Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you in advance :) there are two questions in the excel file 1a, 1b, 1c and 2 5 7 8 9 AAB G You

thank you in advance :)

there are two questions in the excel file 1a, 1b, 1c and 2

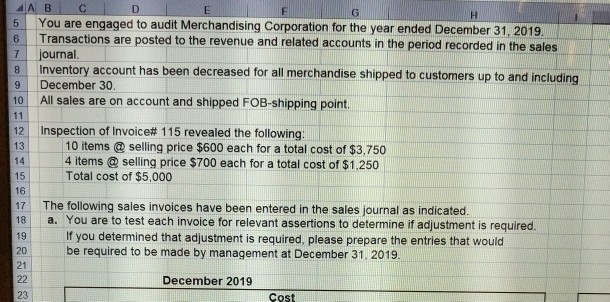

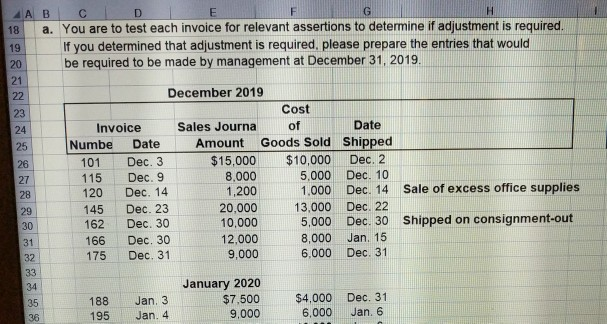

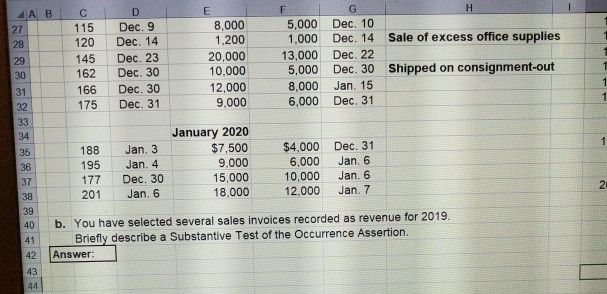

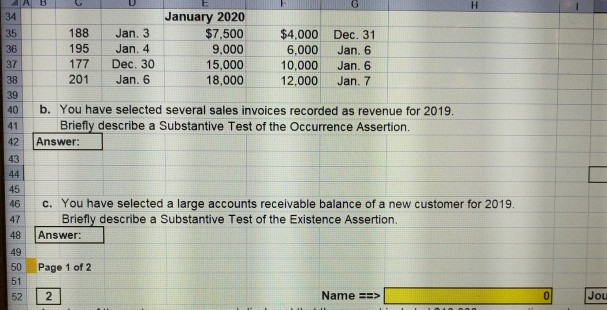

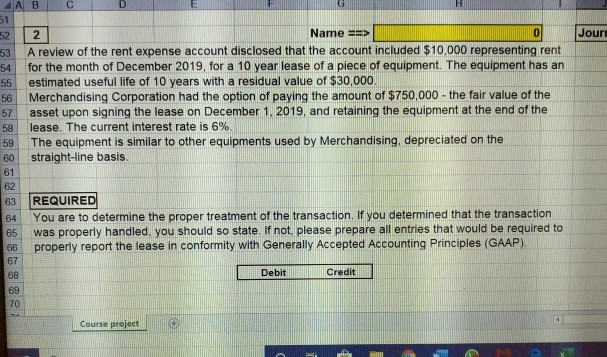

5 7 8 9 AAB G You are engaged to audit Merchandising Corporation for the year ended December 31, 2019. 6 Transactions are posted to the revenue and related accounts in the period recorded in the sales journal. Inventory account has been decreased for all merchandise shipped to customers up to and including December 30. 10 All sales are on account and shipped FOB-shipping point Inspection of Invoice# 115 revealed the following: 13 10 items @ selling price $600 each for a total cost of $3,750 14 4 items @ selling price $700 each for a total cost of $1.250 15 Total cost of $5,000 11 12 16 17 18 19 The following sales invoices have been entered in the sales journal as indicated. a. You are to test each invoice for relevant assertions to determine if adjustment is required. If you determined that adjustment is required, please prepare the entries that would be required to be made by management at December 31, 2019. 20 21 22 23 December 2019 Cost AAB D E F G 18 a. You are to test each invoice for relevant assertions to determine if adjustment is required. 19 If you determined that adjustment is required, please prepare the entries that would 20 be required to be made by management at December 31, 2019. 21 22 December 2019 23 Cost 24 Invoice Sales Journa of Date 25 Numbe Date Amount Goods Sold Shipped 26 101 Dec. 3 $15,000 $10,000 Dec. 2 27 115 Dec. 9 8.000 5,000 Dec. 10 28 120 Dec. 14 1,200 1,000 Dec. 14 Sale of excess office supplies 29 145 Dec. 23 20,000 13,000 Dec. 22 30 162 Dec. 30 10,000 5,000 Dec. 30 Shipped on consignment-out 31 166 Dec. 30 12.000 8,000 Jan. 15 32 175 Dec. 31 9,000 6.000 Dec. 31 33 34 January 2020 35 188 Jan. 3 $7,500 $4,000 Dec. 31 36 195 Jan. 4 9,000 6,000 Jan. 6 1 1 AAB D E F G H 27 115 Dec. 9 8,000 