thank you :)

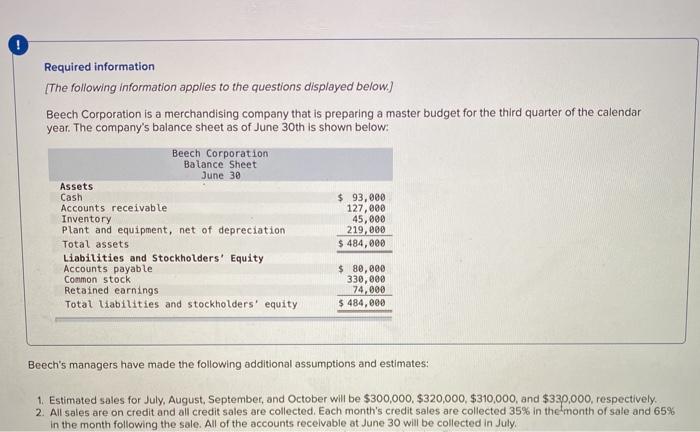

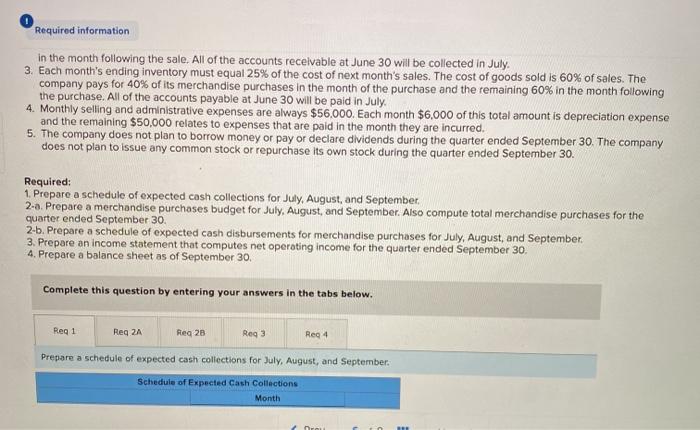

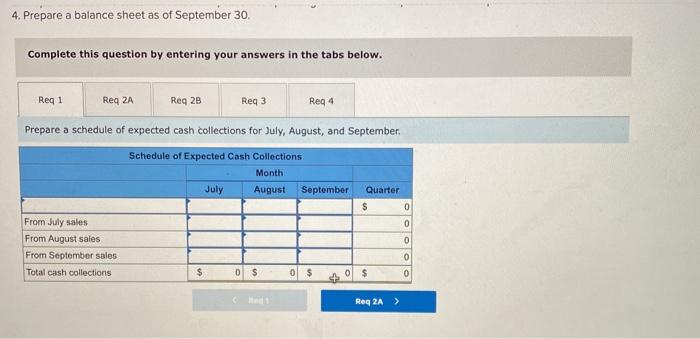

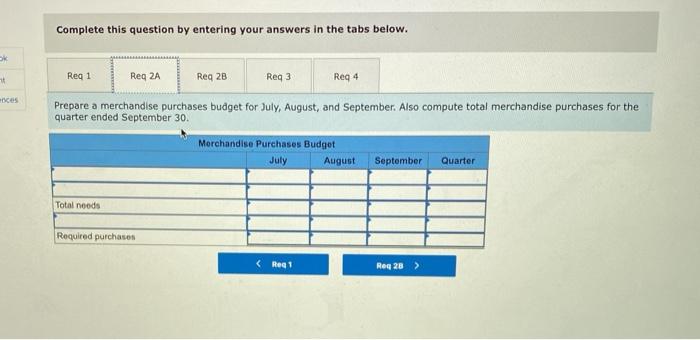

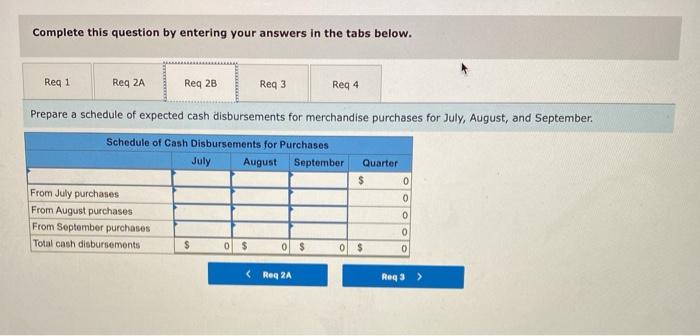

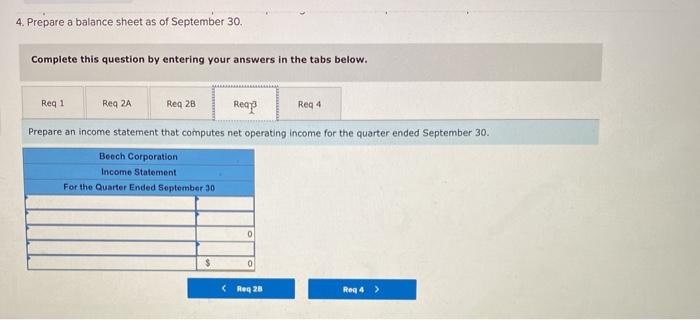

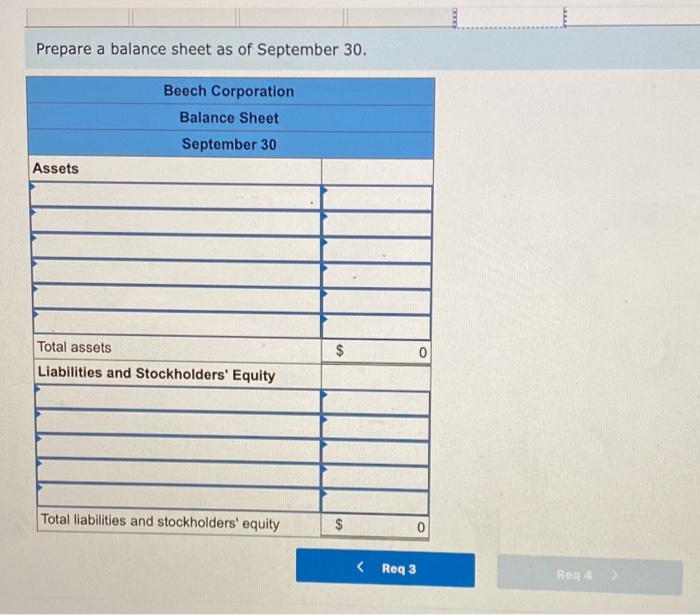

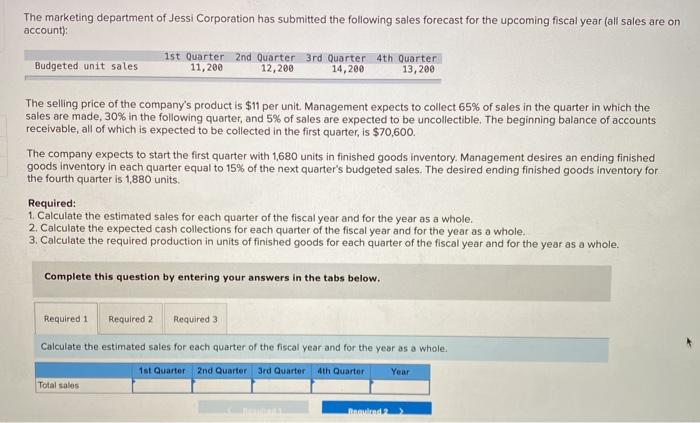

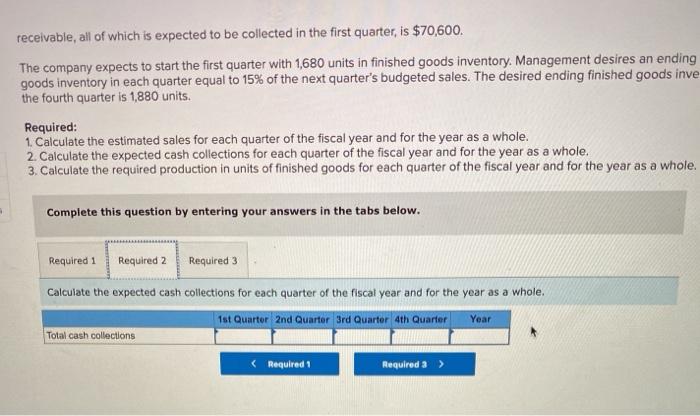

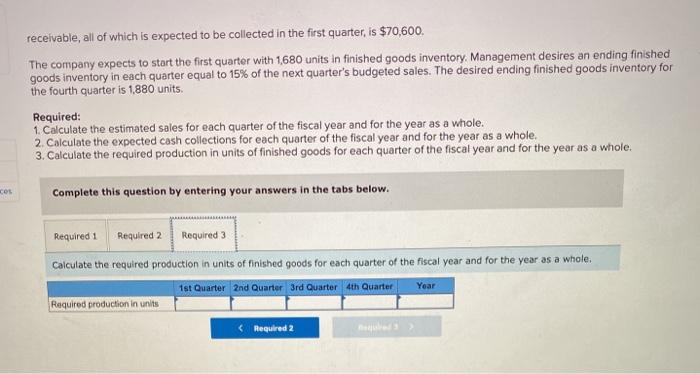

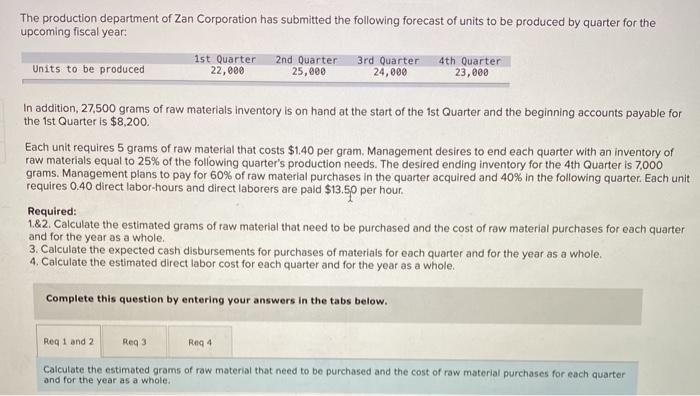

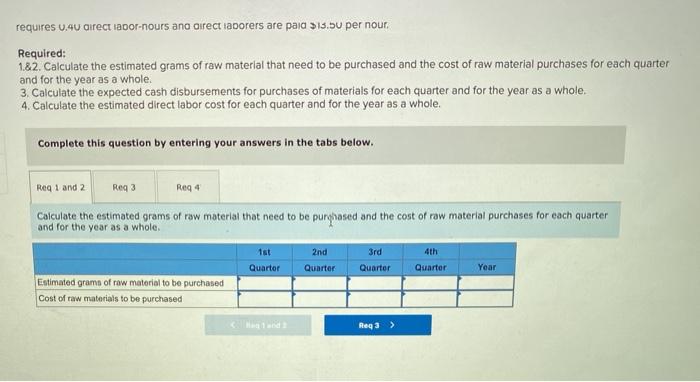

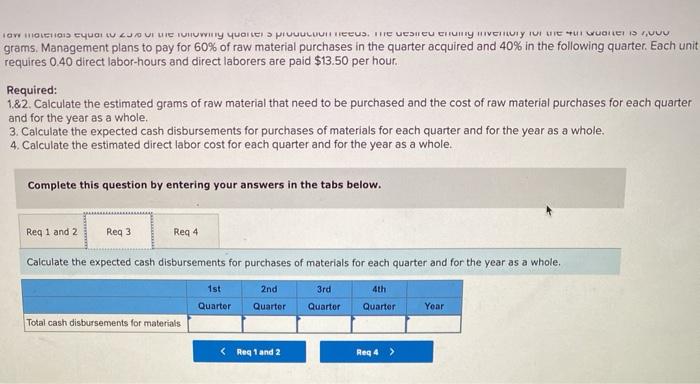

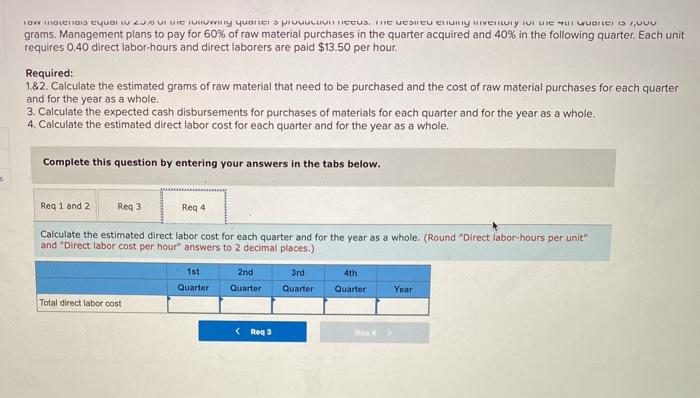

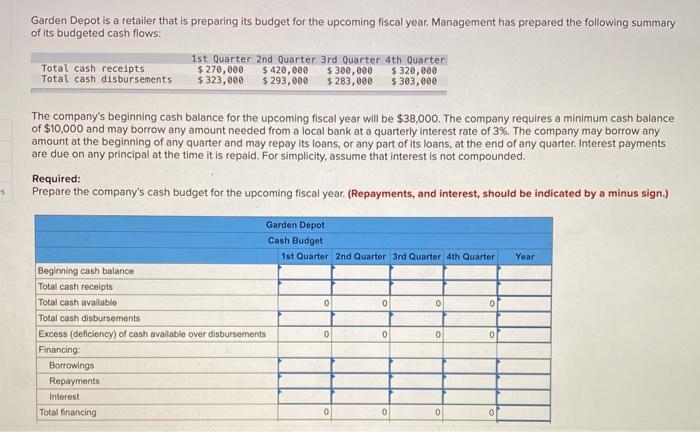

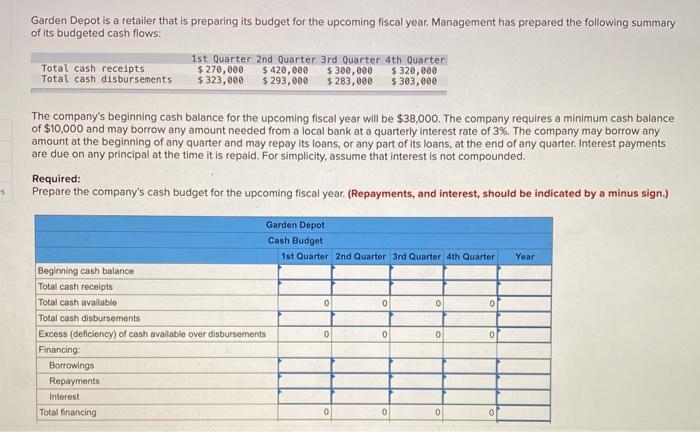

Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total cash receipts $ 270,000 $ 420,000 $300,000 $ 320,000 Total cash disbursements $ 323,000 $ 293,000 $ 283,000 $ 303,000 The company's beginning cash balance for the upcoming fiscal year will be $38,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments, and interest, should be indicated by a minus sign.) Year Garden Depot Cash Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Beginning cash balance Total cash receipts Total cash available 0 0 0 0 Total cash disbursements Excess (deficiency) of cash available over disbursements 0 0 0 0 Financing Borrowings Repayments Interest Total financing 0 0 ! Required information The following information applies to the questions displayed below.) Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash $ 93,000 Accounts receivable 127,000 Inventory 45,000 Plant and equipment, net of depreciation 219,000 Total assets $ 484,000 Liabilities and Stockholders' Equity Accounts payable $ 80,000 Common stock 330,000 Retained earnings 74,900 Total liabilities and stockholders' equity $ 484,000 Beech's managers have made the following additional assumptions and estimates: 1. Estimated sales for July, August, September, and October will be $300,000 $320,000, $310,000, and $330,000, respectively, 2. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts receivable at June 30 will be collected in July, Required information in the month following the sale. All of the accounts receivable at June 30 will be collected in July. 3. Each month's ending inventory must equal 25% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July. 4. Monthly selling and administrative expenses are always $56.000. Each month $6,000 of this total amount is depreciation expense and the remaining $50,000 relates to expenses that are paid in the month they are incurred. 5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The company does not plan to issue any common stock or repurchase its own stock during the quarter ended September 30. Required: 1. Prepare a schedule of expected cash collections for July, August, and September. 2-a. Prepare a merchandise purchases budget for July, August, and September. Also compute total merchandise purchases for the 2-b. Prepare a schedule of expected cash disbursements for merchandise purchases for July, August, and September 3. Prepare an income statement that computes net operating income for the quarter ended September 30. 