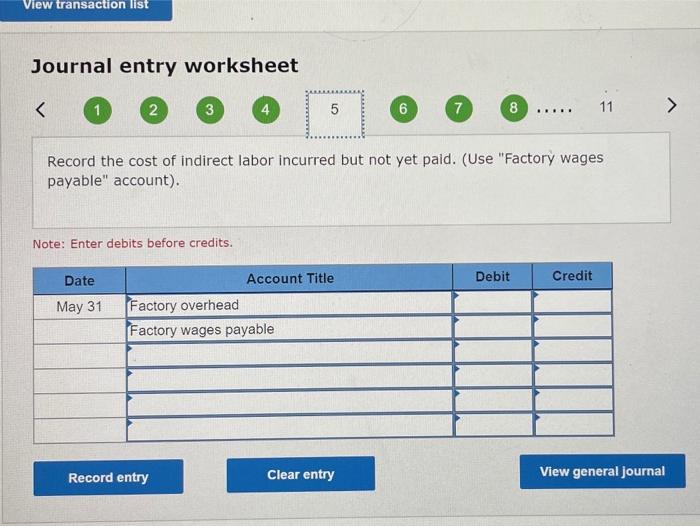

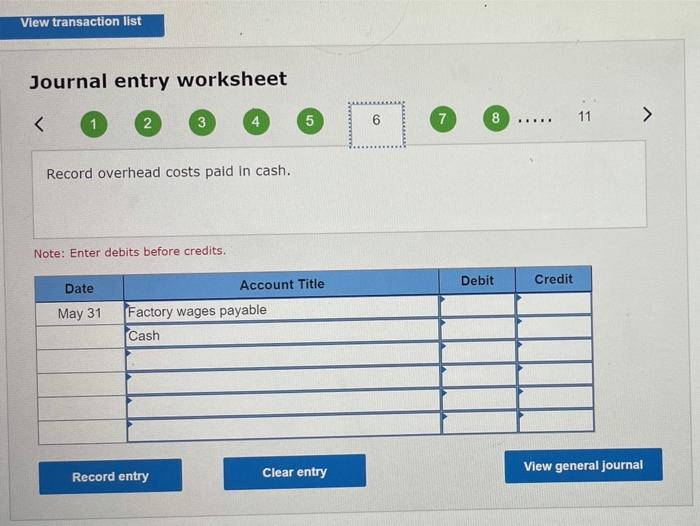

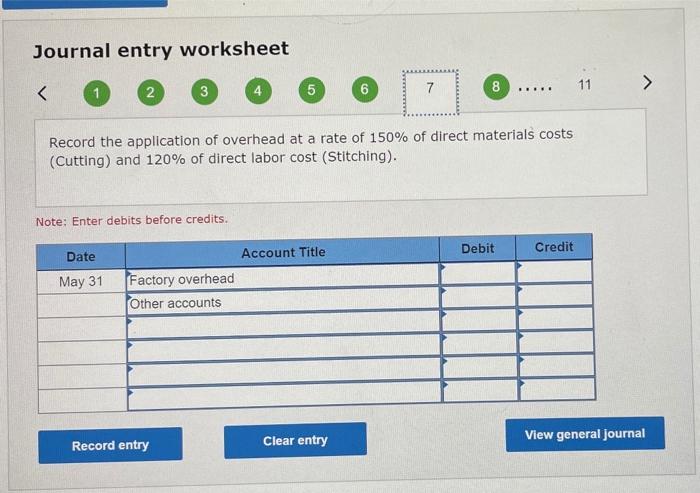

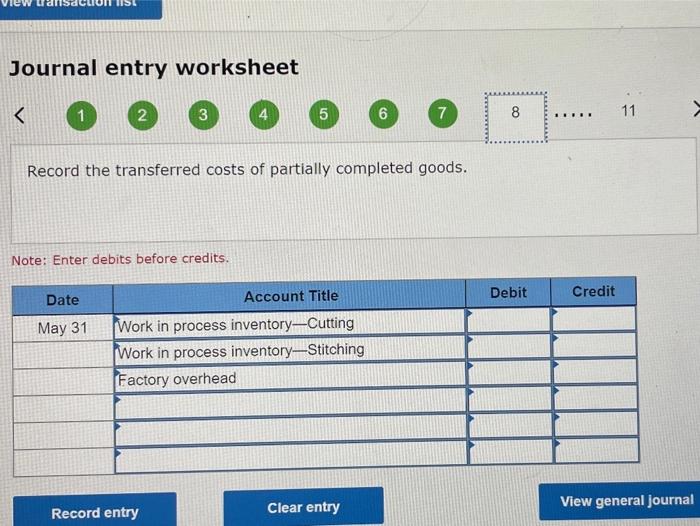

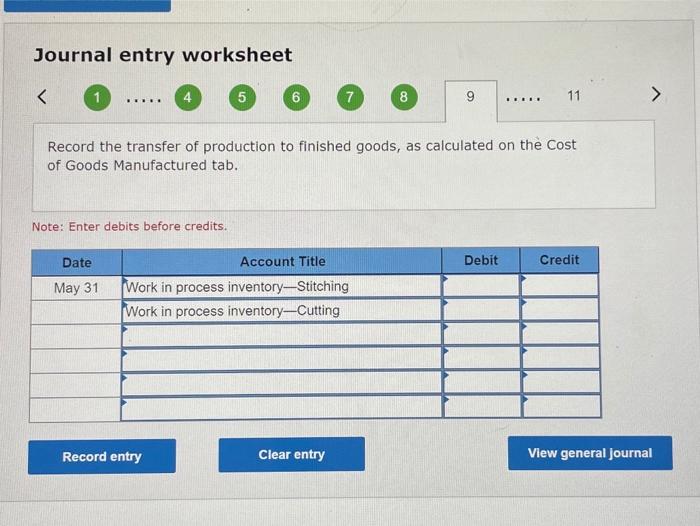

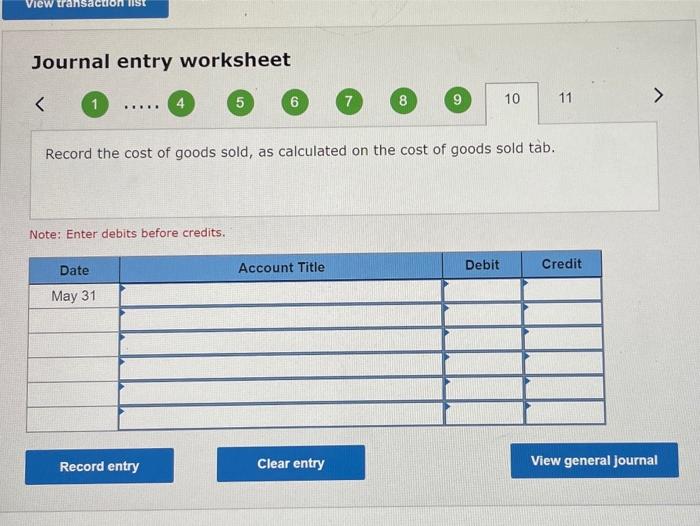

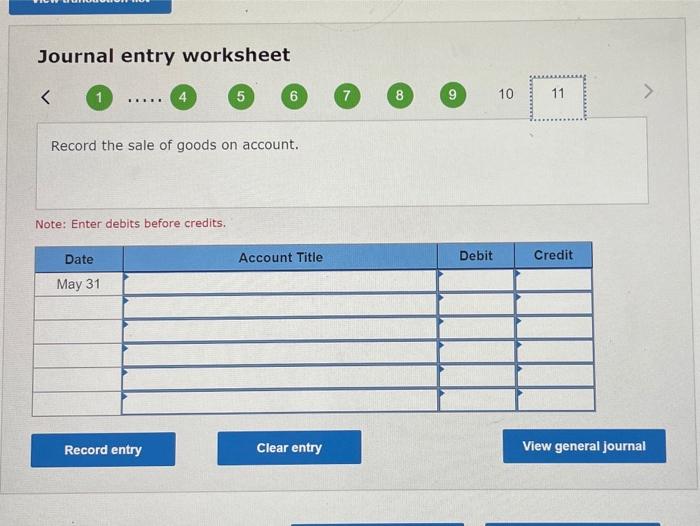

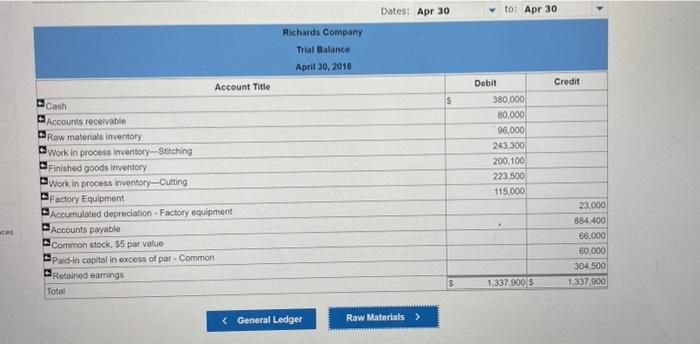

Richards Company manufactures soccer balls in two sequential processes. Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Beginning Ending Inventory Inventory Raw materials inventory $ 96,000 $ 116,350 Work in process inventory-Cutting 223,500 60,500 Work in process inventory-Stitching 243,300 150,500 Finished goods inventory 200, 100 44,250 The following additional information describes the company's production activities for May Direct naterials Raw materials purchased on credit $ 115,000 Direct materials used-cutting 26.250 Direct materials used-stitching 0 ces Direct labor Direct labor-Cutting Direct labor-Stitching $ 24,600 98,400 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $ 68,400 58,600 65,000 Factory Overhead Rates Cutting Stitching Sales (150% of direct materials used) (120% of direct labor used) $976,000 Requirement General Journal General Ledger Trial Balance Raw Materials Cost of Cost of Goods Mo Goods Mfg Goods Sold Cost of Cutting Stitching Gross Profit 1 Record the purchase of materials (on credit). 2 Record direct materials used in production. 3 Record the usage of indirect materials. 