Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you! just wanna check my answers before I submit Alpine Luggage has a capacity to produce 380,000 suitcases per year. The company is currently

thank you! just wanna check my answers before I submit

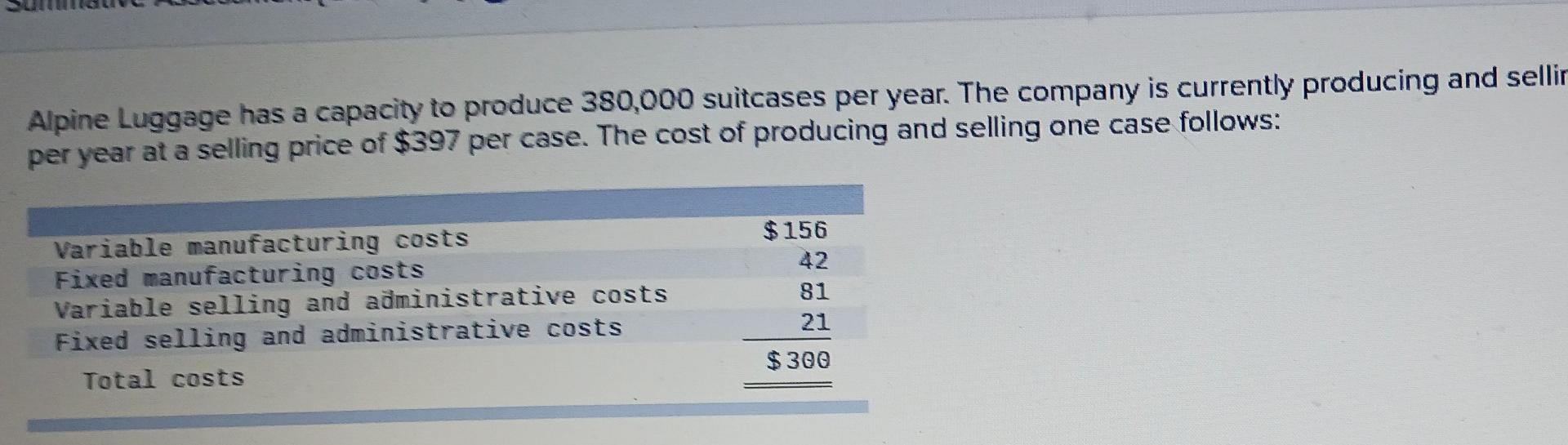

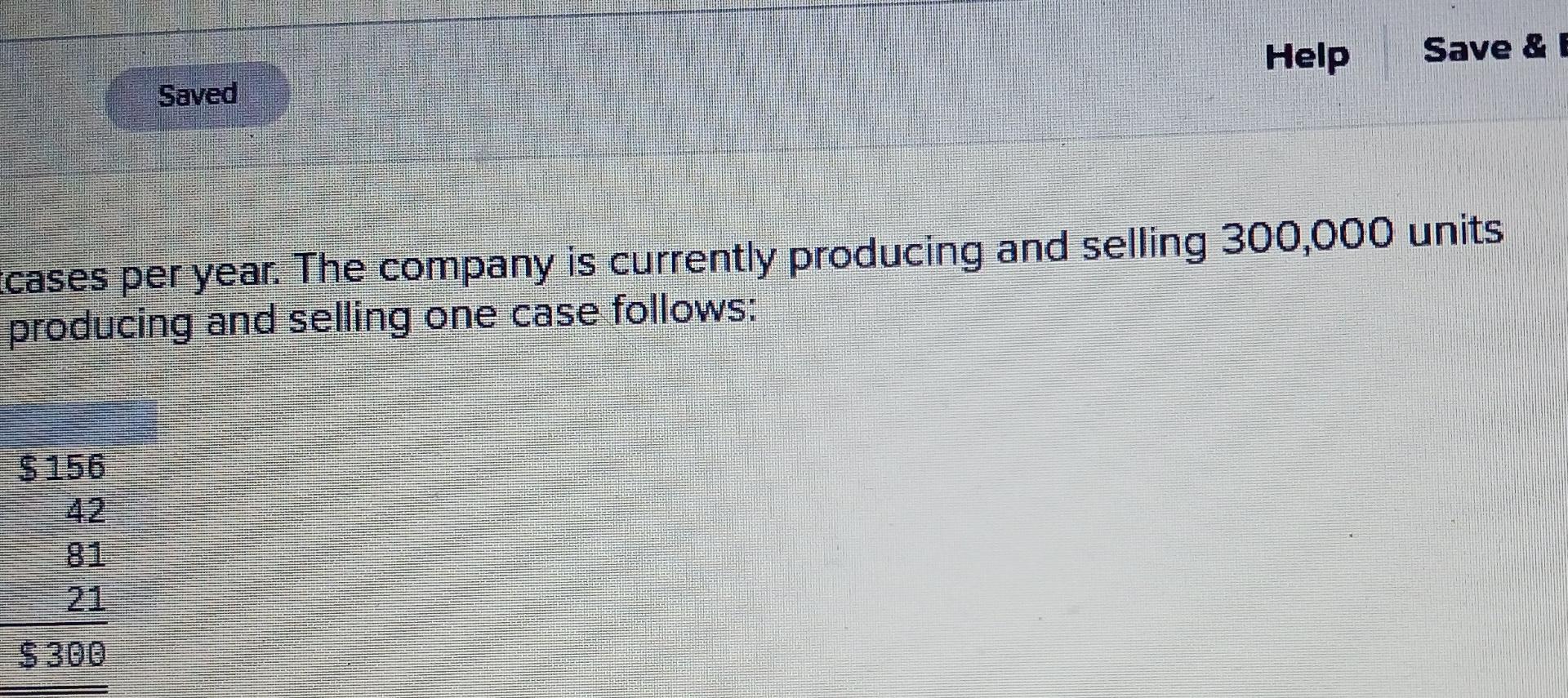

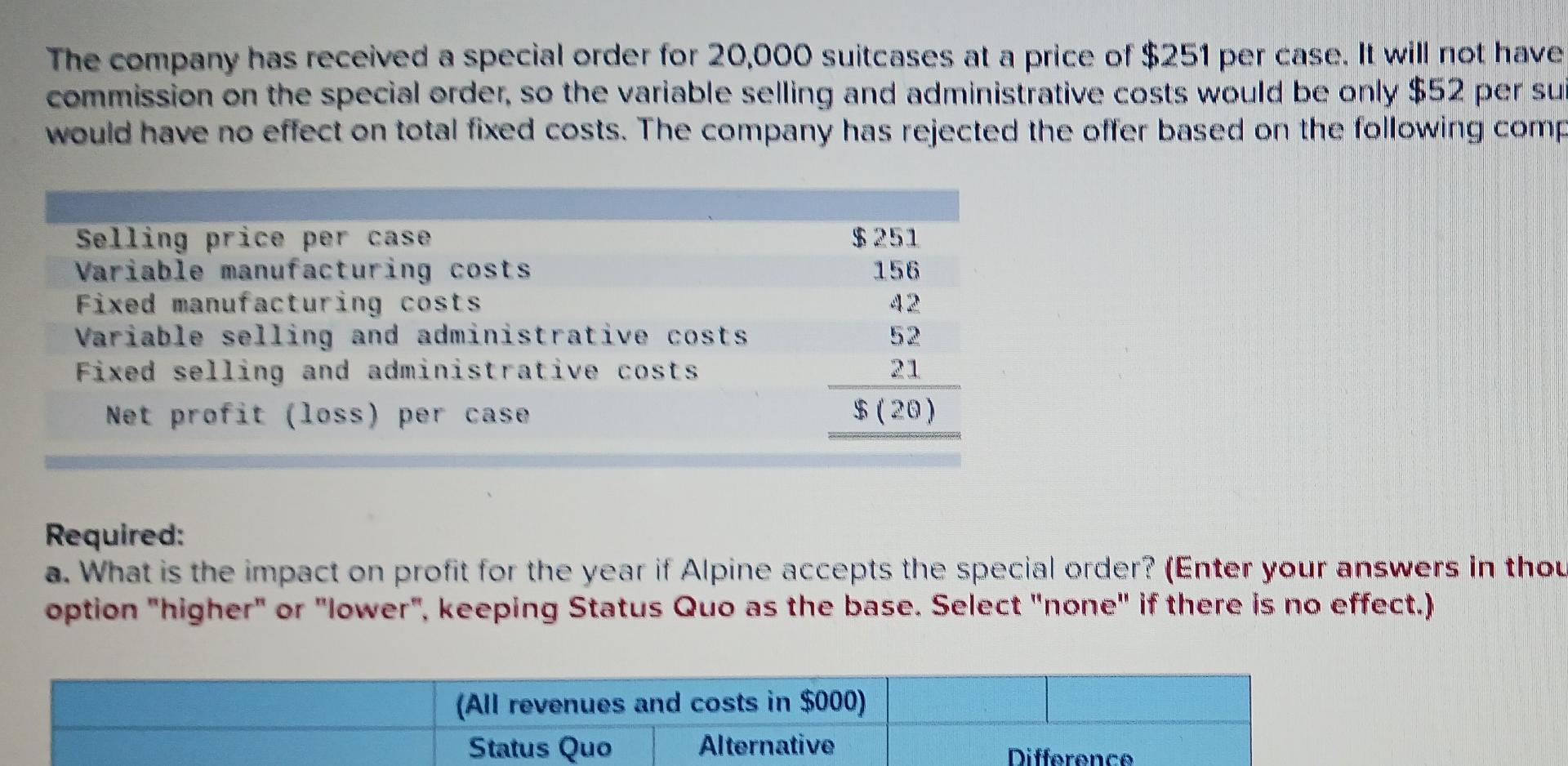

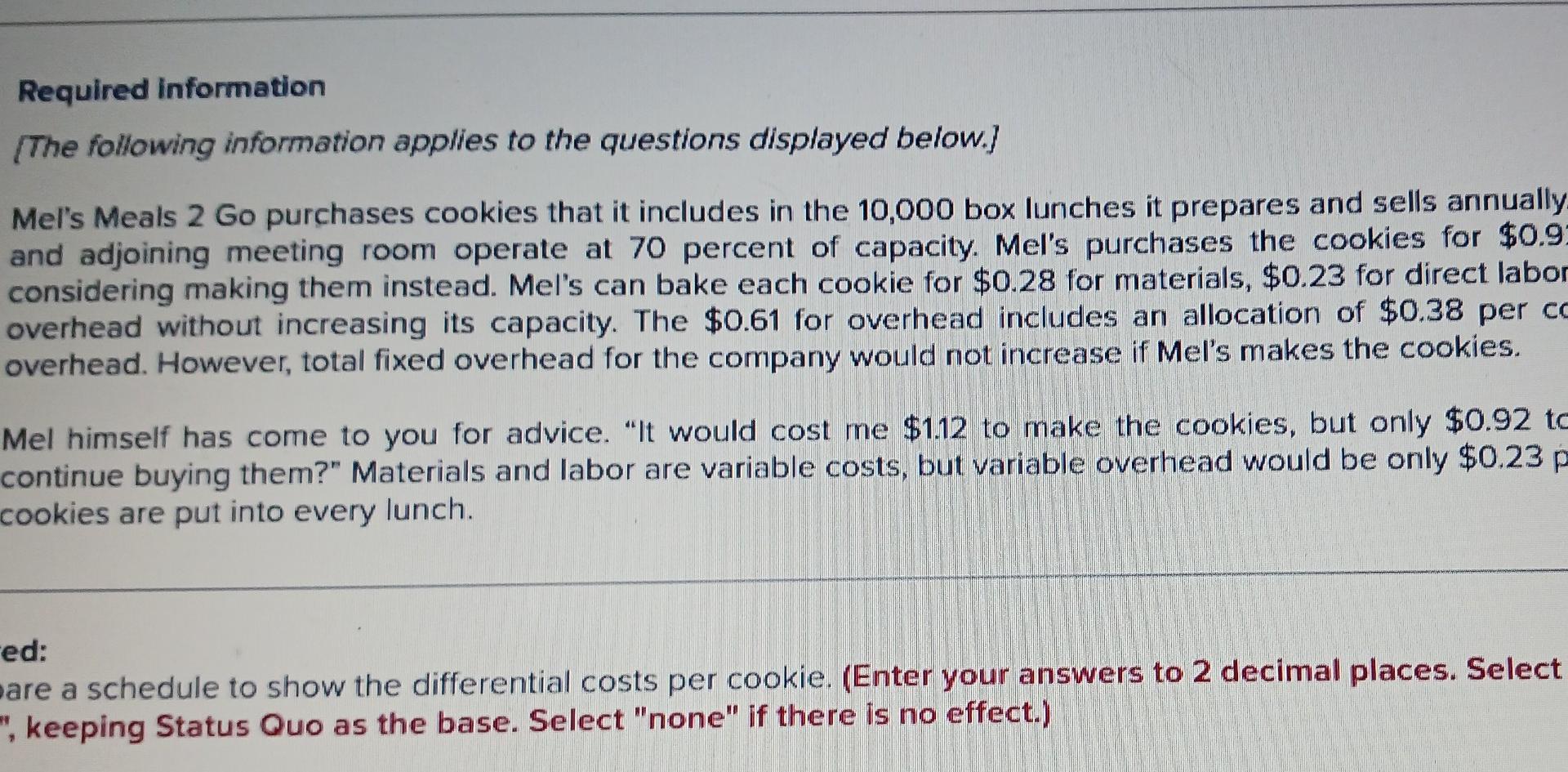

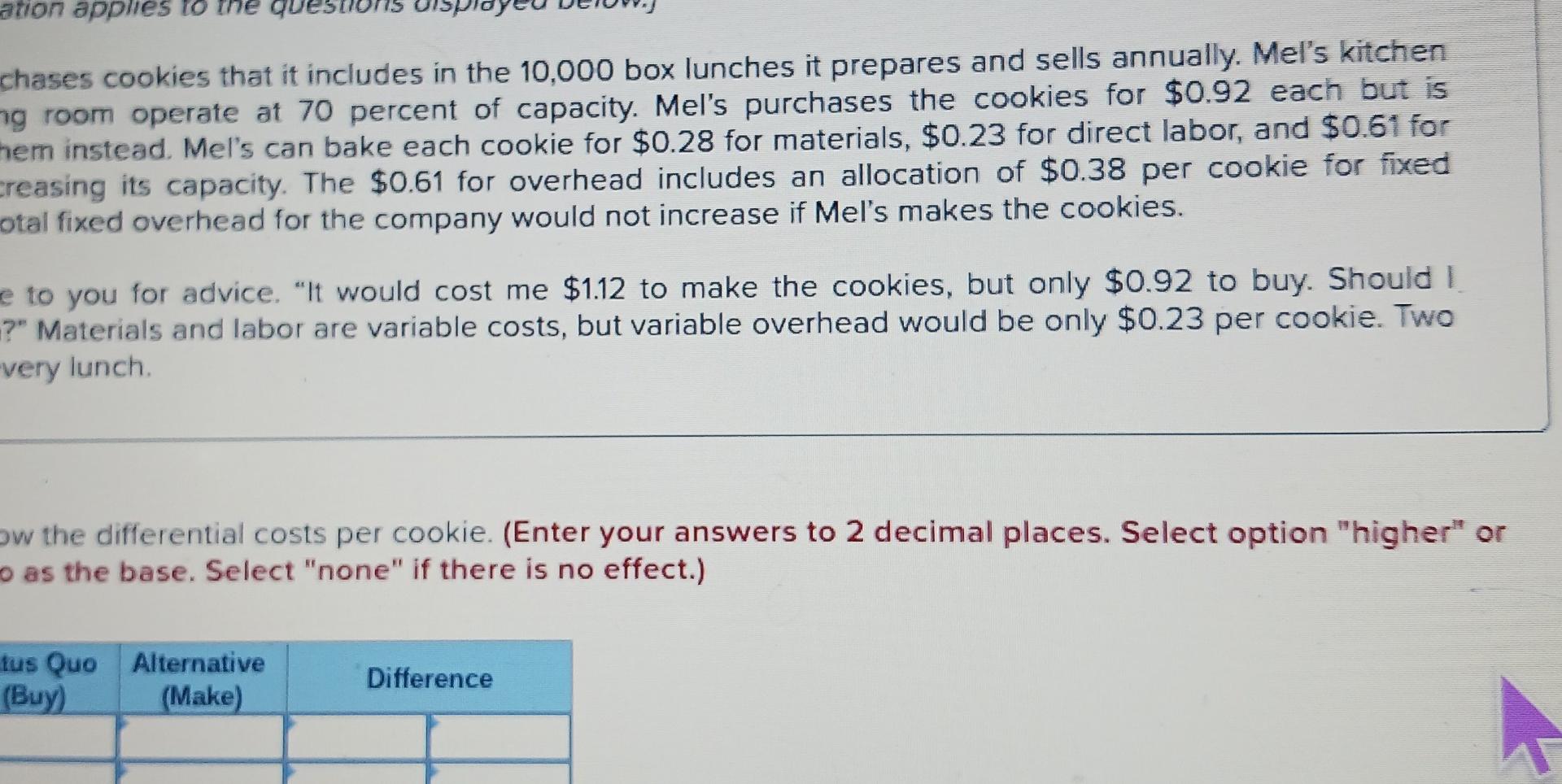

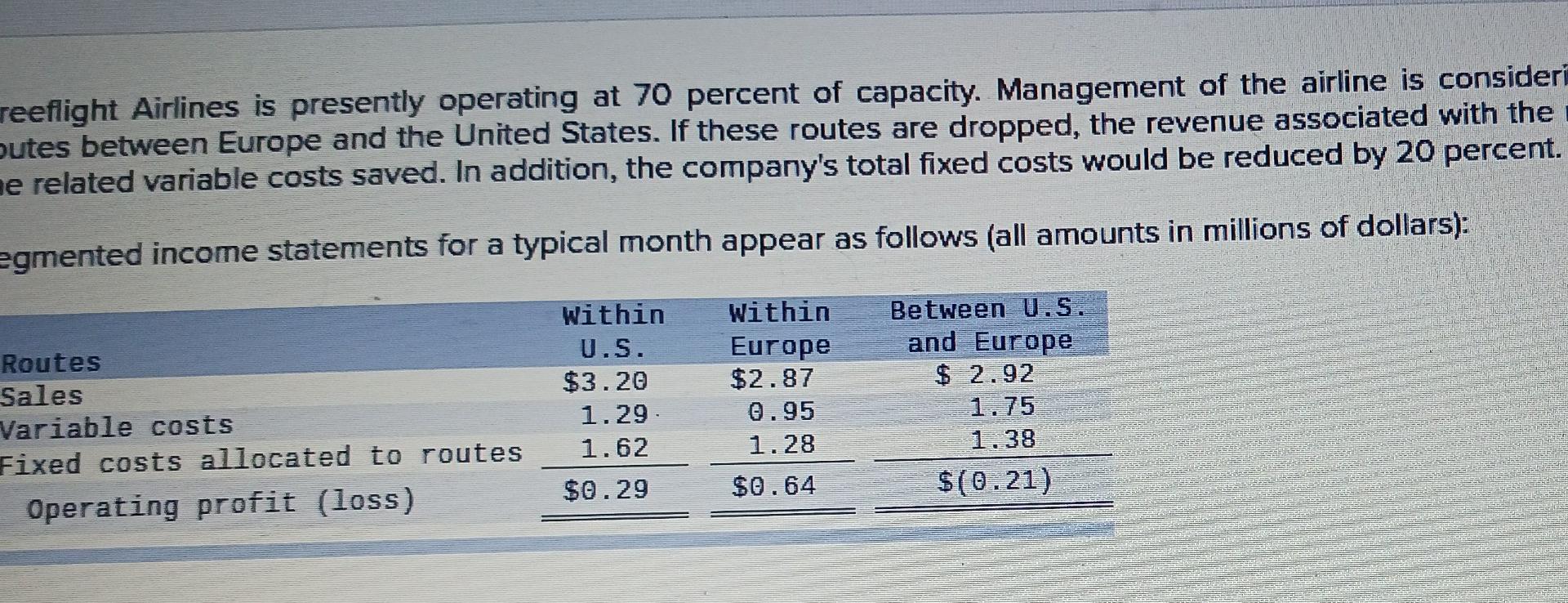

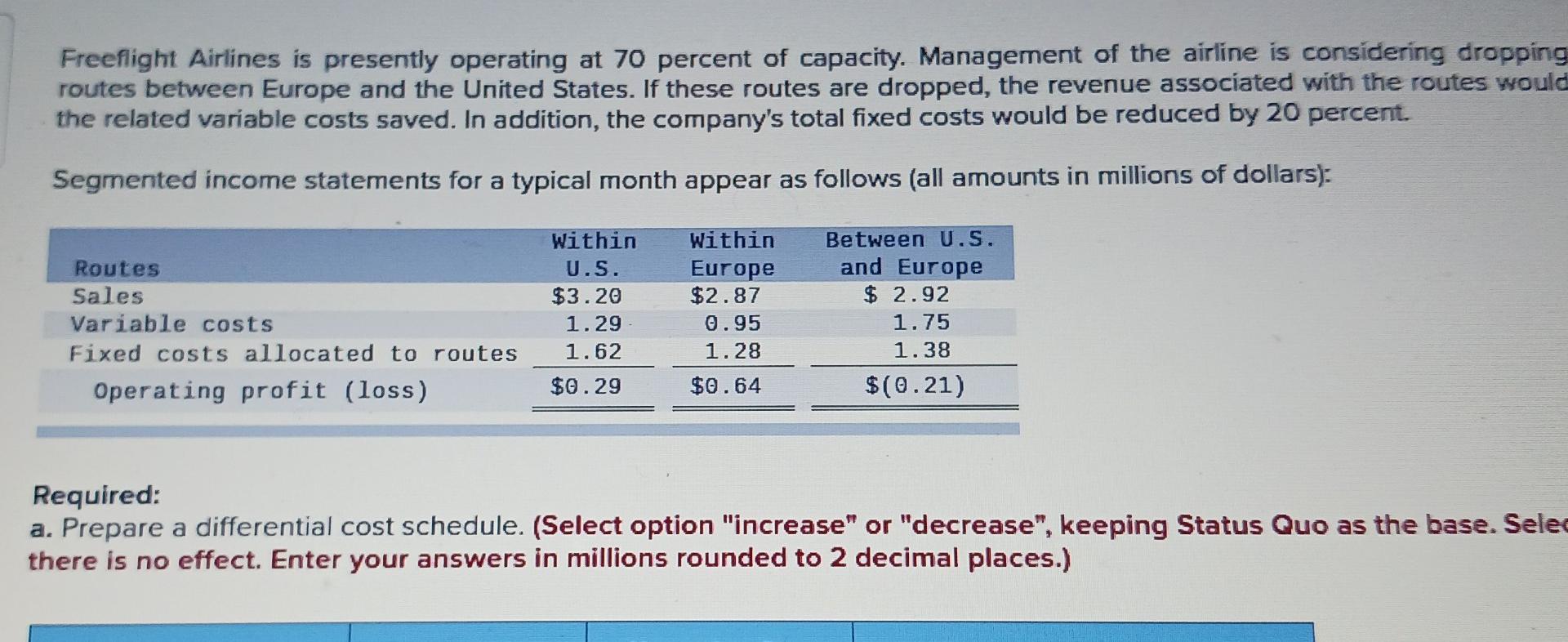

Alpine Luggage has a capacity to produce 380,000 suitcases per year. The company is currently producing and sellir per year at a selling price of $397 per case. The cost of producing and selling one case