4. Prepare a balance sheet as of September 30. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 28 Reg 3 Reg 4 Prepare a schedule of expected cash collections for July, August, and September. Schedule of Expected Cash Collections Month 4. Prepare a balance sheet as of September 30, Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 28 Reg 3 Reg 4 Prepare a schedule of expected cash collections for July, August, and September. Schedule of Expected Cash Collections Month July August September Quarter $ 0 0 From July sales From August sales From September sales Total cash collections 0 0 0 $ O $ 0 $ 0 $ Req 2A > Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Reg 4 Prepare a merchandise purchases budget for July, August, and September. Also compute total merchandise purchases for the quarter ended September 30. Merchandise Purchases Budget July August September Quarter Total needs Required purchases Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Req 2B Reg 3 Reg 4 Prepare a schedule of expected cash disbursements for merchandise purchases for July, August, and September Schedule of Cash Disbursements for Purchases July August September Quarter 0 0 From July purchases From August purchases From September purchases Total cash disbursements 0 0 $ 0 $ 0 $ 0 $ 0 4. Prepare a balance sheet as of September 30, Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reap Reg 4 Prepare an income statement that computes net operating Income for the quarter ended September 30. Beech Corporation Income Statement For the Quarter Ended September 30 0 0 Reg 28 Reg 4 > Prepare a balance sheet as of September 30. Beech Corporation Balance Sheet September 30 Assets $ 0 Total assets Liabilities and Stockholders' Equity Total liabilities and stockholders' equity $ receivable, all of which is expected to be collected in the first quarter, is $70,600. The company expects to start the first quarter with 1,680 units in finished goods inventory Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1.880 units, Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. ces Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Required production in units Year Required 2 The production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 2nd Quarter 3rd Quarter Units to be produced 22,000 25,000 24,000 23,000 1st Quarter 4th Quarter In addition, 27,500 grams of raw materials inventory is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is $8,200. Each unit requires 5 grams of raw material that costs $1.40 per gram Management desires to end each quarter with an inventory of raw materials equal to 25% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 7.000 grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.40 direct labor-hours and direct laborers are paid $13.50 per hour. Required: 1.&2. