Answered step by step

Verified Expert Solution

Question

1 Approved Answer

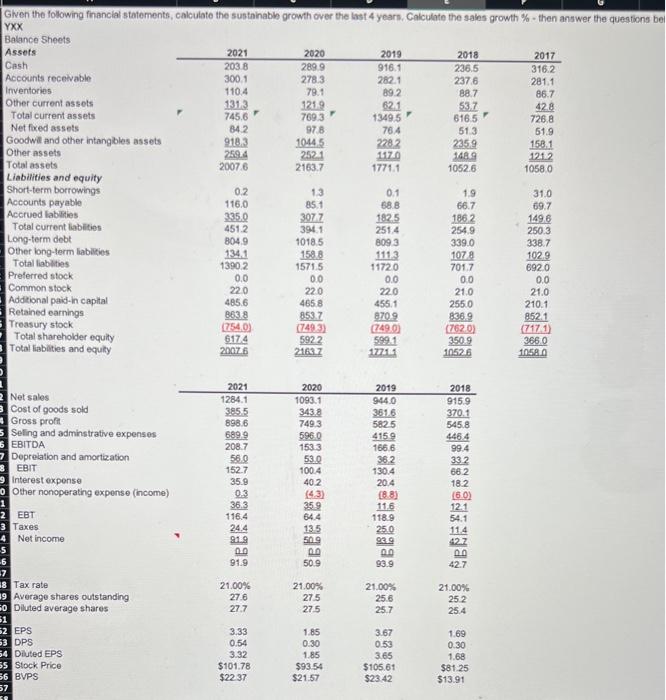

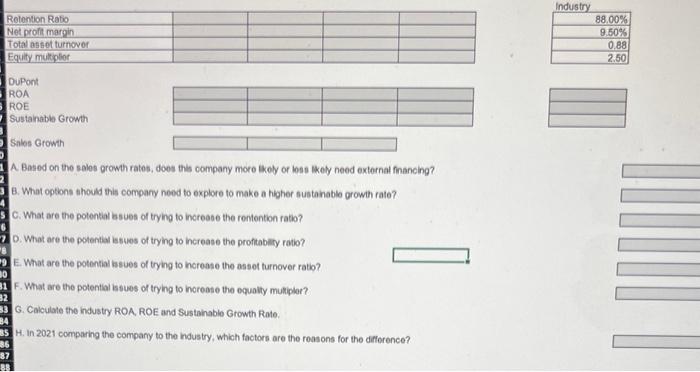

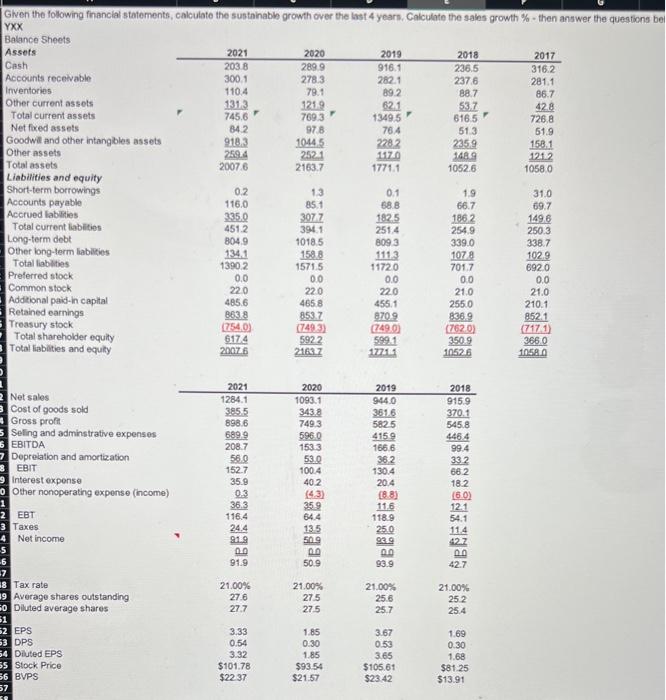

THANK YOU! Gken the following financial statements, calculate the sustainable growth over the last 4 yearn, Calculate the salos growth % - then answer the

THANK YOU!

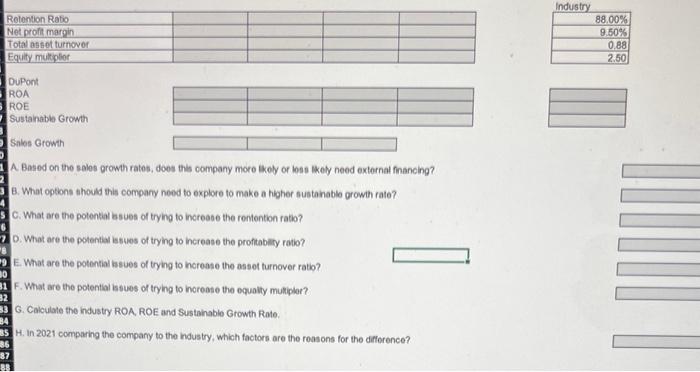

Gken the following financial statements, calculate the sustainable growth over the last 4 yearn, Calculate the salos growth \% - then answer the questions bel YXX Balance Sheots \begin{tabular}{|l|l|l|l|l|} \hline Rotontion Ratio & & & \\ \hline Net profit margin & & & \\ \hline Total assot turnover & & & & \\ \hline Equity mulkplot & & & \\ \hline \end{tabular} \begin{tabular}{l} Industry \\ \hline 88.00% \\ \hline 9.50% \\ \hline 0.88 \\ \hline 2.50 \\ \hline \end{tabular} DuPont ROA Sustanabie Growth \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Silos Growth A Based on the soles growt rates, does this company more likely of less thely need external financing? B. What options thoud this company need to explore to make a higher sus tainablo prowith rate? C. What are the potential bsues of trying to increase the rentention ratio? D. What are the potential issues of trying to increase the proftability ratio? E. What are the potential hssues of trying to horoase the assot turnover ratio? F. What are the potential issues of trying to horease the equalty mutiplen? G. Calculate the industry ROA, ROE and Sustahable Growth Rate. H. In 2021 comparing the company to the industry, which factors are the roasons for the difforence? Gken the following financial statements, calculate the sustainable growth over the last 4 yearn, Calculate the salos growth \% - then answer the questions bel YXX Balance Sheots \begin{tabular}{|l|l|l|l|l|} \hline Rotontion Ratio & & & \\ \hline Net profit margin & & & \\ \hline Total assot turnover & & & & \\ \hline Equity mulkplot & & & \\ \hline \end{tabular} \begin{tabular}{l} Industry \\ \hline 88.00% \\ \hline 9.50% \\ \hline 0.88 \\ \hline 2.50 \\ \hline \end{tabular} DuPont ROA Sustanabie Growth \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Silos Growth A Based on the soles growt rates, does this company more likely of less thely need external financing? B. What options thoud this company need to explore to make a higher sus tainablo prowith rate? C. What are the potential bsues of trying to increase the rentention ratio? D. What are the potential issues of trying to increase the proftability ratio? E. What are the potential hssues of trying to horoase the assot turnover ratio? F. What are the potential issues of trying to horease the equalty mutiplen? G. Calculate the industry ROA, ROE and Sustahable Growth Rate. H. In 2021 comparing the company to the industry, which factors are the roasons for the difforence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started