4 Record the cost of direct labor incurred but not yet paid. (Use "Factory wages payable" account). 5 Record the cost of indirect labor incurred but not yet paid. (Use "Factory wages payable" account). 6 Record overhead costs paid in cash. 7 Record the application of overhead at a rate of 150% of Note : = = journal entry has been entered Record the application of overhead at a rate of 150% of direct materials costs (Cutting) and 120% of direct labor cost (Stitching). 8 Record the transferred costs of partially completed goods. 9 Record the transfer of production to finished goods, as calculated on the Cost of Goods Manufactured tab. 10 Record the cost of goods sold, as calculated on the cost of goods sold tab. 11 Record the sale of goods on account. Note : journal entry has been entered General Journal General Ledger Trial Balance Raw Materials Requirement Cost of Goods Mfg Cutting Verify the ending balance in raw materials inventory. Materials us Beginning Raw Materials Inventory Materials available for use $ 0 Ending raw material inventory Costa Sales Cost of Goods Mfg Stitching Cost of Goods Sold Gross Profit General General Raw Cost of Requirement Goods Mfg Trial Balance Journal Ledger Materials Cutting Calculate the value of gross profit for the month of May. Dates: Apr 30 to: Apr 30 Gross Profit $ Gross Profit ..... 11 Record the purchase of materials (on credit). Note: Enter debits before credits. Debit Account Title Date Credit May 31 Raw materials inventory Accounts payable Record entry Clear entry View general Journal View transaction list Journal entry worksheet 2. 3 > 6 11 7 8 ..... Record direct materials used in production. Note: Enter debits before credits. Debit Credit Date May 31 Account Title Work in process inventory-Cutting Raw materials inventory Record entry Clear entry View general journal View transaction list Journal entry worksheet ..... Record the cost of indirect labor incurred but not yet paid. (Use "Factory wages payable" account). Note: Enter debits before credits. Date Debit Credit May 31 Account Title Factory overhead Factory wages payable Record entry Clear entry View general Journal View transaction list Journal entry worksheet CO ..... Record overhead costs paid in cash. Note: Enter debits before credits. Debit Account Title Date Credit May 31 Factory wages payable Cash Record entry Clear entry View general journal Journal entry worksheet 3 #EB Record the transfer of production to finished goods, as calculated on the Cost of Goods Manufactured tab. Note: Enter debits before credits. Debit Credit Date May 31 Account Title Work in process inventory-Stitching Work in process inventory-Cutting Record entry Clear entry View general Journal View transaculo Journal entry worksheet 5 7 8 ..... Record the cost of goods sold, as calculated on the cost of goods sold tab. Note: Enter debits before credits. Date Account Title Debit Credit May 31 Record entry Clear entry View general journal Journal entry worksheet