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Reg 4 Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. requires 0.40 direct lapor-nours ano direct laborers are paid $13.50 per nour. Required: 1.82. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Reg4 Calculate the estimated grams of raw material that need to be purgnased and the cost of raw material purchases for each quarter and for the year as a whole. 1st 4th 2nd Quarter 3rd Quarter Quarter Quarter Year Estimated grama of raw material to be purchased Cost of raw materials to be purchased Maand: Req3 > HOW TO CHOI CYWILU JAO VIVIC TUHUMIY YURID PUUULUUIUS. THE CU CITY HIVCHUTY TO LICUI VUOTIS VUU grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.40 direct labor-hours and direct laborers are paid $13.50 per hour. Required: 1.&2. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total cash disbursements for materials HOW ROUENOS EyuWLUIUIUE TUTOHY que puULUI CUS. THE USU CHRIY HIVERIUT IUI NE I VUCICII0w grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0,40 direct labor-hours and direct laborers are paid $13.50 per hour. Required: 1.82. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole. Complete this question by entering your answers in the tabs below. 5 Req 1 and 2 Reg 3 Reg 4 Calculate the estimated direct labor cost for each quarter and for the year as a whole. (Round "Direct labor-hours per unit" and "Direct labor cost per hour answers to 2 decimal places.) 3rd 4th 1st Quarter 2nd Quarter Quarter Quarter Year Total direct labor cost

thank you :)

thank you :)