Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! Please only respond if you can complete all steps correctly. Please keep in mind that T accounts will include: Raw Materials Inventory, Work

Thank you! Please only respond if you can complete all steps correctly. Please keep in mind that T accounts will include: Raw Materials Inventory, Work in Process Inventory, Finished Goods Inventory, Manufacturing Overhead, Cost of Goods Sold, Sales Revenue, and Non-Manufacturing Expenses. Thank you.

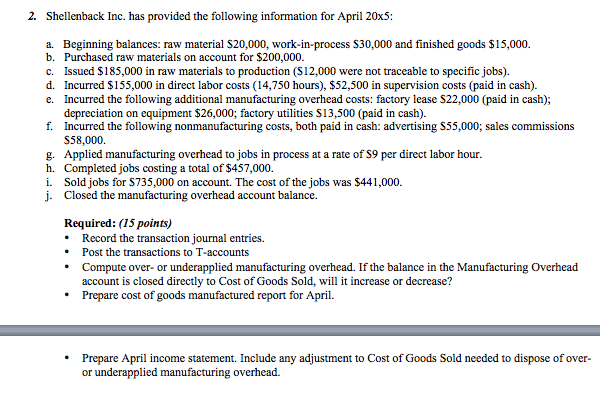

2. Shellenback Inc. has provided the following information for April 20x5 a. Beginning balances: raw material $20,000, work-in-process S30,000 and finished goods $15,000. b. Purchased raw materials on account for $200,000 c. Issued $185,000 in raw materials to production (S12,000 were not traceable to specific jobs). d. Incurred $155,000 in direct labor costs (14,750 hours), $52,500 in supervision costs (paid in cash). e. Incurred the following additional manufacturing overhead costs: factory lease S22,000 (paid in cash); depreciation on equipment $26,000; factory utilities S13,500 (paid in cash). Incurred the following nonmanufacturing costs, both paid in cash: advertising S55,000; sales commissions S58,000. Applied manufacturing overhead to jobs in process at a rate of S9 per direct labor hour Completed jobs costing a total of $457,000. Sold jobs for S735,000 on account. The cost of the jobs was $441,000. Closed the manufacturing overhead account balance. f. g. h. i. j. Required: (15 points) Record the transaction journal entries Post the transactions to T-accounts Compute over- or underapplied manufacturing overhead. If the balance in the Manufacturing Overhead account is closed directly to Cost of Goods Sold, will it increase or decrease? Prepare cost of goods manufactured report for April. Prepare April income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over- or underapplied manufacturing overheadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started