5,000 Dec. 10 28 120 Dec. 14 1,200 1.000 Dec. 14 Sale of excess office supplies 29 145 Dec. 23 20,000 13,000 Dec. 22 30 162 Dec. 30 10,000 5,000 Dec. 30 Shipped on consignment-out 31 166 Dec. 30 12,000 8,000 Jan. 15 32 175 Dec. 31 9,000 6,000 Dec. 31 33 34 January 2020 35 188 Jan. 3 $7,500 $4.000 Dec. 31 36 195 Jan. 4 9.000 6,000 Jan. 6 37 177 Dec. 30 15,000 10,000 Jan. 6 38 201 Jan. 6 18,000 12.000 Jan. 7 39 40 b. You have selected several sales invoices recorded as revenue for 2019. 41 Briefly describe a Substantive Test of the Occurrence Assertion 42 Answer: 43 44 2 A B G H 34 35 36 37 38 39 40 41 42 188 195 177 201 Jan. 3 Jan. 4 Dec. 30 Jan. 6 January 2020 $7,500 9,000 15,000 18,000 $4,000 Dec. 31 6,000 Jan. 6 10,000 Jan. 6 12,000 Jan. 7 b. You have selected several sales invoices recorded as revenue for 2019 Briefly describe a Substantive Test of the Occurrence Assertion. Answer: 43 44 45 46 47 48 49 c. You have selected a large accounts receivable balance of a new customer for 2019. Briefly describe a Substantive Test of the Existence Assertion. Answer: Page 1 of 2 50 51 52 2 Name ==> 0 Jou Jouri AAB 51 52 2 Name ==> 53 A review of the rent expense account disclosed that the account included $10,000 representing rent 54 for the month of December 2019, for a 10 year lease of a piece of equipment. The equipment has an 55 estimated useful life of 10 years with a residual value of $30,000 56 Merchandising Corporation had the option of paying the amount of $750,000 - the fair value of the 57 asset upon signing the lease on December 1, 2019, and retaining the equipment at the end of the 58 lease. The current interest rate is 6% 59 The equipment is similar to other equipments used by Merchandising, depreciated on the 60 straight-line basis 61 62 63 REQUIRED 64 You are to determine the proper treatment of the transaction. If you determined that the transaction 65 was properly handled, you should so state. If not please prepare all entries that would be required to 66 properly report the lease in conformity with Generally Accepted Accounting Principles (GAAP). 67 68 Debit Credit 69 70 Course project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started