Answered step by step

Verified Expert Solution

Question

1 Approved Answer

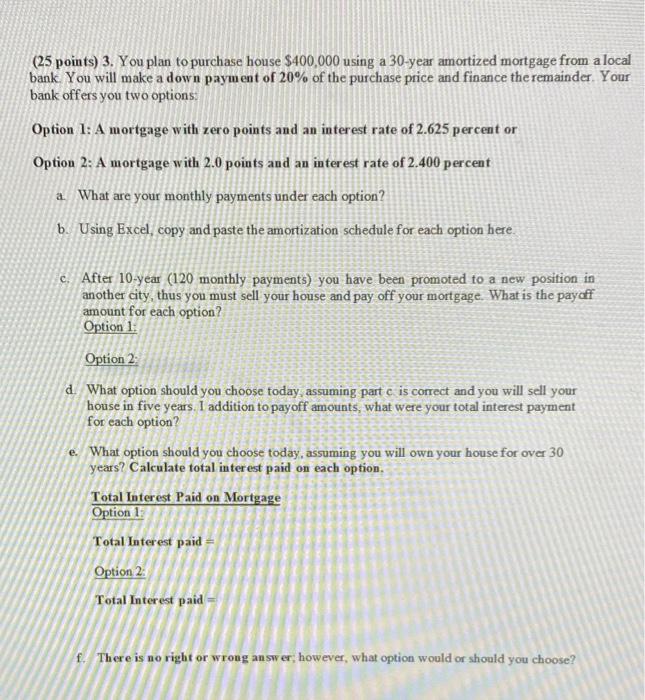

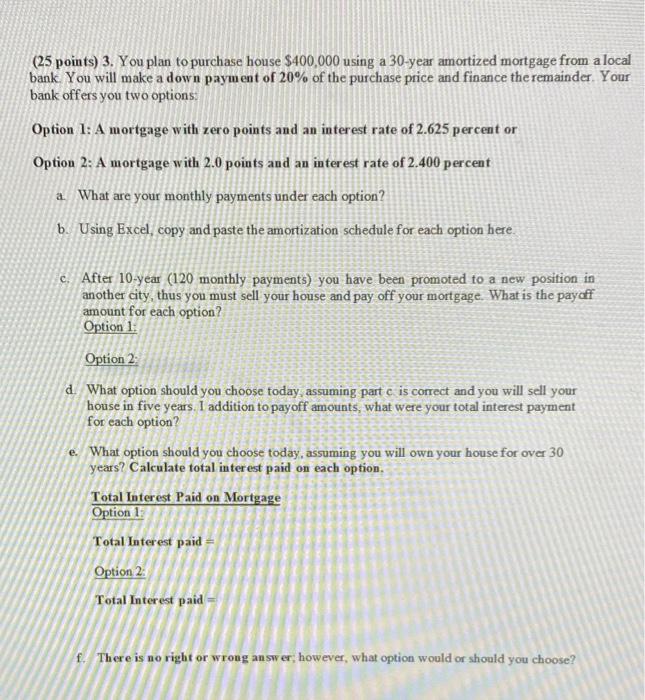

Thank you in advance! (25 points) 3. You plan to purchase house $400,000 using a 30-year amortized mortgage from a local bank. You will make

Thank you in advance!

(25 points) 3. You plan to purchase house $400,000 using a 30-year amortized mortgage from a local bank. You will make a down payment of 20% of the purchase price and finance the remainder. Your bank offers you two options: Option 1: A mortgage with zero points and an interest rate of 2.625 percent or Option 2: A mortgage with 2.0 points and an interest rate of 2.400 percent a What are your monthly payments under each option? b. Using Excel, copy and paste the amortization schedule for each option here e. After 10-year (120 monthly payments) you have been promoted to a new position in another city, thus you must sell your house and pay off your mortgage. What is the payoff amount for each option? Option 1 Option 2 d. What option should you choose today, assuming part c is correct and you will sell your house in five years. I addition to payoff amounts, what were your total interest payment for each option? e. What option should you choose today, assuming you will own your house for over 30 years? Calculate total interest paid on each option. Total Interest Paid on Mortgage Option 1: Total Interest paid = Option 2 Total Interest paid f. There is no right or wrong answer, however, what option would or should you choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started