follows: Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Total costs $156 42 81 21 $300 Help Save & E Saved cases per year. The company is currently producing and selling 300,000 units producing and selling one case follows: S56 21 S 300 The company has received a special order for 20,000 suitcases at a price of $251 per case. It will not have commission on the special order, so the variable selling and administrative costs would be only $52 per su would have no effect on total fixed costs. The company has rejected the offer based on the following comp $251 156 Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case $(20) Required: a. What is the impact on profit for the year if Alpine accepts the special order? (Enter your answers in thou option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) (All revenues and costs in $000) Status Quo Alternative Difforonco S $300 0,000 suitcases at a price of $251 per case. It will not have to pay any sales e selling and administrative costs would be only $52 per suitcase. The special order ompany has rejected the offer based on the following computations: $ 251 156 42 52 21 $ (20) s ine accepts the special order? (Enter your answers in thousands of dollars. Select Required information (The following information applies to the questions displayed below.) Mel's Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares and sells annually. and adjoining meeting room operate at 70 percent of capacity. Mel's purchases the cookies for $0.9 considering making them instead. Mel's can bake each cookie for $0.28 for materials, $0.23 for direct labor overhead without increasing its capacity. The $0.61 for overhead includes an allocation of $0.38 per co overhead. However, total fixed overhead for the company would not increase if Mel's makes the cookies. Mel himself has come to you for advice. "It would cost me $1.12 to make the cookies, but only $0.92 tc continue buying them?" Materials and labor are variable costs, but variable overhead would be only $0.23 p cookies are put into every lunch. ed: pare a schedule to show the differential costs per cookie. (Enter your answers to 2 decimal places. Select ", keeping Status Quo as the base. Select "none" if there is no effect anon applies to the que chases cookies that it includes in the 10,000 box lunches it prepares and sells annually. Mel's