Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you! Quantitative Problem 1: Beasley Industries' sales are expected to increase from $5 million in 2021 to $6 million in 2022, or by 20%.

thank you!

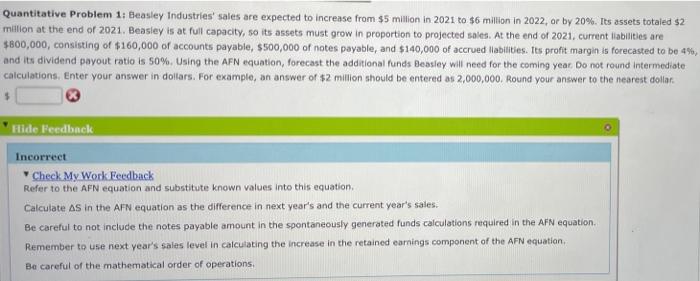

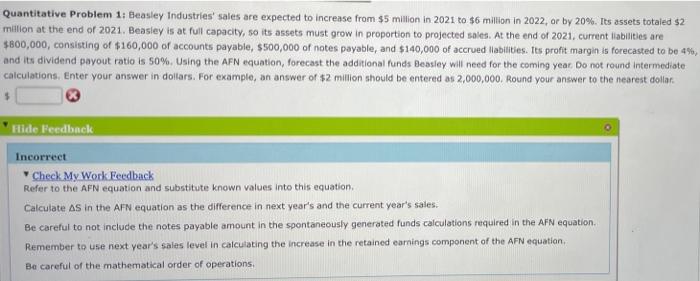

Quantitative Problem 1: Beasley Industries' sales are expected to increase from $5 million in 2021 to $6 million in 2022, or by 20%. Its assets totaled $2 million at the end of 2021. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2021, current liabilities are $800,000, consisting of $160,000 of accounts payable, $500,000 of notes payable, and $140,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 50%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year Do not round Intermediate calculations, Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollar Hide Feedback Incorrect Check My Work Feedback Refer to the AFN equation and substitute known values into this equation. Calculate as in the AFN equation as the difference in next year's and the current year's sales. Be careful to not include the notes payable amount in the spontaneously generated funds calculations required in the AFN equation. Remember to use next year's sales level in calculating the increase in the retained earnings component of the AFN equation Be careful of the mathematical order of operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started