Answered step by step

Verified Expert Solution

Question

1 Approved Answer

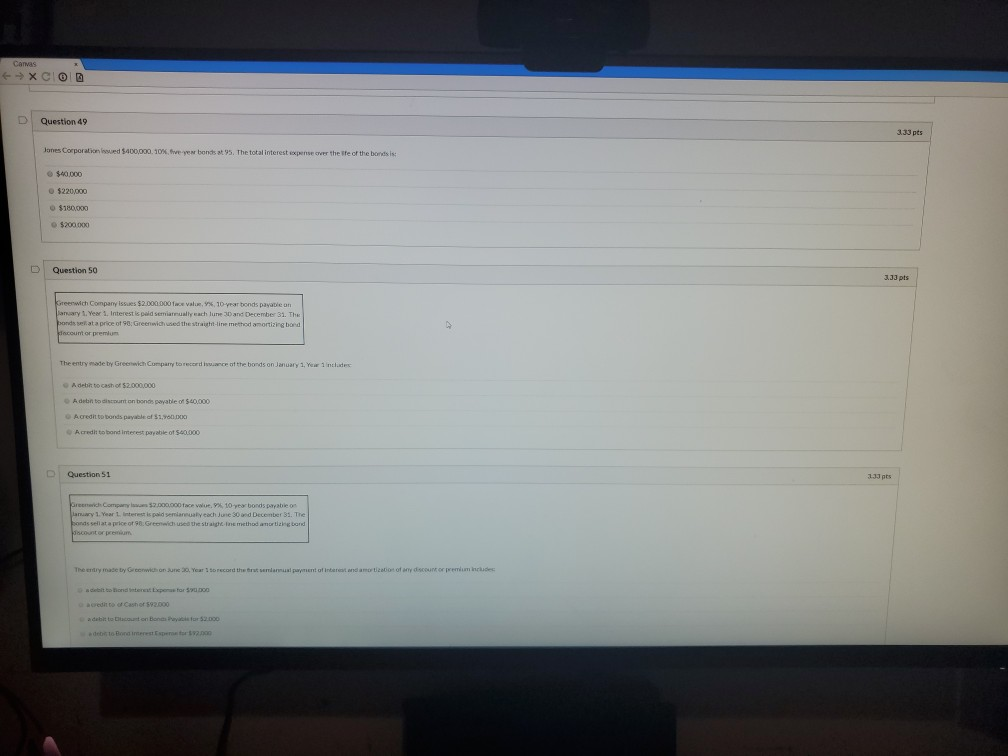

Thank you! Question 49 3.33 pts Jones Corporation Ward $400,000, 10% five-year bonds at the total interest expense over the Ife of the bordis $40.000

Thank you!

Question 49 3.33 pts Jones Corporation Ward $400,000, 10% five-year bonds at the total interest expense over the Ife of the bordis $40.000 $220.000 $180,000 $200.000 Question 50 3.33 pts Kareenwich Company issues $2.000.000 face value, x, 10 year bonds payable on January 1, Year 1. Interest is paid semially each lune 30 and December 31. The pondelata price of 90: Greenwich used the strat line method amortizing bord count or premium The entry made by Greenwich Company to recordance at the bonds on January 1, Yow incat A debt to cash of $2.000.000 Adelanto diston bonds payable of $40.000 Acredito bonds payable of $1,900.00 Acredit to band interest payable of 540.000 Question 51 3.33 pts Greenwich Company 12.000.000 face value. 9. 10year bonds payable Larry 1 Year L. Interest ispalderanalyech June Sand December 31. The bordssellat a price of Greenwald use the straine method amorting bond scoustor premium The entry made by Greenwich on June 30 Years to record the first mal payment of interest and most of any discount or premium includes debit oond treat Esperator do Borse 2.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started