Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! Question 34 Jerri's Jewelry accepted a $2,400 note receivable from S. Wells in settlement of an overdue account receivable. The 10% note was

Thank you!

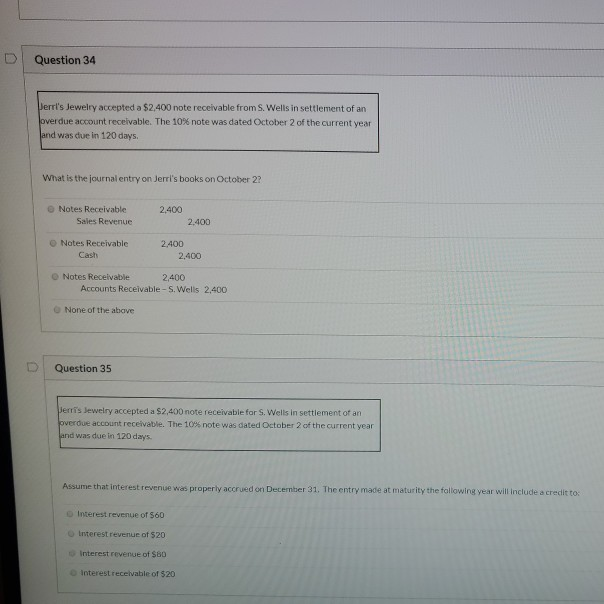

Question 34 Jerri's Jewelry accepted a $2,400 note receivable from S. Wells in settlement of an overdue account receivable. The 10% note was dated October 2 of the current year and was due in 120 days. What is the journal entry on Jerri's books on October 2? 2.400 Notes Receivable Sales Revenue 2.400 Notes Receivable Cash 2.400 2.400 Notes Receivable 2,400 Accounts Receivable - S. Wells 2,400 None of the above Question 35 Perris Jewelry accepted a $2,400 note receivable for S. Wells in settlement of an overdue account receivable. The 10% note was dated October 2 of the current year and was due in 120 days. Assume that interest revenue was properly accrued on December 31. The entry made at maturity the following year will include a credit to Interest revenue of $60 Interest revenue of 520 Interest revenue of $80 Interestreceivable of $20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started