Thank you for your help.

Thank you for your help.

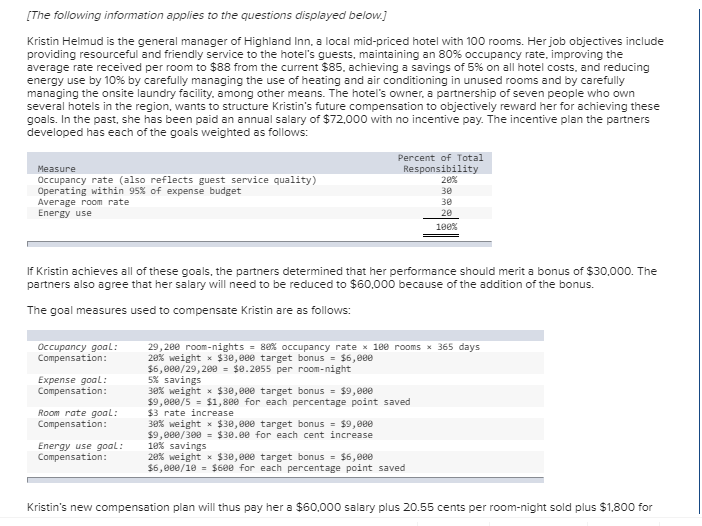

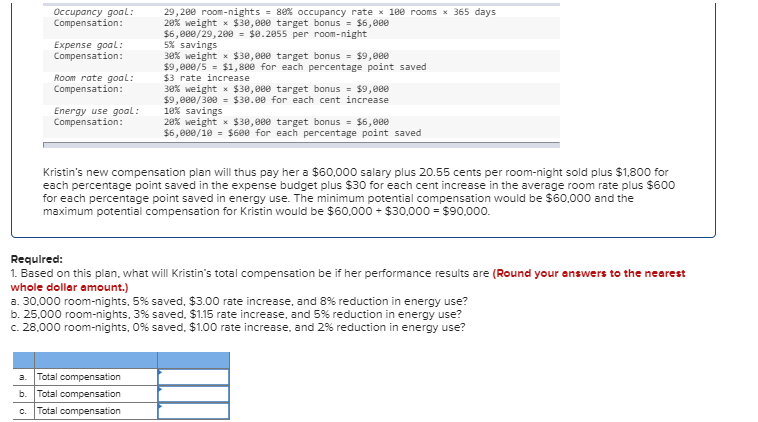

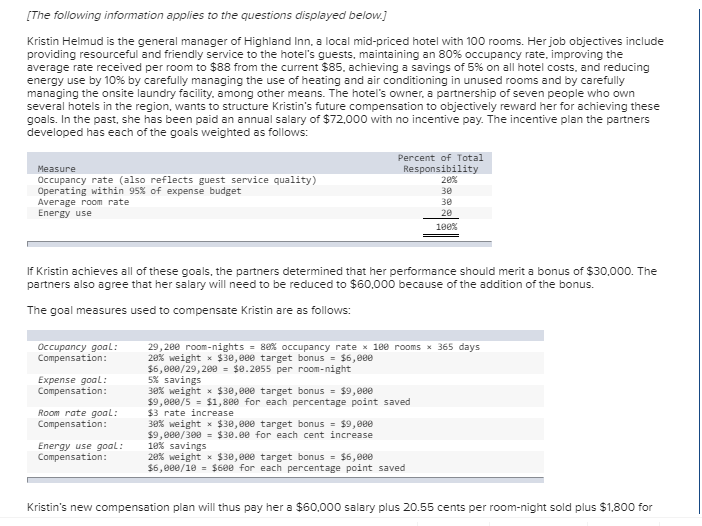

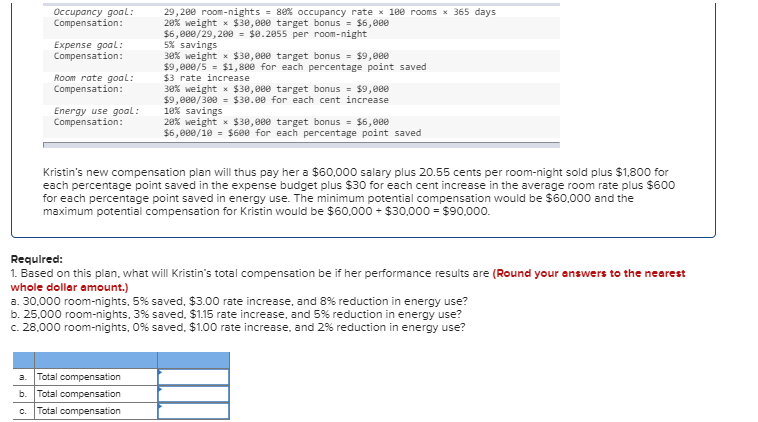

(The following information applies to the questions displayed below.] Kristin Helmud is the general manager of Highland Inn, a local mid-priced hotel with 100 rooms. Her job objectives include providing resourceful and friendly service to the hotel's guests, maintaining an 80% occupancy rate, improving the average rate received per room to $88 from the current $85. achieving a savings of 5% on all hotel costs, and reducing energy use by 10% by carefully managing the use of heating and air conditioning in unused rooms and by carefully managing the onsite laundry facility. among other means. The hotel's owner, a partnership of seven people who own several hotels in the region, wants to structure Kristin's future compensation to objectively reward her for achieving these goals. In the past, she has been paid an annual salary of $72,000 with no incentive pay. The incentive plan the partners developed has each of the goals weighted as follows: Percent of Total Responsibility 2er Measure Occupancy rate (also reflects guest service quality) Operating within 95% of expense budget Average room rate Energy use 2e 100% If Kristin achieves all of these goals, the partners determined that her performance should merit a bonus of $30,000. The partners also agree that her salary will need to be reduced to $60,000 because of the addition of the bonus. The goal measures used to compensate Kristin are as follows: Occupancy goal: Compensation: Expense goal: Compensation: Room rate goal: Compensation: 29, 280 room-nights = 80% occupancy rate x 180 rooms x 365 days 20% weight x $30,000 target bonus = $6,000 $6,080/29, 208 = $0.2855 per room-night 5% savings 30% weight x $30,000 target bonus = $9.000 $9,080/5 = $1,800 for each percentage point saved $3 rate increase 30% weight * $30,000 target bonus = $9,880 $9,000/300 = $30.00 for each cent increase 10% savings 20% weight x $30,089 target bonus = $6,080 $6,000/10 = $600 for each percentage point saved Energy use goal: Compensation: Kristin's new compensation plan will thus pay her a $60,000 salary plus 20.55 cents per room-night sold plus $1,800 for Occupancy goal: Compensation: Expense goal: Compensation: 29, 280 room-nights = 80% occupancy rate x lee rooms x 365 days 20% weight x $30,000 target bonus = $6,000 $6,080/29,208 = $0.2855 per room-night 5% savings 30% weight x $30,000 target bonus = $9,000 $9,080/5 = $1,800 for each percentage point saved $3 rate increase 30% weight x $30,000 target bonus = $9,000 $9,000/300 = $30.ee for each cent increase 10% savings 20% weight x $3e.eee target bonus = $6,000 $6,000/10 = $600 for each percentage point saved Room rate goal: Compensation: Energy use goal: Compensation: Kristin's new compensation plan will thus pay her a $60.000 salary plus 20.55 cents per room-night sold plus $1,800 for each percentage point saved in the expense budget plus $30 for each cent increase in the average room rate plus $600 for each percentage point saved in energy use. The minimum potential compensation would be $60.000 and the maximum potential compensation for Kristin would be $60,000+ $30,000 = $90,000. Required: 1. Based on this plan, what will Kristin's total compensation be if her performance results are (Round your answers to the nearest whole dollar amount.) a. 30,000 room-nights, 5% saved, $3.00 rate increase, and 8% reduction in energy use? b. 25,000 room-nights, 3% saved. $1.15 rate increase, and 5% reduction in energy use? c. 28,000 room-nights, 0% saved. $1.00 rate increase, and 2% reduction in energy use? a. Total compensation b. Total compensation c. Total compensation

Thank you for your help.

Thank you for your help.