Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! PART 1: LOAN (50 POINTS) 1. Suppose you want to borrow money from a bank (either for a business or for education) and

Thank you!

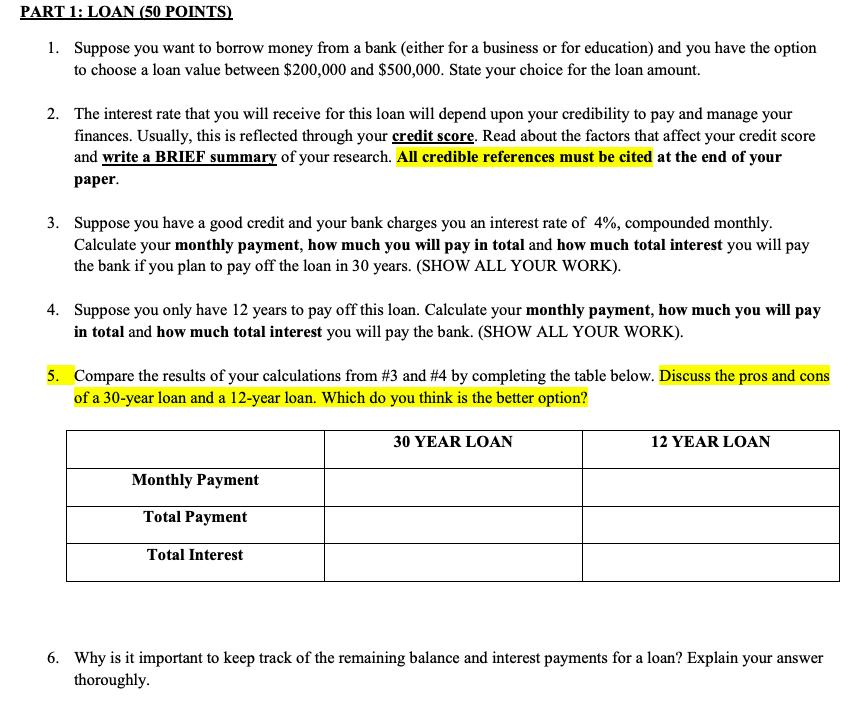

PART 1: LOAN (50 POINTS) 1. Suppose you want to borrow money from a bank (either for a business or for education) and you have the option to choose a loan value between $200,000 and $500,000. State your choice for the loan amount. 2. The interest rate that you will receive for this loan will depend upon your credibility to pay and manage your finances. Usually, this is reflected through your credit score. Read about the factors that affect your credit score and write a BRIEF summary of your research. All credible references must be cited at the end of your paper. 3. Suppose you have a good credit and your bank charges you an interest rate of 4%, compounded monthly. Calculate your monthly payment, how much you will pay in total and how much total interest you will pay the bank if you plan to pay off the loan in 30 years. (SHOW ALL YOUR WORK). 4. Suppose you only have 12 years to pay off this loan. Calculate your monthly payment, how much you will pay in total and how much total interest you will pay the bank. (SHOW ALL YOUR WORK). 5. Compare the results of your calculations from #3 and #4 by completing the table below. Discuss the pros and cons of a 30-year loan and a 12-year loan. Which do you think is the better option? 30 YEAR LOAN 12 YEAR LOAN Monthly Payment Total Payment Total Interest 6. Why is it important to keep track of the remaining balance and interest payments for a loan? Explain your answer thoroughlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started