Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you!! Please show calculation steps if needed. or explain for me to understand and follow. THANK YOU 2. Consider a bank with the following

Thank you!! Please show calculation steps if needed. or explain for me to understand and follow. THANK YOU

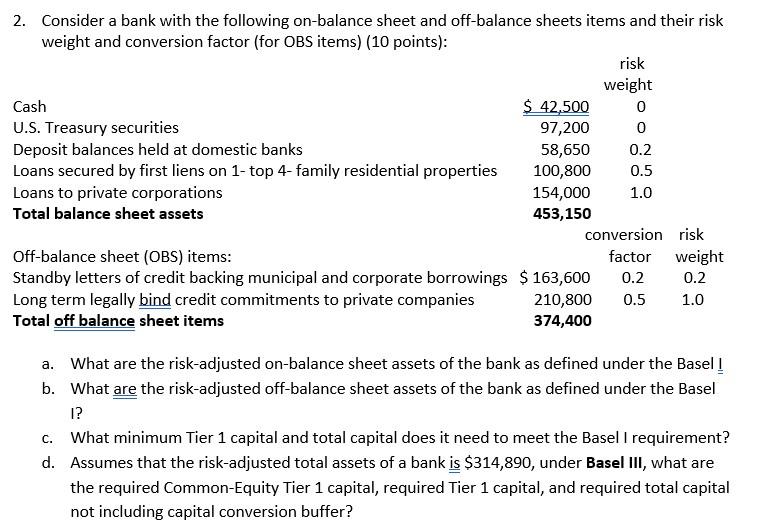

2. Consider a bank with the following on-balance sheet and off-balance sheets items and their risk weight and conversion factor (for OBS items) (10 points): risk weight Cash $ 42,500 0 U.S. Treasury securities 97,200 0 Deposit balances held at domestic banks 58,650 0.2 Loans secured by first liens on 1- top 4-family residential properties 100,800 0.5 Loans to private corporations 154,000 1.0 Total balance sheet assets 453,150 conversion risk Off-balance sheet (OBS) items: factor weight Standby letters of credit backing municipal and corporate borrowings $ 163,600 0.2 0.2 Long term legally bind credit commitments to private companies 210,800 0.5 1.0 Total off balance sheet items 374,400 a. What are the risk-adjusted on-balance sheet assets of the bank as defined under the Basel ! b. What are the risk-adjusted off-balance sheet assets of the bank as defined under the Basel I? c. What minimum Tier 1 capital and total capital does it need to meet the Basel I requirement? d. Assumes that the risk-adjusted total assets of a bank is $314,890, under Basel III, what are the required Common-Equity Tier 1 capital, required Tier 1 capital, and required total capital not including capital conversion buffer? 2. Consider a bank with the following on-balance sheet and off-balance sheets items and their risk weight and conversion factor (for OBS items) (10 points): risk weight Cash $ 42,500 0 U.S. Treasury securities 97,200 0 Deposit balances held at domestic banks 58,650 0.2 Loans secured by first liens on 1- top 4-family residential properties 100,800 0.5 Loans to private corporations 154,000 1.0 Total balance sheet assets 453,150 conversion risk Off-balance sheet (OBS) items: factor weight Standby letters of credit backing municipal and corporate borrowings $ 163,600 0.2 0.2 Long term legally bind credit commitments to private companies 210,800 0.5 1.0 Total off balance sheet items 374,400 a. What are the risk-adjusted on-balance sheet assets of the bank as defined under the Basel ! b. What are the risk-adjusted off-balance sheet assets of the bank as defined under the Basel I? c. What minimum Tier 1 capital and total capital does it need to meet the Basel I requirement? d. Assumes that the risk-adjusted total assets of a bank is $314,890, under Basel III, what are the required Common-Equity Tier 1 capital, required Tier 1 capital, and required total capital not including capital conversion bufferStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started