Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you! Northern Illinois Manufacturing prepared the balance sheet and income statement for this year. Now the company needs to prepare its statement of cash

thank you!

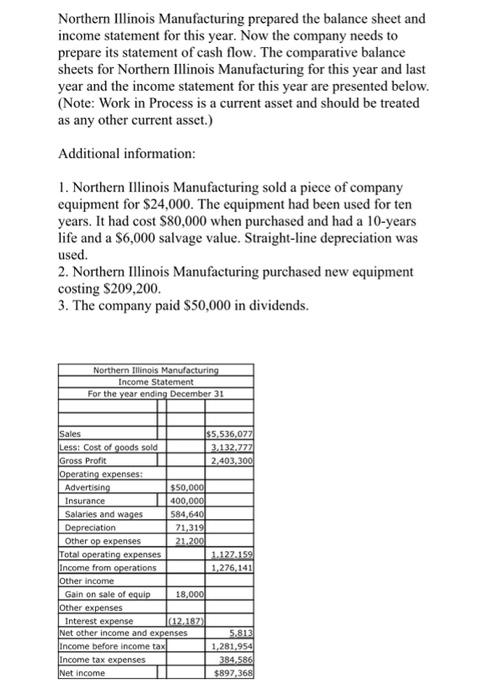

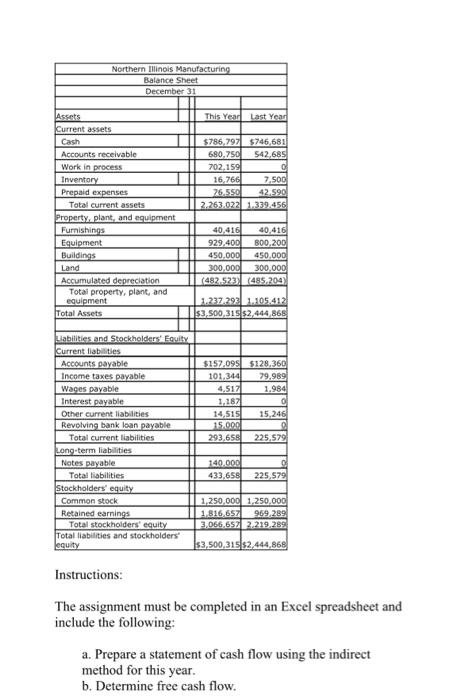

Northern Illinois Manufacturing prepared the balance sheet and income statement for this year. Now the company needs to prepare its statement of cash flow. The comparative balance sheets for Northern Illinois Manufacturing for this year and last year and the income statement for this year are presented below. (Note: Work in Process is a current asset and should be treated as any other current asset.) Additional information: 1. Northern Illinois Manufacturing sold a piece of company equipment for $24,000. The equipment had been used for ten years. It had cost $80,000 when purchased and had a 10-years life and a $6,000 salvage value. Straight-line depreciation was used. 2. Northern Illinois Manufacturing purchased new equipment costing $209,200. 3. The company paid $50,000 in dividends. Instructions: The assignment must be completed in an Excel spreadsheet and include the following: a. Prepare a statement of cash flow using the indirect method for this year. b. Determine free cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started