Kitchen ng room operate at 70 percent of capacity. Mel's purchases the cookies for $0.92 each but is hem instead. Mel's can bake each cookie for $0.28 for materials, $0.23 for direct labor, and $0.61 for creasing its capacity. The $0.61 for overhead includes an allocation of $0.38 per cookie for fixed otal fixed overhead for the company would not increase if Mel's makes the cookies. to you for advice. "It would cost me $1.12 to make the cookies, but only $0.92 to buy. Should I ?" Materials and labor are variable costs, but variable overhead would be only $0.23 per cookie. Two very lunch ow the differential costs per cookie. (Enter your answers to 2 decimal places. Select option "higher" or o as the base. Select "none" if there is no effect.) tus Quo Alternative (Buy) (Make) Difference reeflight Airlines is presently operating at 70 percent of capacity. Management of the airline is consideri outes between Europe and the United States. If these routes are dropped, the revenue associated with the ne related variable costs saved. In addition, the company's total fixed costs would be reduced by 20 percent. egmented income statements for a typical month appear as follows (all amounts in millions of dollars): Routes Sales Variable costs Fixed costs allocated to routes Operating profit (loss) Within U.S. $3.20 1.29 1.62 $0.29 Within Europe $2.87 0.95 1.28 $0.64 Between U.S. and Europe $ 2.92 1.75 1.38 $(0.21) Freeflight Airlines is presently operating at 70 percent of capacity. Management of the airline is considering dropping routes between Europe and the United States. If these routes are dropped, the revenue associated with the routes would the related variable costs saved. In addition, the company's total fixed costs would be reduced by 20 percent. Segmented income statements for a typical month appear as follows (all amounts in millions of dollars): Routes Sales Variable costs Fixed costs allocated to routes Operating profit (loss) Within U.S. $3.20 1.29 1.62 $0.29 Within Europe $2.87 0.95 1.28 Between U.S. and Europe $ 2.92 1.75 1.38 $(0.21) $0.64 Required: a. Prepare a differential cost schedule. (Select option "increase" or "decrease", keeping Status Quo as the base. Sele there is no effect. Enter your answers in millions rounded to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started